Most investors nod along when they hear about portfolio rebalancing. Yet when real money is on the line, emotions take over. It feels counterintuitive to sell your winners and add to your laggards. But if you use a factor based investing strategy, especially one that depends on the interplay between value, size, momentum, quality, or low volatility, then rebalancing isn’t optional. It’s mandatory. Letting your portfolio drift may not only distort your intended risk exposure, it can also quietly cripple long-term returns and erode the very benefits that make factor based investing work in the first place.

Let’s walk through why this discipline is at the core of long-term success.

Factor Based Investing Isn’t Set-It-and-Forget-It

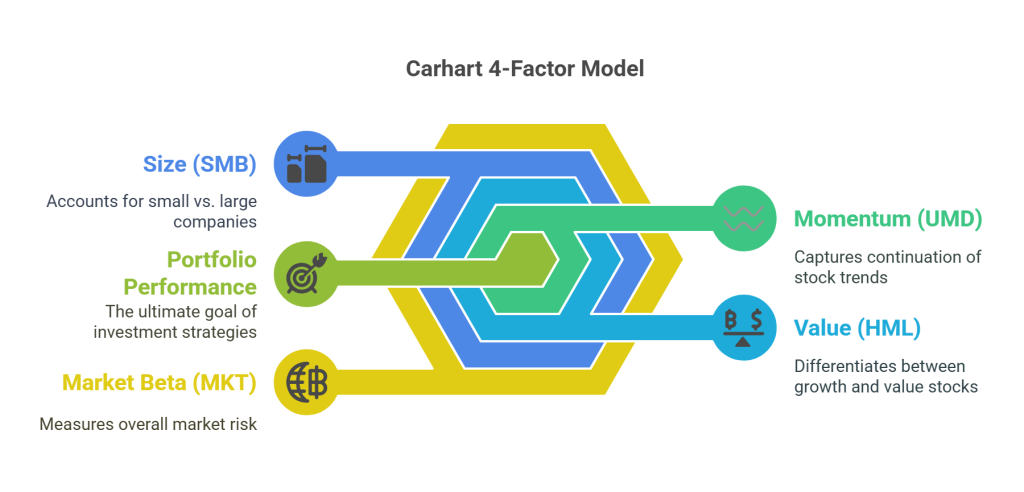

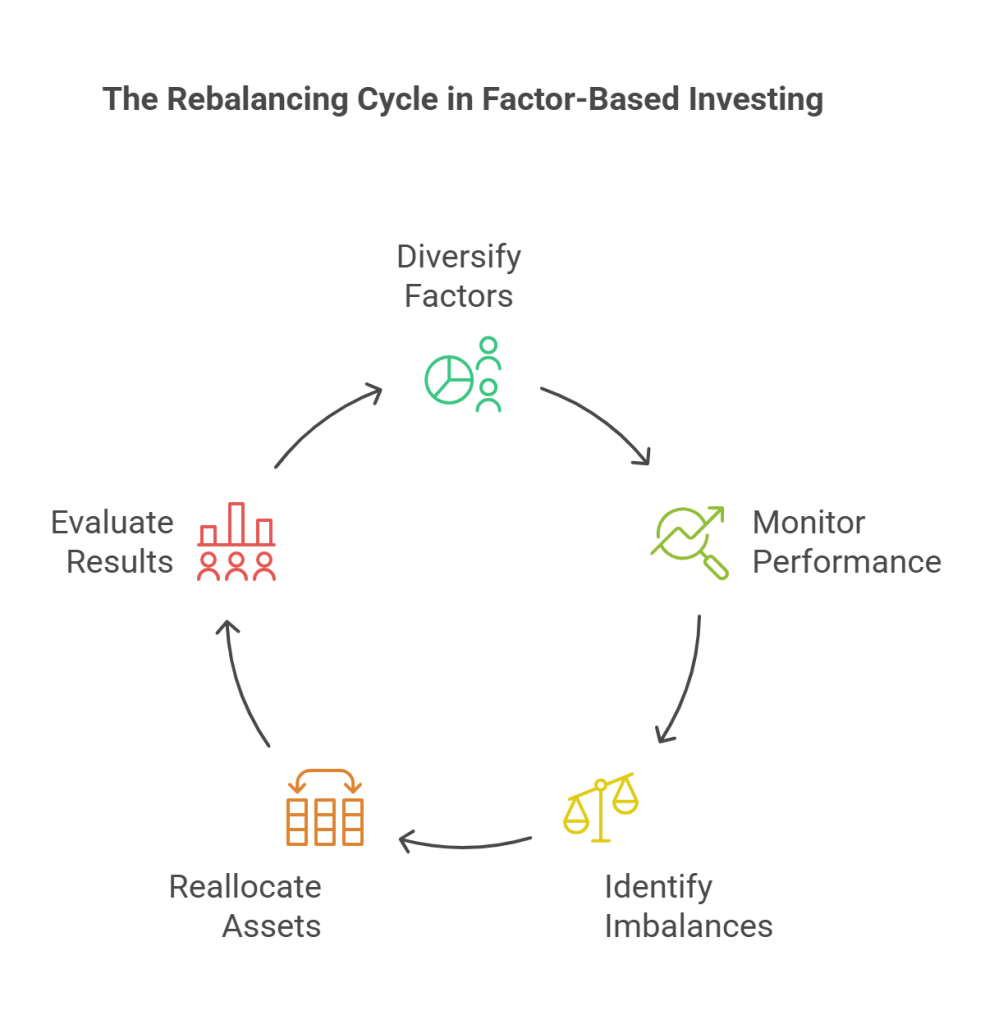

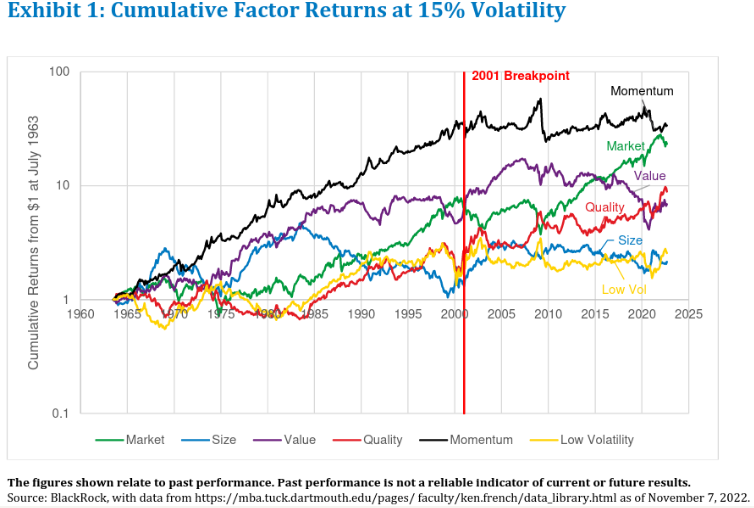

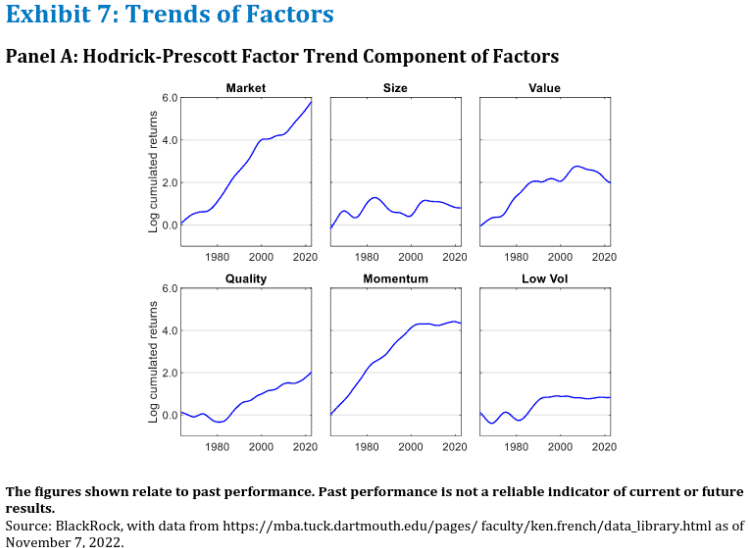

Once you’ve built your diversified set of factors, value, momentum, size, quality, or low volatility, the clock starts ticking. Each factor moves on a different cycle. They go in and out of favor depending on macroeconomic shifts, central bank policy, inflation expectations, and investor behavior. If you don’t rebalance, your exposure in a factor based investing strategy tilts over time, often in the wrong direction.

Think about it this way. If momentum rallies during a bull market, it will naturally take up a larger slice of your portfolio. Over time, this can crowd out your exposure to value or size just when those factors are about to rebound. If you don’t trim your momentum exposure, you’re no longer running a balanced factor strategy. You’re simply letting market winners dominate your allocation. That’s not strategic investing. That’s style drift masquerading as success.

And when that reversal inevitably comes – and it always does – you may find yourself overexposed to the worst-performing corner of the market. A rebalanced portfolio would have caught that rotation. A complacent one won’t.

Rebalancing Restores the Edge

Factor based investing works because of discipline. You’re systematically buying what’s out of favor and selling what’s become too frothy. Rebalancing forces you to do this at the portfolio level. This doesn’t mean selling your winners indiscriminately. It means asking whether those winners still offer enough forward return for the risk they now carry.

This is where the math matters. The act of trimming outperformers and reallocating to underperformers, when executed consistently, generates what’s called a rebalancing bonus. This small but consistent gain is the product of selling high and buying low, over and over again, without trying to time the market. It won’t show up in any single trade, but over five, ten, or twenty years, it compounds. And when paired with the long-term outperformance of proven factors, it creates a return stream that’s greater than the sum of its parts.

The Kelly Criterion Gives You the Why and the How

In your portfolio, you probably don’t use arbitrary 25-25-25-25 allocations across factors. If you’re doing it right, you’re thinking in terms of optimal capital allocation. This is where tools like the Kelly Criterion come in. By sizing your positions based on expected return, volatility, and correlations, you construct a portfolio that is mathematically optimized to grow your wealth while managing risk.

This process isn’t academic, it’s practical. In a factor based investing strategy, each factor brings its own level of volatility, cyclicality, and correlation to the others. When the landscape shifts, so do the optimal weights. Market prices change. Factor spreads widen or compress. Macroeconomic trends evolve. Your expected returns adjust. If you let your allocations drift from those new optimal weights, you’re not just tolerating inefficiency. You’re actively sabotaging your long-term growth.

The beauty of a disciplined rebalancing framework grounded in expected return is that it adapts. It evolves. It keeps your portfolio aligned with your best available information, not your past decisions.

Rebalancing Is Not the Same as Selling Winners

One of the most common criticisms of rebalancing is that it forces you to sell the very positions that are working. This view is shortsighted. A good rebalancing process doesn’t blunt momentum or punish success. It simply acknowledges that a stock or factor that has appreciated significantly may no longer offer the same risk-adjusted return going forward.

It’s important to distinguish between a price increase that is supported by fundamentals and one that has run ahead of them. If the fundamentals improve along with the price, say the company has grown its earnings or expanded its moat, then the expected return may actually rise. In this case, a recalculated weight could justify holding or even adding to the position.

So yes, factor based investing allows you to let your winners run, but only when the data supports it. It’s not about intuition or momentum chasing. It’s about updating your view with every piece of new information and aligning your capital accordingly.

Drift Happens Fast in Factor Based Investing

In factor based investing, the interplay between signals can shift rapidly. A single earnings season, interest rate change, or geopolitical event can cause momentum to spike and value to stall or vice versa. Within just a few weeks, your portfolio could be dominated by one or two factors that were never meant to take center stage.

Without intervention, this imbalance persists. And while it might feel good while your top performer is running, it’s a dangerous illusion. When that factor cycle turns, the lack of diversification will reveal itself in painful fashion.

Rebalancing acts as a self-correcting mechanism. It ensures that your exposure stays aligned with your long-term strategy and not the whims of the current market cycle. It’s how you maintain structural integrity in a portfolio designed to exploit diversification across factor premiums.

Final Thought: Discipline Is the Alpha Generator

You can’t predict which factor will lead next quarter or next year. You don’t need to. The power of factor based investing lies in diversification across strategies that each have long-term statistical edges. Your job is not to guess the next winner. It’s to structure a portfolio that lets all of them do their job.

Rebalancing won’t get you a headline on CNBC. It won’t feel exciting. But it will quietly and relentlessly compound the advantages you built into your portfolio in the first place.

You’re not just selling high and buying low. You’re sticking to the rules that make your process work. You’re enforcing the logic of your model. And over time, that discipline becomes the engine of outperformance.

When you run a strategy built on factor based investing, rebalancing is the guardrail that keeps your returns on track. Skip it, and you may still catch a few rallies. But systematize it, and you won’t need luck. You’ll have math, logic, and structure on your side, and that’s a far better foundation for wealth.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: