Investors have long debated why cheap stocks—those with low price-to-book (P/B), price-to-earnings (P/E), or price-to-cash flow (P/CF) ratios—tend to outperform over the long run. This persistent phenomenon, known as the value premium, has been a cornerstone of quantitative and fundamental investing for decades. But why does it exist? Is it a free lunch, or does it come with risks?

In this article, we break down the mechanics of the value factor, what drives its long-term outperformance, and why, despite periods of underperformance, it remains one of the most powerful strategies for building wealth.

What is the Value Premium?

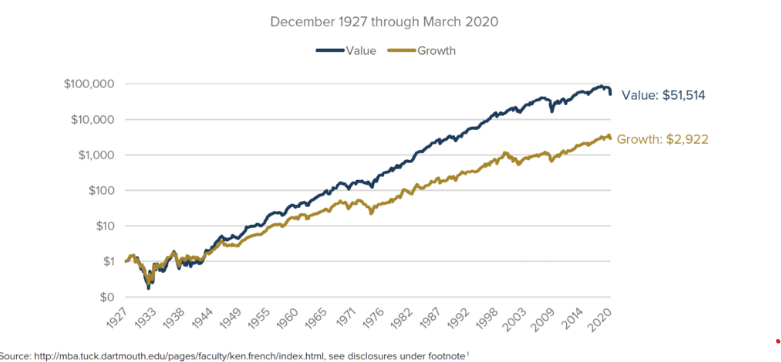

The value premium refers to the historical tendency of value stocks to outperform growth stocks over extended periods. It is one of the core factors identified in asset pricing models, most notably in Fama and French’s 3 Factor Model (1993). Research by Fama & French (1992, 1993) demonstrated that stocks with low P/B ratios significantly outperformed stocks with high P/B ratios over the long term. The value premium has persisted across different markets and time periods, suggesting it is not a statistical anomaly.

Shorter time periods may not show a persistent value premium as there are times when growth outperforms value. Today, in early 2025, we have seen a recent such period of growth dominance. However, value premium has historically always returned.

Why Does the Value Premium Exist?

The value premium exists due to a combination of behavioral biases, risk-based explanations, and structural market inefficiencies.

Risk-Based Explanation: Value Stocks Carry More Risk

Value stocks tend to be companies in distress, with uncertain futures and potential operational difficulties. Often the risk is overstated as investors err to the extremes. Because of this additional perceived risk, investors demand higher expected returns.

In addition to the risk of capital loss, value stocks tend to be more volatile as well. Part of the reason is that these stocks by definition are underfollowed and therefore the liquidity has dried up. Any transaction of significance can move the stock price significantly.

Investors that hold value stocks also tend to be nervous holders likely to sell at the slightest trigger. For example, during the Global Financial Crisis (2008–2009), value stocks suffered deep losses as investors fled to safer assets.

Behavioral Explanation: Investor Psychology Creates Mispricings

Investor psychology pushes investors to take things to the extreme, both on the upside and on the downside. Investors often overpay for growth stocks due to recency bias and excessive optimism about future earnings growth. Think of a hot Mag 7 stock that everyone around you owns and raves about day after day. Will you be the only one in your group to be left out from unimaginable profits? Similarly, stocks that have fallen see most investors leave as no one wants to see their portfolio going deeper and deeper in red. This causes the stock to fall more as investors sell. Investors also underestimate the potential recovery of beaten-down value stocks, leading to mispricing opportunities.

Overreaction and mean reversion: Stocks that become too cheap often revert to fair value over time. The market eventually self-corrects, often on its way to becoming over-extended on the other side. The gap between the intrinsic value and the discounted stock price eventually will be filled.

Historical Performance of the Value Premium

Despite occasional setbacks, value investing has delivered superior returns over multiple decades.

- From 1926 to 2021, value stocks have outperformed growth stocks by approximately 3-5% annually.

- The 2000 Tech Bubble was a classic example where overpriced growth stocks collapsed, while value stocks thrived.

- The 2010s were a challenging period for value as low interest rates and a technology-driven market favored growth stocks.

- In 2022–2023, value made a comeback as inflation concerns and higher interest rates shifted investor preferences toward profitable, cash-flow-generating companies.

Ken French maintains an extensive data library going back 100s of years tracking the performance of value stocks and growth stocks. You can spend hours perusing the data here.

Why Has the Value Premium Struggled in Recent Years?

While the value premium has historically been strong, it has faced periods of underperformance, particularly during the 2010s. I personally think these are cycles that eventually revert, but there are some underlying factors that help the cycle along.

Consider the following:

The Rise of Intangible Assets

Traditional manufacturing based businesses and trading businesses (wholesale, retail, etc) used to have significant tangible assets with well defined market value. These assets anchored the book value of the company. Today a larger and larger proportion of the market is made up of tech and service oriented companies that rely on intellectual property and other soft skills, and less on tangible goods. These businesses exhibit low book value, high P/B ratio and therefore look expensive on the P/B valuation, but they generate massive free cash flow. Take Google or Microsoft for example.

You can mitigate some of these issues by focusing solely on old line businesses, for example. Other possibility is to use a different metric to calculate the fair value. Alternatively, you can determine ranges for acceptable P/B ratios by industry, so perhaps a P/B ratio of 1 is great for a Steel manufacturer and a P/B ratio of 2 is expensive, but a P/B ratio of 3 is acceptable for a software company.

Ultra-Low Interest Rates

Growth stocks benefit more from low rates because their future earnings are discounted less. The Federal Reserve’s decade of easy money boosted tech and growth stocks at the expense of value stocks. Credit issuers are also lax in issuing funds as the money is cheap, therefore many moonshot projects are undertaken and some succeed spectacularly even if others fail.

When the interest rates are high, investors prioritize real assets and look for value and stable dividends.

Indexing and Passive Investing

The rise of passive ETFs has concentrated capital into a few large-cap growth stocks. Some of the largest mutual funds and ETFs today are S&P500 index funds and Total Market index funds. These funds are weighted by market capitalization and they all tend to own the same large company stocks. Many value stocks remain under-owned, suppressing their relative valuations.

Of course, this lopsidedness of investor attention also presents significant opportunities for value investors as there are many pockets in the markets where large discounts are to be had.

Can the Value Premium Continue?

The fundamental drivers of the value premium remain intact, but investors need to adapt with the changing times. For example, in Benjamin Graham mainly focused on the balance sheet and existing tangible assets in estimating fair value. He did not pay much attention to earnings growth. Warren Buffett realized that this approach was quite limiting to him so he adapted it by including quality and profitability metrics. He introduced the concept of a Moat, which is the competitive advantage that will allow the company maintain or even grow its profit margins over time while growing its top line.

Today, modern value investing systems pay attention to R&D and intellectual capital, recognizing these as key assets that will drive returns in the future.

Macro-economic cycles: Let’s not forget that the interest rates rise and fall in cycles. Along with this, there is a corresponding fall and rise in the credit that is available to the industry and this creates a cycle where either value stocks or growth stocks dominate.

Asness, Frazzini & Pedersen introduced a QMJ factor, Quality Minus Junk, that can filter the value stocks to deliver those where value premium still exists.

Conclusion: Should You Invest in Value Stocks?

The value premium is one of the most well-documented phenomena in finance. While it has experienced extended periods of underperformance, history suggests that value investing continues to be a proven, time-tested strategy.

The key takeaway? Cheap stocks outperform over the long run, but patience and discipline are required.

👉 For investors willing to ride out volatility and avoid value traps, the value factor remains a powerful tool for compounding wealth.

References

- Fama, E. F., & French, K. R. (1993). “Common Risk Factors in the Returns on Stocks and Bonds.” Journal of Financial Economics.

- Lakonishok, J., Shleifer, A., & Vishny, R. W. (1994). “Contrarian Investment, Extrapolation, and Risk.” Journal of Finance.

- French, K. R. (2021). Data Library on Value and Growth Returns.

- Asness, C., Frazzini, A., & Pedersen, L. H. (2019). “Quality Minus Junk.” Review of Financial Studies.

Featured products

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies.

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: