Risk averse investors buy classic defensive value plays, but if you are an enterprising investor willing to take a little more risk, Benjamin Graham suggested adding a little bit of growth in the mix when searching for candidates.

The Graham Enterprising Investor screens for underpriced stocks with a history of earnings growth. Additional filters include current ratio to check for financial strength, and continuing profitability. We also require the company to pay a dividend, which shows that the company is serious about creating shareholder value.

We ran this screen and filtered for the large cap stocks with market capitalization above $5 Billion. Large caps are generally slower growth, but they do offer stability and dividends.

Stock Rover is the tool I use for all my screening and research needs. Learn more how you can save hours of your time and do better research using Stock Rover

Here are the 18 stocks we found with this screen.

Let’s take a look at these stocks quickly and find the top stocks to invest in right now from this list.

VICI: VICI Properties Inc

VICI is a real estate investment trust based in the United States.

It engaged in the business of owning and acquiring gaming, hospitality, wellness, entertainment and leisure destinations, subject to long-term triple net leases.

It own nearly 93 experiential assets across a geographically diversified portfolio consisting of nearly 54 gaming properties and nearly 39 other experiential properties across the United States and Canada, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas.

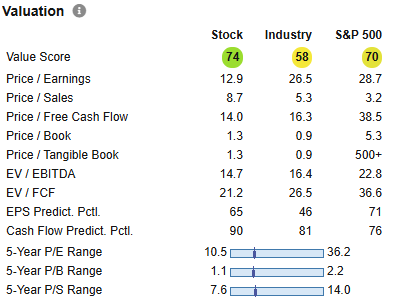

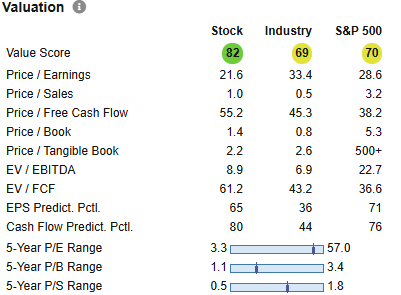

While the valuation numbers look good, keep in mind that this is a REIT and you will need to consider the FFO. The free cash flow can be a good indication and the first scan does not raise any red flags. This could be a good research candidate.

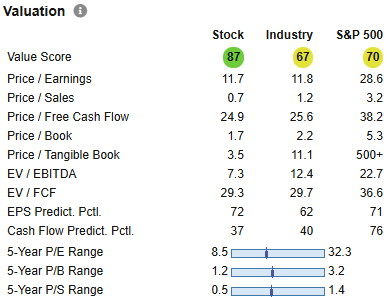

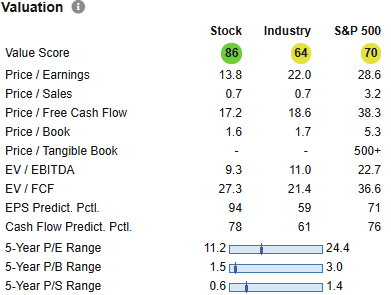

WCC: Wesco Intl

WCC primarily distributes electrical, networking, security, and utility equipment used in the construction and repair of structures such as offices, data centers, power transmission lines, and manufacturing plants. Wesco has operations around the globe but generates the majority of its revenue in the United States.

With the buildout of data centers for AI, this could be a stock to keep an eye on.

Price/Sales looks good, and both sales and EPS are expected to grow quickly next year. The stock definitely needs further review.

TXT: Textron

Textron is a conglomerate that designs, manufactures, and services a range of specialty aircraft including small jets, propeller-driven airplanes, helicopters, and tilt-rotor aircraft. Textron Aviation manufactures and services Cessna and Beechcraft planes. Bell is a helicopter and tilt-rotor manufacturer and servicer for both commercial and military customers. Textron Systems produces uncrewed aircraft and armored vehicles for the military market as well as aircraft simulators and training for the commercial and military markets. Textron Industrial contains the Kautex business, which manufactures plastic fuel tanks for conventional and hybrid motor vehicles, and other subsidiaries that produce specialized vehicles such as golf carts and all-terrain vehicles.

The current global political climate may be positive for this stock going forward though it is not at attractive valuations today. I would pass

OSK: Oshkosh

Oshkosh Corp is the top producer of access equipment, specialty vehicles, and military trucks. It serves diverse end markets, where it is typically the market share leader in North America, or, in the case of JLG aerial work platforms. The company had manufactured joint light tactical vehicles for the U.S. Department of Defense. The company reports in three segments: Access, Vocational and Defense. It derives maximum revenue from Access Segment.

I like this name better than TXT if we were to look for military exposure. Valuations are far more reasonable.

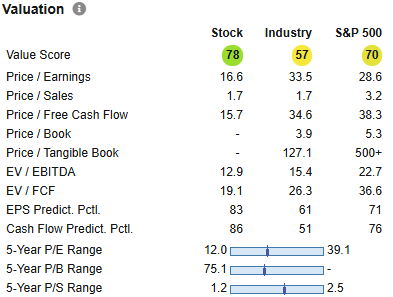

MAS: Masco

Masco manufactures a variety of home improvement and building products. The company’s $5-billion plumbing segment, led by the Delta and Hansgrohe brands, sells faucets, showerheads, and other related plumbing fixtures and components. The $3-billion decorative architectural segment primarily sells paints and other coatings under the Behr and Kilz brands, but it also sells builder hardware and lighting products.

Masco has been an interesting stock for me for many years but I have never had the opportunity to take a stake.

From valuation perspective the stock appears to be fairly priced. Not sure why the stockholder’s equity (book value) is negative. This requires to be looked at – it doesn’t necessarily disqualify the stock – it just means that I need to look deeper to understand better what is going on.

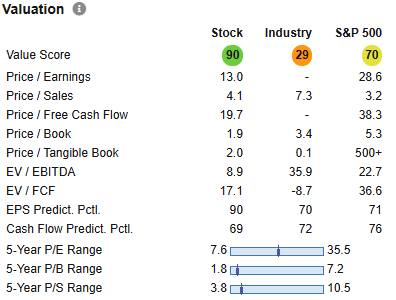

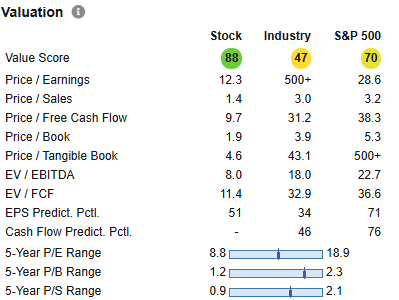

REGN: Regeneron Pharmaceuticals

Regeneron Pharmaceuticals discovers, develops, and commercializes products that fight eye disease, cardiovascular disease, cancer, and inflammation. The company has several marketed products, including low-dose Eylea and Eylea HD, approved for wet age-related macular degeneration and other eye diseases; Dupixent in immunology; Praluent for LDL cholesterol lowering; Libtayo in oncology; and Kevzara in rheumatoid arthritis. Regeneron is also developing monoclonal and bispecific antibodies with Sanofi, other collaborators, and independently, and has earlier-stage partnerships that bring new technology to the pipeline, including RNAi (Alnylam) and Crispr-based gene editing (Intellia).

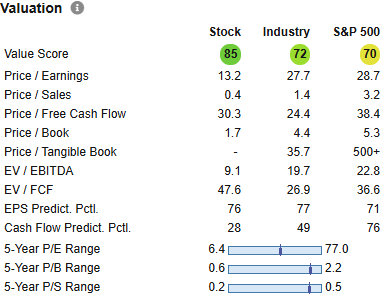

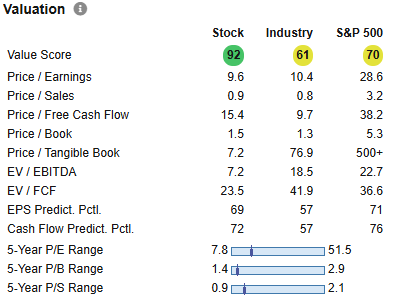

The stock appears to be undervalued and this goes on my watchlist for deeper review.

SUN: Sunoco

Sunoco LP is engaged in the distribution of motor fuels to independent dealers, distributors, and other commercial customers as well as the distribution of motor fuels to end-use customers at retail sites operated by commission agents.

The company is structured as a Master Limited Partnership (MLP) that brings with it some tax issues if owned in a retirement account.

Oil may be ripe for appreciation as the tensions in the middle east continue. is that enough to look past the concerns I have with its current valuation, especially concerning the free cash flow? Probably not. I will be passing for now.

TOL (Toll Brothers), PHM (Pulte Home), LEN (Lennar) and DHI (DH Horton)

These are all homebuilders that have been beaten down as the residential real estate market has been soft. With the interest rates high and the economic conditions set to worsen, I expect any investment in home builders will be dead money for many years. There are better opportunities and I have no interest in spending much time on these names today.

LKQ: LKQ

Since forming in 1998 to consolidate the auto salvage business in the United States, LKQ has developed into a leading distributor of aftermarket and recycled auto parts with around 1,500 facilities across North America and Europe. The company primarily sells into the professional channel and offers an assortment of collision and mechanical parts to both body shops and mechanical repair shops. It also continues to operate more than 70 LKQ pick-your-part junkyards. Separate from the self-service business, LKQ usually purchases around 250,000 salvage vehicles annually that are used to extract vehicle parts for resale.

Again, I will have to avoid what is perhaps a good value because of my macro views on the US economy. I think that while a worsening economic condition will move people away from buying cars and more towards maintaining their existing vehicles for longer, and therefore increasing the demand for LKQ offerings, I believe that this is not a sustainable situation long term.

FOX: Fox

Fox operates in two segments: cable networks and television. Cable networks primarily includes Fox News, Fox Business, and several pay-TV sports stations. Television primarily includes the Fox broadcast network, 29 owned and operated local television stations, of which 18 are affiliated with the Fox network, and streaming platform Tubi, which is not subscription-based and is completely ad-supported. Fox effectively sold most of its entertainment assets to Disney in 2019, so it no longer creates entertainment content and relies heavily on live news and sports, with nearly all tied to the pay-TV bundle.

The Murdoch family controls Fox.

Media companies are hard to invest in unless the valuation is very compelling. it is not in this case, I have alternative stocks that are better values, and there is a great deal of political risk associated with this name. I will avoid.

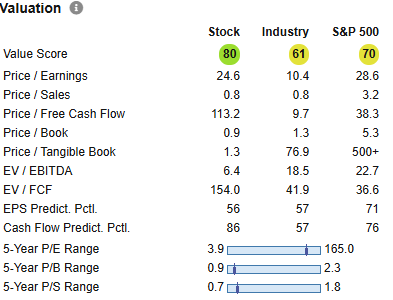

WLK: Westlake Corp

Westlake Corp is a manufacturer and supplier of chemicals, polymers, and building products. Its Performance and Essential Materials segment offers a wide range of essential building blocks for making products utilized in everyday living, including olefins, vinyl chemicals, polyethylene, and epoxies. Its Housing and Infrastructure Products segment produces key finished goods for building products, pipe and fittings, and global compounds businesses.

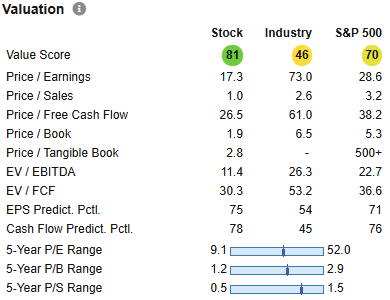

Chemical companies have had it bad this year as the tariffs have affected their business significantly. I am watching another chemical company stock that i think is a better value, but this one can be a great purchase as well. It is trading below book value although book values can decline if the business environment goes really bad. I will add to the watchlist.

UFPI: UFP Industries

UFP Industries Inc is a supplier of lumber to the manufactured housing industry. Today UFP Industries is a multibillion-dollar holding company with subsidiaries around the globe that serve three markets: retail, packaging and construction. Its business segments consist of UFP Retail Solutions, UFP Packaging, UFP Construction, All other and Corporate.

My sentiments on this mirror that of the homebuilders. There will be a time when these stocks are attractive again, but not yet.

NUE: Nucor

Nucor Corp manufactures steel and steel products. The company’s reportable segments are steel mills, steel products, and raw materials. A majority of its revenue is derived from the steel mills segment, which is engaged in producing sheet steel (hot-rolled, cold-rolled, and galvanized), plate steel, structural steel (wide-flange beams, beam blanks, H-piling, and sheet piling), and bar steel products. Nucor manufactures steel principally from scrap steel and scrap steel substitutes using electric arc furnaces (EAFs) along with continuous casting and automated rolling mills. The steel mills segment sells its products mainly to steel service centers, fabricators, and manufacturers located in the United States, Canada, and Mexico.

I love mini-mills like Nucor and this is a great company. It is also a dividend aristocrat.

But a great company does not mean a great stock. The valuation needs to come down further, there are significant headwinds with the on and off tariffs. There are better opportunities elsewhere.

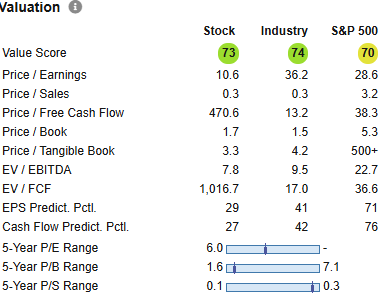

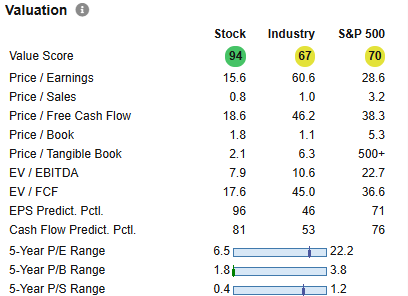

EMN: Eastman Chemical

Established in 1920 to produce chemicals for Eastman Kodak, Eastman Chemical has grown into a global specialty chemical company with manufacturing sites around the world. The company generates the majority of its sales outside of the United States, with a strong presence in Asian markets. During the past several years, Eastman has sold noncore businesses, choosing to focus on higher-margin specialty product offerings.

The valuation looks attractive, better than Westlake. I also like the fact that it has strong presence in the Asian markets, which where the locus of economic growth is going to be in the next 50 years. I will add this to the watchlist as well.

Out of 17 stocks, I am adding 5 to my watchlist for further research. These are WCC, MAS, REGN, WLK and EMN. The research will be posted soon.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in:

I track ongoing research and updates in a public research tracker, with links to live X research threads:

View the Watchlist and Research Tracker