Intrinsic value is not enough in a world of macro uncertainty

You can do everything right as a value investor. Buy below intrinsic value. Demand a margin of safety. Stick to your thesis. And still, your portfolio can suffer when inflation spikes, interest rates lurch, or trade wars disrupt entire sectors. The truth is, intrinsic value isn’t immune to macro shocks. But that doesn’t mean you’re powerless. You just need to bake portfolio resilience into your process.

Why Macro Events Overwhelm Even the Best Ideas

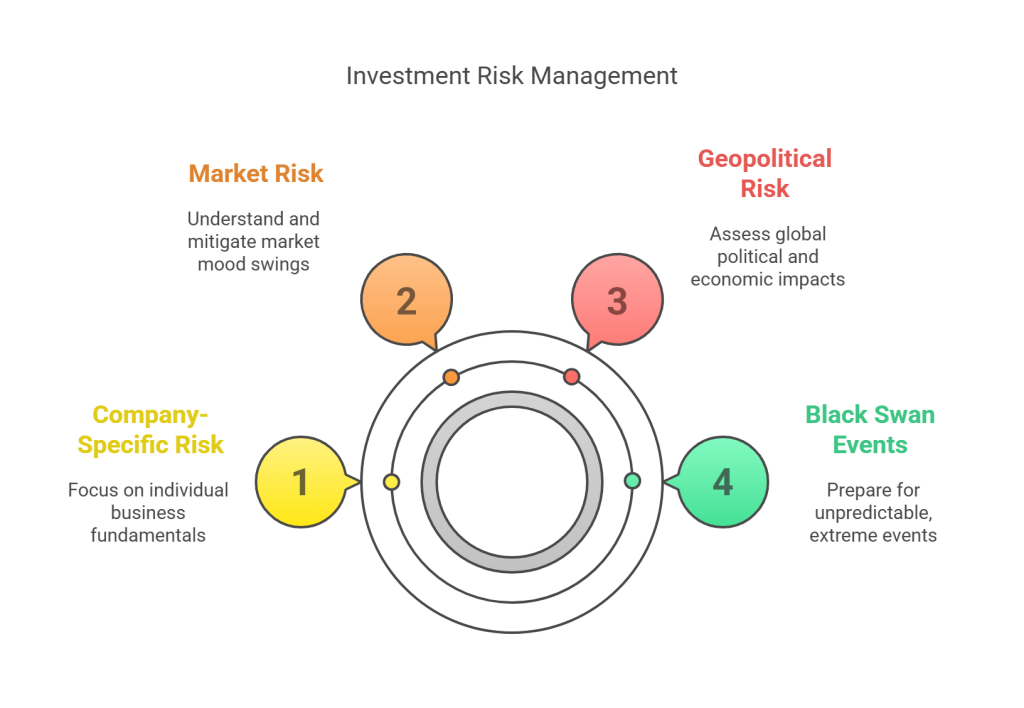

Let’s start with a reality check. A company can be fundamentally sound and still see its stock cut in half. Why? Because markets are driven not just by cash flows and earnings, but by fear, liquidity, sentiment, and external forces beyond any investor’s control. Tariffs can crush margins. Wars can upend supply chains. Currency crises can make earnings forecasts obsolete overnight.

And when investors stampede into safe havens, even the best quality stocks can suffer.

If you can’t predict or prevent macro shocks, the only rational move is to prepare for them. And that preparation begins with understanding what resilience truly means.

What Portfolio Resilience Really Means

Resilience doesn’t mean immunity. It means recovery. It means staying intact long enough to benefit from the rebound. And it starts by ensuring that no single shock can take down your entire strategy. That’s why I build portfolios around three principles:

- Margin of safety – to absorb the unexpected.

- Low correlation – to avoid cascading losses.

- Multiple return drivers – so performance doesn’t depend on one narrative.

These concepts are familiar. But how you structure them together makes all the difference. A resilient portfolio doesn’t just survive, it emerges stronger over time.

Margin of Safety: Your First Line of Defense

In an unpredictable world, the price you pay matters more than ever. A healthy margin of safety protects your downside. If a stock’s fair value is $20 and you buy it at $10, even a global panic that pushes it to $8 leaves you better off than if you had bought at $18. You’ve built cushion into your decision.

We are protecting against company specific risk here.

This built-in protection is the foundation of resilience. But on its own, it’s not enough.

Low Correlation Is Your Hidden Asset

During a crisis, it feels like everything crashes at once. This is why I intentionally construct portfolios with uncorrelated or weakly correlated holdings. Some are event-driven. Some generate consistent income. Others are strategic hedges. The point isn’t traditional diversification. It’s insulation. So when one corner of the market gets hit, your entire portfolio doesn’t follow.

We are protecting against market risk here.

Structuring your holdings this way adds balance and gives you staying power during turbulence.

Inner Circle Portfolios: Designed for Resilience

If you’re in the Inner Circle, you already know the power of multi-strategy design:

- Dividend Fortress Portfolio – focused on durable income and business quality.

- Rapid Wealth Compounder – high-yield vehicles that pay you or grow your income base steadily.

- Dynamic Core Hedge – factor-based ETF exposure designed to adapt across market cycles.

Each of these strategies behaves differently in response to macro events. Combined, they form a cohesive defense against economic storms while still compounding wealth.

And of course we have the Small Cap Value portfolio generating alpha for us in the longer term, that by itself is designed with margin of safety and low correlation in mind.

This kind of design helps you build strength into your portfolio, not just deliver returns.

Rebalancing with Purpose: Locking in Strength, Not Chasing Gains

When markets wobble, many investors freeze. But in a resilient portfolio, you expect there will be volatility. Rebalancing adds discipline to your process, and it allows you to take advantage of the volatility. You trim what has outrun its fair value. You add to what’s become undervalued.

This helps in harvesting incremental returns from volatility, and at the same time it helps you mentally go past the fear of volatility and build resilience in your process.

This consistency in execution makes your resilience real, not just theoretical.

Your Mindset: Calm Amid the Chaos

Markets will always give you a reason to panic. But a resilient investor doesn’t operate on emotion. You act from principle. You’ve built your portfolio for turbulence. You’ve accounted for drawdowns. That’s what gives you the clarity to stay calm when others are selling into fear.

The more prepared you are structurally, the more composed you can be psychologically.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies.

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: