The market may be irrational, but your portfolio doesn’t have to be. Most investors are just hoping for the best in every market cycle. You, on the other hand, can engineer a portfolio that adapts, hedges, and outperforms. This article shows you how to build a dynamic, globally diversified factor-based portfolio, using real ETFs like the ones we own in the Dynamic Core Hedge Portfolio. Whether you’re just getting started or rethinking your asset mix, you’ll walk away with a blueprint to help you thrive through whatever the market throws your way.

What Makes Factor Investing a Resilience Strategy, Not Just a Smart Beta Play

Let’s start with why this works.

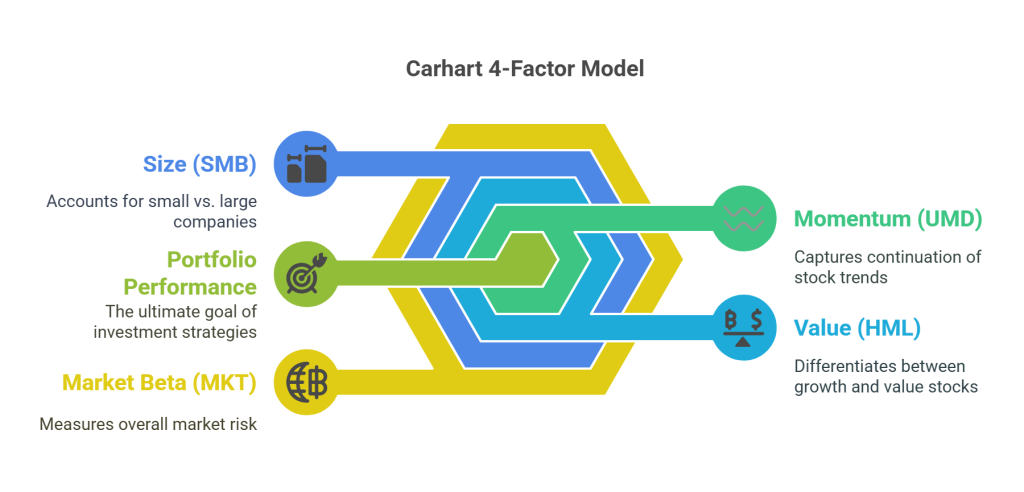

You’re not trying to beat the market every year. You’re building something that holds up when others break down, and compounds better over the long run. Factor investing allows you to harness persistent return drivers like value, momentum, and size, but also hedge volatility and macro risk using real assets, bonds, and diversification across regions.

When structured right, factor exposures work together to reduce overall portfolio risk. You’re not betting on a single outcome. You’re stacking the odds in your favor by holding assets with consistent outperformance traits.

Factor Based Portfolios That Have Stood the Test of Time

We’re not the only ones who believe in this approach.

Some of the most resilient and well-known all-weather portfolios also rely on principles of factor diversification, asset balance, and geographic spread:

- Ray Dalio’s All Weather Portfolio: Built on the idea of balancing risk rather than capital, with allocations across stocks, bonds, gold, and commodities to thrive in any macroeconomic environment.

- The Permanent Portfolio (by Harry Browne): A simple four-part allocation to stocks, long-term bonds, cash, and gold. Designed to perform in inflation, deflation, prosperity, and recession.

- Rob Arnott’s Fundamental Indexing Approach: Though not a portfolio per se, this strategy emphasizes company fundamentals over market capitalization and has inspired many factor-based approaches.

- Larry Swedroe’s Factor-Based Model Portfolios: Widely referenced in financial planning circles, these emphasize tilts toward value, size, and profitability using DFA and similar funds.

These frameworks all reinforce the same core insight: You don’t need to predict the future to do well, you just need to prepare for it intelligently.

Inside the Dynamic Core Hedge Portfolio: A Real-World Example

This isn’t theory. These are the ETFs we actually hold.

The Dynamic Core Hedge Portfolio is built for macro-resilience. It’s globally diversified, factor-aware, and designed to play offense and defense at the same time:

- AVUV – U.S. Small-Cap Value

- AVDV – International Developed Small-Cap Value

- DGS – Emerging Markets Value with a small-cap tilt

- MTUM and IMTM – U.S. and International Momentum

- VT – Total Global Market Exposure

- GLDM – Physical Gold

- SGOV – Ultra-short Duration Treasuries

- FBTC – Bitcoin ETF for Asymmetric Upside

This isn’t an exhaustive factor grid. It’s a carefully selected mix that offers high-performing factor exposure while also hedging monetary and market risk. You can adopt this model or tailor it based on your own needs.

Why Geographical Diversification Multiplies the Power of Factors

Different economies, different cycles, different opportunities.

A U.S. small-cap value stock doesn’t behave the same as one in Japan or Brazil. That’s why breaking out factors by geography enhances both performance and resilience.

- AVDV provides exposure to undervalued small caps in developed markets like Europe and Japan.

- DGS targets fundamentally sound emerging market small-cap stocks.

- IMTM helps capture momentum outside the U.S.

- VT delivers global beta for diversification and context.

This geographic spread ensures you aren’t leaning too heavily on any one economy, policy regime, or currency. It’s an essential hedge against overconfidence in a single market.

This strategy has been validated this year as the US markets have wobbled and the investors have lost confidence in the US treasuries as safe haven. The geographical diversification means the portfolio has held up extremely well, far outpacing the returns of the standard US stock market index.

How to Build Your Own Factor Based Portfolio: A Practical Framework

You don’t have to use the exact ETFs we do, but you do need to be intentional.

Here’s a simple framework:

- Start with Market Exposure: A fund like VT provides broad global equity exposure.

- Add Value with a Size Tilt: Combine AVUV, AVDV, and DGS to cover multiple regions.

- Include Momentum: MTUM and IMTM help capture performance persistence.

- Hedge Volatility and Macro Risk: GLDM protects against inflation, while SGOV adds short-term stability.

- Optional Convexity: FBTC offers asymmetric potential in digital asset growth.

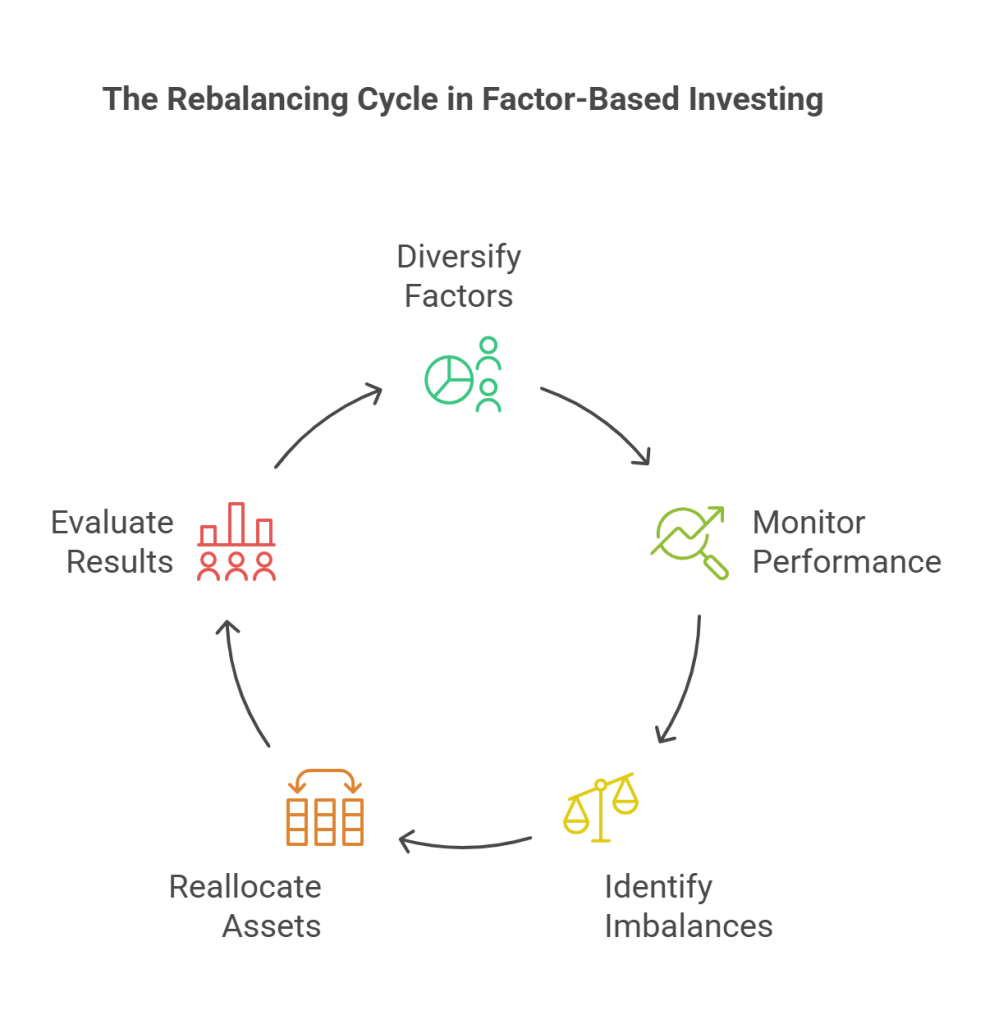

Rebalance your portfolio semi-annually or annually. You don’t need to micromanage it, but you do need consistency.

What to Expect from a Portfolio Like This

No fireworks. No implosions. Just steady, engineered performance.

This kind of portfolio won’t always top the charts in bull markets, but it rarely sits at the bottom in bear markets. That’s the power of compounding without large drawdowns.

- Value shines in recoveries and inflationary periods.

- Momentum leads in growth-driven rotations.

- Gold and Bitcoin offer ballast in times of monetary stress.

- Treasuries help when risk assets decline.

Stay consistent and you’re likely to outperform the traditional 60/40 over time, with fewer surprises along the way.

A Smarter Way to Stay Invested

This isn’t guesswork. It’s structure.

Markets change. Headlines shift. Fear and greed trade places. But a portfolio grounded in factor resilience and geographic diversification doesn’t panic. It adapts.

Our Dynamic Core Hedge Portfolio is one such structure. Yours might look different, but when you build with intention instead of reacting to headlines, you gain the clarity and confidence to stay the course.

Want to See How We Allocate and Rebalance This Portfolio in Real Time?

While we’ve shared the actual ETFs in our Dynamic Core Hedge Portfolio here, our Founder’s Club members receive exclusive access to:

- Our target allocations

- Real-time updates and tactical tilts

- Rebalancing schedules

- Regime-switching models

- Private commentary and insights

This is where the edge really comes from, and it’s yours to tap into.

Join the Founder’s Club Today and take control of your financial future with the confidence of a strategy built for every market cycle.

Plus, Access Three Additional Exclusive Portfolios:

- Small-Cap Value Portfolio (Premium) – A concentrated portfolio of deep-value small-cap stocks with high upside potential.

- Rapid Wealth Compounder – An income factory-style portfolio focused on generating and reinvesting high yields.

- Dividend Fortress Portfolio – A dividend growth strategy based on earnings strength, low payout ratios, and consistent monthly income.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies.

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: