The best dividend growth stocks give you a history of consistent dividend growth, nice current dividend yield, and a low payout ratio that means the dividend should keep growing in the near future. In addition, a history of EPS growth adds additional confidence that the company is well run and growing, and your investment in these stocks will be rewarded.

The following screen is focused on large cap stocks with market capitalization above $5 Billion USD.

Additionally, the screen calls for

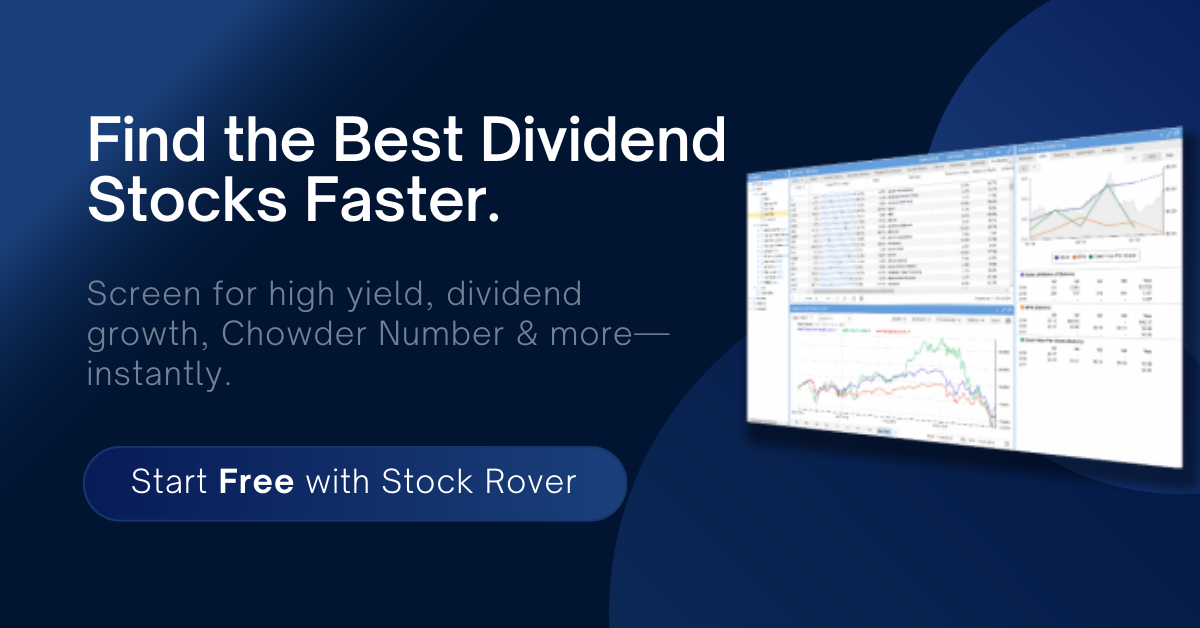

Stock Rover is the tool I use for all my screening and research needs. Learn more how you can save hours of your time and do better research using Stock Rover

- 1 yr, 3 yr and 5 yr average dividend growth rate > 8%

- 5 yr average EPS growth > 8%

- Payout ratio between 10% and 40%, and,

- Forward dividend yield between 1.5% and 3.75%

The goal of the screen is to find stocks that can become part of your long term dividend growth portfolio.

One advantage of looking at large cap stocks like this is that the companies have history of execution and profitability and there is enough confidence that it will continue. Any and all of these stocks can be a solid choice for your portfolio. However, for best results, you should also consider the current valuation and go for the stocks that are valued fairly or even undervalued.

We own SNA in our Founder’s Club Dividend Fortress Portfolio.

Featured products

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in:

I track ongoing research and updates in a public research tracker, with links to live X research threads:

View the Watchlist and Research Tracker