What if you could decode the financial health of a company in minutes? For value investors, financial ratios offer this very power—a way to measure the intrinsic worth of a company against its current market price. Understanding and applying these ratios can help uncover hidden gems in the stock market. This article will explore the most critical financial ratios, how to use them effectively, and their pivotal role in identifying value stocks.

Understanding Value Investing and Financial Ratios

Value investing relies on a disciplined approach to finding stocks that trade below their intrinsic value. This requires a combination of patience, a long-term outlook, and analytical tools that help investors separate bargains from overhyped opportunities. Among these tools, financial ratios stand out as indispensable for identifying undervalued stocks and assessing their potential for growth.

What is Value Investing?

Value investing is a strategy focused on identifying and purchasing stocks trading below their intrinsic value. The goal is simple: buy undervalued companies and hold them until the market recognizes their true worth. This approach requires patience, discipline, and a reliance on fundamental analysis.

What Are Financial Ratios?

Financial ratios are quantitative tools that provide insights into a company’s performance, financial health, and valuation. By comparing a company’s metrics to industry benchmarks, investors can quickly assess whether a stock is overvalued, undervalued, or fairly priced.

By understanding these fundamental tools, you gain a clear framework to evaluate companies and uncover investment opportunities others might miss.

Key Financial Ratios for Identifying Value Stocks

Financial ratios act as a lens through which investors can examine the health and valuation of a company. By focusing on specific metrics, value investors can gain a deeper understanding of a company’s profitability, stability, and market position. Let’s delve into the most important ratios for identifying value stocks.

Price-to-Earnings (P/E) Ratio

- Definition: Measures the price investors are willing to pay per dollar of earnings.

- Formula: P/E = Market Price per Share / Earnings per Share (EPS)

- Application: A low P/E ratio suggests a stock might be undervalued, especially when compared to industry peers or historical averages.

Price-to-Book (P/B) Ratio

- Definition: Compares a company’s market value to its book value.

- Formula: P/B = Market Price per Share / Book Value per Share

- Application: A P/B ratio below 1 can indicate that a stock is trading for less than its net asset value, presenting a potential bargain.

Debt-to-Equity (D/E) Ratio

- Definition: Assesses a company’s financial leverage.

- Formula: D/E = Total Liabilities / Shareholders’ Equity

- Application: A low D/E ratio signifies a conservative approach to debt, reducing financial risk.

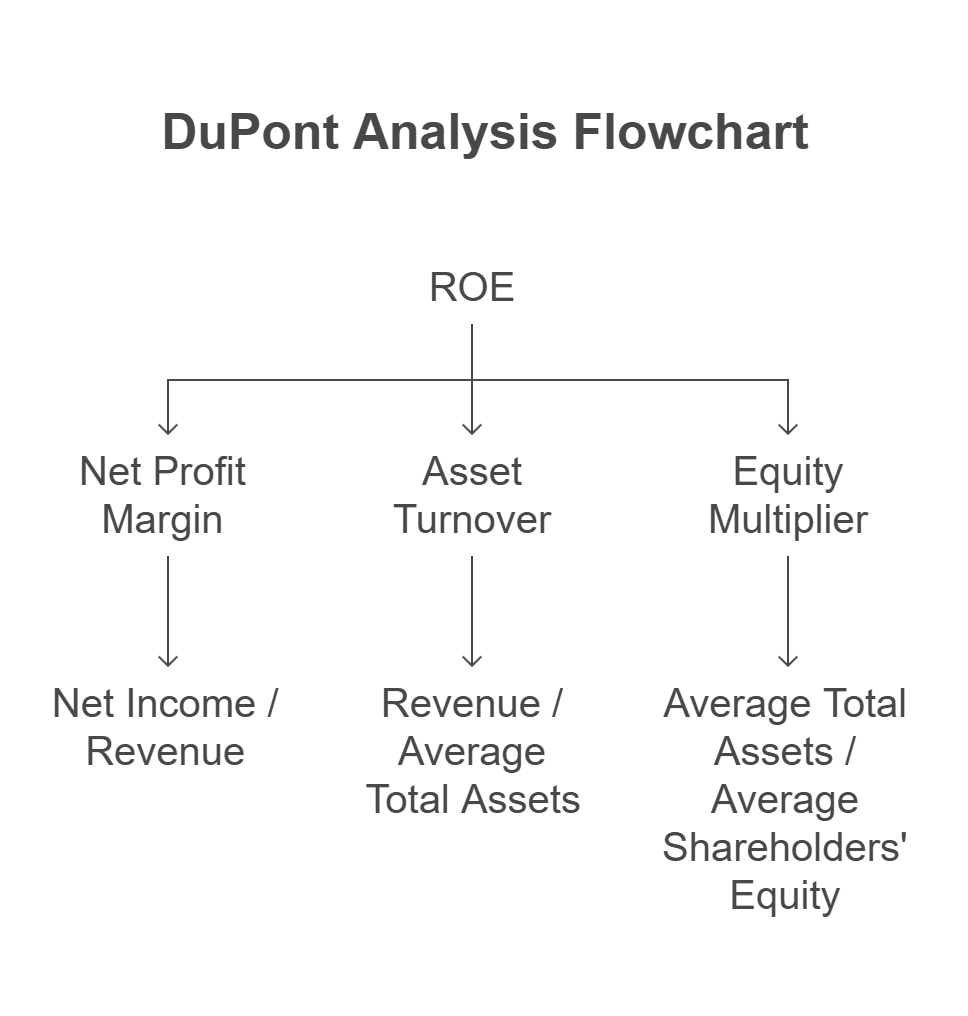

Return on Equity (ROE)

- Definition: Evaluates a company’s profitability relative to shareholder equity.

- Formula: ROE = Net Income / Shareholders’ Equity

- Application: A consistently high ROE reflects efficient management and a profitable business model.

Free Cash Flow (FCF)

- Definition: The cash a company generates after accounting for capital expenditures.

- Formula: FCF = Operating Cash Flow – Capital Expenditures

- Application: Positive FCF indicates financial flexibility and the ability to reinvest, pay down debt, or return value to shareholders.

Using these ratios in tandem, you can create a comprehensive snapshot of a company’s financial health and uncover potential investment opportunities. Here is a bigger list of financial ratios you can consider.

Interpreting Financial Ratios in Context

Numbers alone don’t tell the full story. To truly understand a company’s value, investors must interpret financial ratios in the context of industry trends, historical performance, and the broader economic landscape. This contextual analysis ensures that you’re making informed decisions rather than relying on isolated data points.

Industry Comparisons

Financial ratios are most meaningful when compared to industry benchmarks. For example, a P/E ratio of 10 may indicate undervaluation in the utility sector but might be average in technology.

Historical Trends

Tracking a company’s ratios over time helps reveal whether its fundamentals are improving or deteriorating. A declining P/B ratio, for instance, might indicate growing undervaluation.

Cross-Ratio Analysis

Combining ratios provides a more comprehensive view. For example, pairing a low P/E ratio with a high ROE can confirm that a company is both undervalued and efficiently managed.

Understanding these nuances ensures that you’re not just relying on raw numbers but interpreting them in the proper context to make informed decisions.

Building a Screening Strategy Using Financial Ratios

Creating a systematic approach to identifying value stocks is essential for any investor. Screening strategies help narrow down the vast universe of stocks to a manageable list of high-potential candidates, allowing you to focus your efforts on the most promising opportunities.

Step 1: Define Your Investment Criteria

Establish clear thresholds for key ratios. For instance:

- P/E < 15

- P/B < 1.5

- ROE > 15%

Step 2: Use Screening Tools

Platforms like Stock Rover or Finviz allow you to filter stocks based on predefined financial metrics.

Step 3: Analyze Qualitative Factors

Beyond ratios, assess qualitative factors like management quality, competitive advantages, and industry position.

Step 4: Monitor and Reassess

Regularly review your portfolio to ensure holdings still meet your investment criteria.

By following these steps, you can efficiently narrow down the vast universe of stocks to a curated list of promising value investment opportunities.

Here is my list of the 8 of my favorite value stock screener criteria.

Limitations of Financial Ratios

While financial ratios are invaluable, they have their limitations. Investors must be aware of potential pitfalls and supplement their analysis with qualitative insights. Understanding these limitations helps ensure that your investment decisions are as well-rounded as possible.

Accounting Manipulations

Companies can manipulate earnings or inflate book values, distorting ratios like P/E and P/B.

Sector-Specific Challenges

Certain industries, such as tech or biotech, often defy traditional valuation metrics due to high growth expectations or intangible assets.

Complementary Analysis

Financial ratios should complement, not replace, a deeper understanding of the company’s operations, competitive landscape, and macroeconomic environment.

By recognizing these limitations, you can avoid common pitfalls and enhance the effectiveness of your analysis.

Key Takeaways

Financial ratios are essential tools for identifying value stocks. They offer a straightforward way to analyze a company’s valuation, profitability, and financial health. However, they must be used judiciously and in conjunction with qualitative analysis. By mastering financial ratios and applying them strategically, you can uncover hidden opportunities and build a portfolio poised for long-term success. Start incorporating these ratios into your investment process today and take your value investing to the next level.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: