Value Investing Insights for Serious, Independent Investors

Actionable research, proven frameworks, and high-conviction analysis designed to help you identify undervalued opportunities and compound long-term wealth.

Purchase Research or Become a Member

Build Your Edge with Proven Value Investing Systems

Explore advanced research memberships, detailed stock reports, and deep-dive guides designed to give you clarity, conviction, and repeatable results.

-

Astute Investor’s Calculus: Inner Circle Investment Subscription (1 Year Access)

-

Graham Holdings (GHC) Stock Analysis: Exclusive Valuation Report (Only 1,000 Copies Available!)

-

Shoe Carnival (SCVL) Stock Analysis: Exclusive Valuation Report (Only 100 Copies Available!)

-

SM Energy Stock Analysis: Exclusive Valuation Report (Only 50 Copies Available!)

Inside Astute Investor’s Calculus, you’ll learn:

- How to find undervalued small-cap stocks

- How to apply intrinsic value and earnings yield models

- How to build Kelly-optimized, high-conviction portfolios

- How to use volatility to compound faster (Shannon’s Demon)

- How to navigate risk with evidence-based strategies

About the Author

I’m Shailesh Kumar, a value investor with decades of experience in small-cap analysis, intrinsic value modeling, and systematic portfolio construction. Everything I share here comes from real strategies I use to build long-term wealth for my family and businesses.

4,800+

Subscribers

25+

Years of Value Investing Success

NYT, CNBC

Widely Quoted and Profiled in Media

Latest Value Investing Articles

Latest Value Investing Research & Insights

Stay current with fresh analysis and timeless principles. Each article is crafted to help you understand markets better, identify mispriced opportunities, and strengthen your investment process.

Yahoo Finance Community Panel – 3 Stock Presentations

https://www.youtube.com/watch?v=SAb1ODXszz8 We had the first Yahoo Finance Community Meet-Up on Dec 12, 2025. Nathan Worden…

18 Mid Cap Stocks that Fit the Buffettology Criteria – Dec 2025

The book Buffettology describes a screen that is similar to how Warren Buffett looks for…

From Cloud to Vendor: Google’s Historic Pivot to Selling ‘Merchant Silicon’

The Unlikely Alliance Threatening the AI Status Quo The recent news that Google sells TPU…

How the Income Factory Strategy Builds Cash Flow in Any Market

IntroductionYou want a portfolio that works for you every week, every month, and in every…

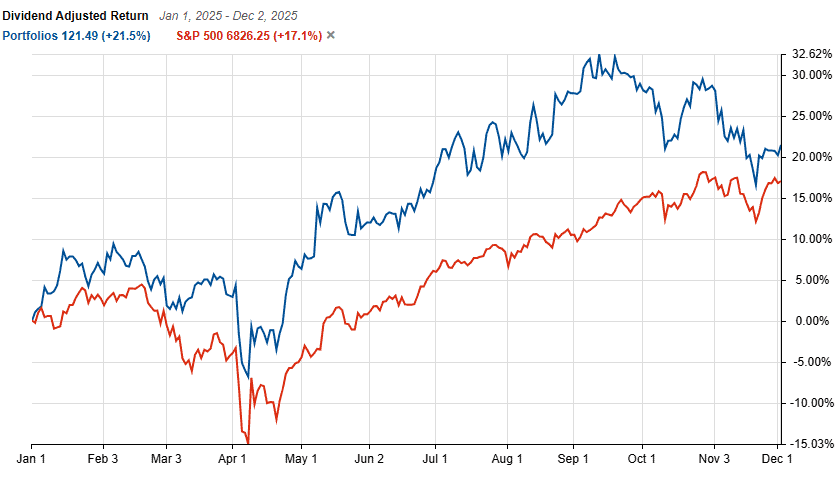

Track My Watchlist on GitHub

Check it out at https://github.com/shailesh-cmyk It has been difficult to share my working watchlist with…

The William Bernstein 5/25 Rule: The Simple Rebalancing System That Protects You from Yourself

It’s easy to let a portfolio drift. Stocks rise, bonds fall, and before you know…

Do Not Fear Volatility, Trust the Process

Claude Shannon (right) 1955, source: https://www.kerryr.net/pioneers/gallery/ns_shannon2.htm I was asked recently if we should move to cash…

5 Large Cap Stocks for GARP Investors – Oct 2025

Growth is all the rage today and the markets are quite frothy. Never mind the…

Is Gold the New Treasury? How Investors Are Redefining “Safe Haven”

Gold has done the unthinkable. In early October 2025, it broke through $4,000 per ounce…

Martingale vs Anti-Martingale Strategies: The Real Math Behind Risk, Reward, and the Value Investor’s Edge

You’ve heard it before: “cut your losses and let your winners run.” But most investors…

Why Value Investing Works Over the Long Term?

Value investing works because it is grounded in buying companies for less than their intrinsic worth and letting fundamentals drive long-term returns. By focusing on earnings power, cash flow, and true business value, investors position themselves to benefit when mispriced stocks eventually converge toward fair value. This disciplined approach favors patience, rational decision-making, and the compounding of high-quality opportunities over time.

At Astute Investor’s Calculus, we focus on small-cap value stocks because this is where mispricing is most common. In my 25+ years of investing, I’ve consistently found that small caps are overlooked by institutions and largely ignored by retail investors who concentrate on index-heavy large caps. This lack of attention creates persistent inefficiencies, allowing disciplined investors to buy fundamentally strong businesses at steep discounts to intrinsic value. It’s in these under-followed corners of the market where true value investing edges are built.