AIC Portfolios – Outperforming the Market in First Half

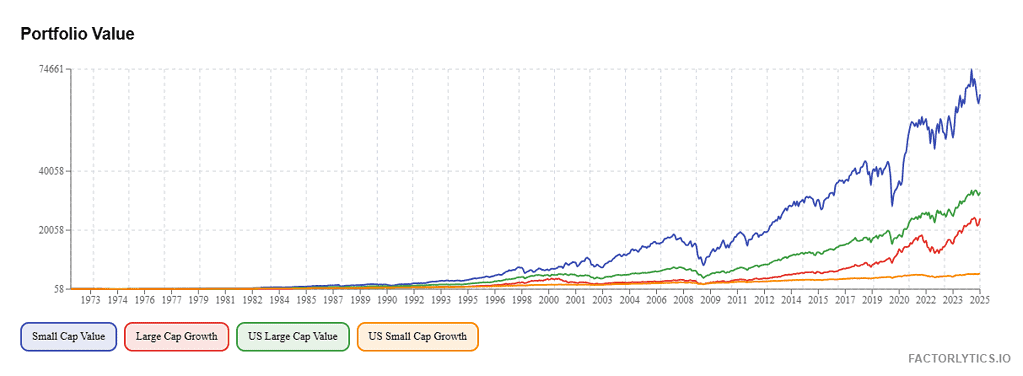

The first half of the year is done and dusted. The markets have been all over the place, but all our portfolios have performed extremely well. We have not only beat the S&P 500 in 3 out of 4 portfolios (and were in line with the market in the 4th portfolio), but our flagship Small […]

AIC Portfolios – Outperforming the Market in First Half Read More »

![[Inner Circle] The Next Berkshire Hathaway, Part 3, Final 14 Next Berkshire Hathaway](https://astuteinvestorscalculus.com/wp-content/uploads/2025/06/next-berkshire-hathaway-1-1024x574.png)