You’ve probably looked at a company’s book value and thought, “This stock is cheap.” But hold on. That number on the balance sheet doesn’t always mean what you think it means. For value investors, book value is a starting point, not the finish line. It can offer a clue to undervaluation, but only if you understand the business behind the number. In this article, you’ll learn when the book value of a company is useful, when it’s misleading, and how to avoid falling for a fake bargain.

What Is Book Value and Why Investors Rely on It

Let’s begin with the basics before we get into the misinterpretations and traps.

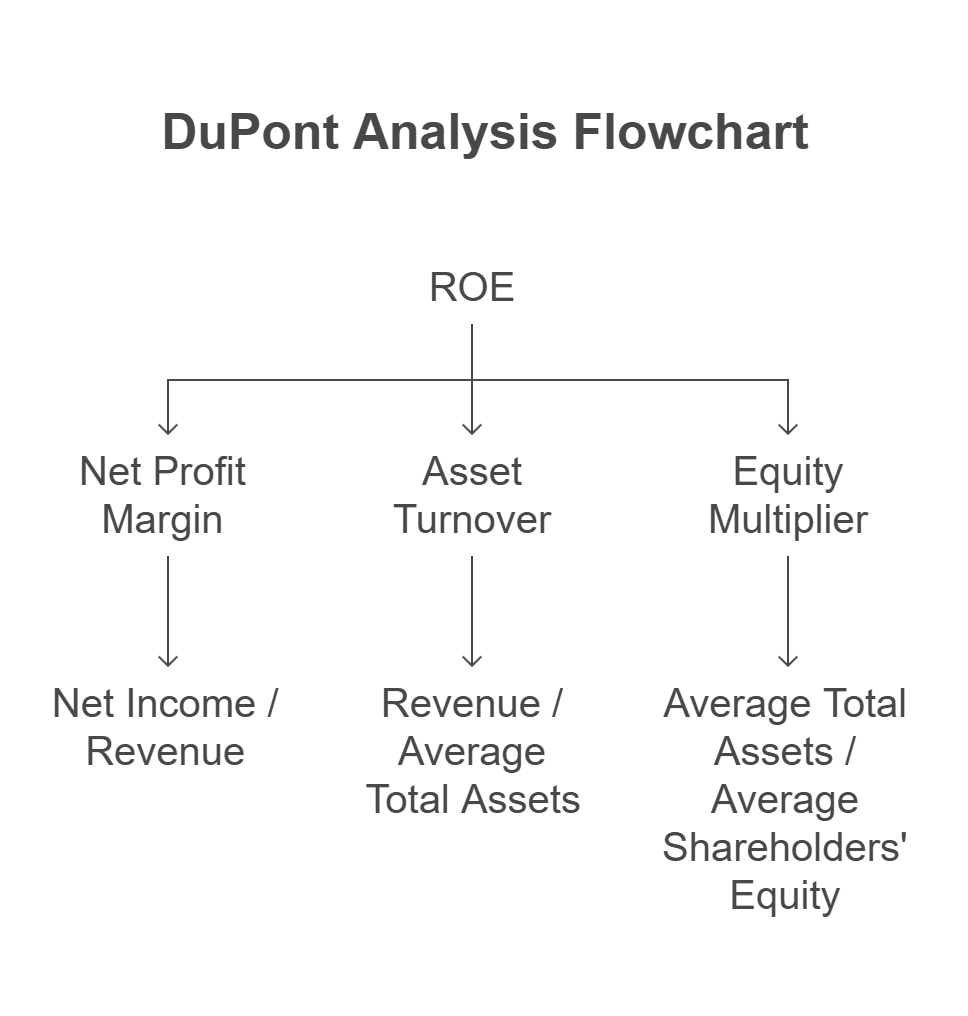

Book value is simply the company’s total assets minus its total liabilities:

Book Value = Total Assets – Total Liabilities = Shareholder’s Equity

Think of it as the accounting version of net worth. Investors often use it as a conservative benchmark, especially in value investing where margin of safety is critical. The price-to-book (P/B) ratio compares the market price to this accounting value and is frequently used as a valuation filter:

P/B Ratio = Market Price per Share / Book Value per Share

P/B Ratio = Market Value / Shareholder’s Equity

This second version of the formula is more useful when you’re analyzing the company as a whole rather than on a per-share basis. Market value is the total equity value as assigned by the stock market, while shareholder’s equity is the total book value on the balance sheet. If the market value is well above shareholder equity, the market expects strong future earnings growth. If it’s below, the market may be pricing in distress or ignoring undervalued assets.

When Book Value Reflects Real Intrinsic Worth

Sometimes, book value does align with economic reality, and this is when it becomes a powerful tool.

In industries like financials, insurance, and heavy manufacturing, book value tends to reflect real, tangible assets. You can find undervalued opportunities when a company is trading below a well-audited, asset-heavy book value. If there are no major intangibles or inflated asset estimates, book value can serve as a floor below which the stock shouldn’t trade. Add in insider ownership and consistent capital discipline, and now you have something actionable.

The Hidden Pitfalls of Blindly Trusting Book Value

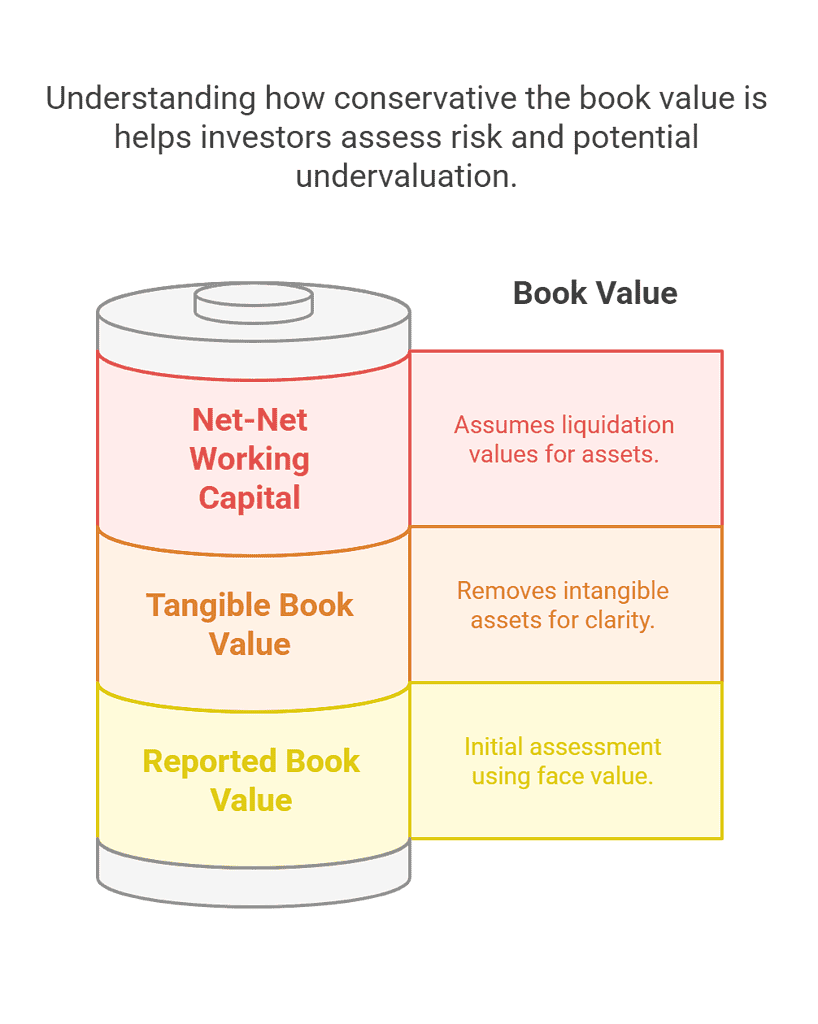

Book value, in its rawest form, is just the first step. As investors seek greater clarity and downside protection, they often refine this measure to get closer to economic reality. This refinement process follows a spectrum—from reported book value, to tangible book value, to Benjamin Graham’s net-net working capital approach. Each level strips away layers of assumptions and accounting estimates, making the valuation more conservative.

But here’s the catch. Many companies stretch the truth about what their assets are really worth.

Book value often includes goodwill and other intangibles that may be wildly overstated. Equipment and property values might be outdated or not reflective of liquidation value. Some companies keep receivables on the books that they may never collect. You’ll also find inventory that hasn’t moved in years. All of these distortions can make book value look sturdier than it really is.

This is why many investors look at tangible book value as a critical next level of refinement. Tangible book value strips out goodwill and other intangible assets to provide a clearer view of what shareholders could actually claim in a worst-case scenario. It’s especially useful in identifying financial health and downside risk. The formula is:

Tangible Book Value = Total Assets – Intangibles – Total Liabilities

On the flip side, book value can sometimes understate the true worth of a company. This often happens when long-held assets like real estate are carried on the books at historical cost, while their market value has appreciated significantly. For example, a legacy manufacturing company might own land acquired decades ago that’s now worth 10 times its carrying value. Similarly, patents, proprietary technology, or brands can have real economic value that’s not captured in the book. In these cases, the accounting book value is artificially low, making the company look more expensive on paper than it actually is. When this happens, the reported book value becomes a poor proxy for the company’s true intrinsic value.

The Danger of Overpaying for “Cheap” Book Value

A stock trading below book can still be a terrible investment.

Low P/B might reflect structural decline, poor management, or a shrinking industry. Without real earnings power or a catalyst to unlock value, it’s just dead money. Think of struggling retailers with big inventory write-downs or legacy manufacturers sitting on obsolete assets. On paper, they look cheap. In practice, they burn cash and destroy capital.

📈 Energy Gains Start With Knowing the Real Value

SM Energy (SM) Stock Analysis: Exclusive Valuation Report

Built for investors who want more than just momentum — this report reveals whether SM’s current price reflects its true worth in today’s energy landscape. No hype. Just numbers.

- Intrinsic value estimate grounded in energy sector fundamentals

- Detailed upside/downside analysis from today’s market price

- Clear context on SM’s competitive position among shale players

Serious analysis for serious capital.

👉 Get the SM Energy Report – $167

How to Make Book Value Work for You

So how do you avoid falling into the trap while still using book value effectively?

Scrub the balance sheet. Adjust for questionable intangibles, subtract dead inventory, and check whether receivables are actually collectible. For example, apply a haircut to accounts receivable that are aged beyond 90 days, write down slow-moving or obsolete inventory, and discount fixed assets that are industry-specific or hard to liquidate.

This is where Benjamin Graham’s concept of Net-Net Working Capital (NNWC) becomes highly relevant. The formula is:

Net-Net Working Capital = Current Assets – Total Liabilities – Adjustments for Asset Risk

More specifically:

NNWC = Cash + 75% Accounts Receivable + 50% Inventory – Total Liabilities

This conservative method assumes only a portion of assets can be realized in a worst-case liquidation scenario. It represents the most stripped-down form of book value—one that aligns closely with what an investor might recover if the company were liquidated tomorrow. For deep value investors, especially those inspired by Graham, this is the gold standard of conservative valuation. Companies trading below NNWC offer an unusually high margin of safety and may represent rare opportunities if the assets are real and liabilities are properly accounted for.

Look at trends in book value per share. Is it growing or shrinking? Compare that growth to earnings and free cash flow. And always evaluate asset quality—ask how liquid, how durable, and how marketable those assets truly are.

When You Should Ignore Book Value Entirely

Sometimes, the best use of book value is to know when to ignore it.

In capital-light businesses, like software firms, asset managers, or brand-heavy consumer companies, book value is often irrelevant. These companies generate massive cash flows with little need for tangible assets. In fact, management may deliberately keep book value low to optimize return on equity. In such cases, a low book value doesn’t mean undervalued. It means the business model is built differently.

Final Thoughts: Use Book Value as a Filter, Not a Formula

The book value of a company is not gospel. It shines in some sectors, misleads in others, and demands context. Don’t fall in love with a low P/B ratio until you understand what’s underneath it. Treat book value as a filter in your idea generation process—a way to surface potential bargains. But before you invest, roll up your sleeves and do the work. Real value is always in the details.

🪪 Sleek Design. Everyday Function. Timeless Leather.

Slim Bifold Card Holder Wallet – Italian Leather

Designed for minimalists who still carry with intent. This handcrafted bifold wallet features rich Italian leather and a built-in ID window, offering a clean profile without sacrificing practicality.

- Full-grain, vegetable-tanned leather from Tuscany – ages with character and depth

- Four card slots, two side pockets, and a clear ID window

- Hand saddle stitched with polished, burnished edges Refined utility in your front pocket.

👉 Shop the Slim Bifold Wallet – $85

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies.

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: