Smart Capital Allocation Separates Winners From Average Investors

You’ve probably seen it happen—two investors buy similar stocks, but only one walks away with real wealth. The difference isn’t the stock picks. It’s how they allocate capital. Asset allocation is more than a pie chart—it’s the lens through which value investors make high-conviction, risk-aware decisions. And no, it has nothing to do with guessing interest rates or timing the market. This article walks you through how elite value investors approach capital allocation across asset classes—and how you can apply the same frameworks to grow your own wealth with clarity and confidence.

Stop Guessing. Start Allocating Like a Rational Capitalist

Before we explore strategies, we need to debunk the traditional mindset.

Most asset allocation advice revolves around age-based models or passive risk tolerance questionnaires. These are built for asset gatherers, not capital compounders.

You’re not here to match the market—you’re here to beat it. That means you need a mental model for allocation that reflects opportunity, not averages.

Traditional models like the 60/40 portfolio ignore nuance. They assume that stocks and bonds will always balance each other, and that you’ll sleep better just because you’re diversified. But true diversification requires understanding correlation, expected return, and volatility.

The best investors think in terms of expected value, not vague labels like “stocks” or “bonds.” Every capital decision is a bet—your job is to size it rationally based on what you expect to gain and what you risk losing.

Use a Multi-Strategy Framework, Not a One-Size Portfolio

Value investors don’t allocate based on asset classes—they allocate based on strategy goals.

Think like a fund-of-funds manager—but where every fund is one of your own personalized strategies.

You might have a core allocation to small-cap value stocks that deliver long-term appreciation. Pair that with a cash-flow engine built from covered call ETFs or CEFs. Add a counter-cyclical ETF portfolio designed to weather economic shocks. Layer in tactical bets on special situations or turnaround plays.

Each strategy has a different job: growth, stability, income, or asymmetry. You allocate capital to fulfill those roles—not because “bonds go down when stocks go up.”

Some investors also adopt broader frameworks like:

- Risk-Parity, which balances risk rather than capital across assets

- Equal-Weight Allocation, which treats every asset with the same nominal exposure

- Optimal-F, an extension of Kelly that accounts for drawdown risk and non-normal return distributions

While these methods are more quantitative, they can be powerful tools when customized to your investment universe and risk tolerance.

Use the Kelly Criterion to Size Positions for Long-Term Growth

Once you have your strategy mix, the next question is: how much do you allocate to each? That’s where most investors go wrong.

The pros don’t guess. They use probabilistic tools like the Kelly Criterion to calculate position sizes that maximize geometric compounding.

The Kelly Formula considers three key variables: your estimate of the expected return, the variance (or risk), and how correlated the asset is to the rest of your portfolio. It tells you how much to bet to grow your capital over time without blowing up your portfolio.

This means:

- A high-conviction, low-volatility dividend stock may deserve a bigger slice.

- A volatile but promising turnaround might get a small speculative position.

- A stock that overlaps heavily with another holding might get zero.

Equal-weighting might feel “fair,” but it’s almost always suboptimal.

Asset Allocation Strategies are a Living System

Most retail investors rebalance once a year and call it a day. But your portfolio is a living organism. The fundamentals of your investments change, and so should your allocation.

The best value investors continuously update their estimates of intrinsic value and expected returns—and adjust allocation accordingly.

Rebalancing doesn’t just mean selling what went up and buying what went down. It means recalculating your growth-optimal weights as the opportunity set evolves. It means trimming a position not because it’s up, but because the upside is now limited. It means increasing a position if new data increases your estimate of intrinsic value.

Reallocation is a tool to keep your capital working where it can do the most good—without falling into the trap of emotional decision-making.

The Secret Sauce—Cross-Asset Correlations and Behavioral Discipline

Smart asset allocation isn’t just math. It’s about controlling human behavior.

A portfolio with uncorrelated strategies smooths out the emotional rollercoaster—and keeps you in the game when others fold.

Allocating across strategies with different emotional profiles helps you avoid panic selling. When one strategy is out of favor, another is likely carrying the load. This mental ballast keeps you from making short-term mistakes that sabotage long-term results.

Example: Pairing event-driven small-caps with a steady dividend fortress or an ETF core can provide the stability you need to weather volatility.

When you diversify by behavior as well as by return stream, your portfolio becomes more resilient than the sum of its parts.

Build Your Own Value-Based Allocation Model Today

You don’t need a team of analysts or a CFA to allocate like the pros. You just need a repeatable process.

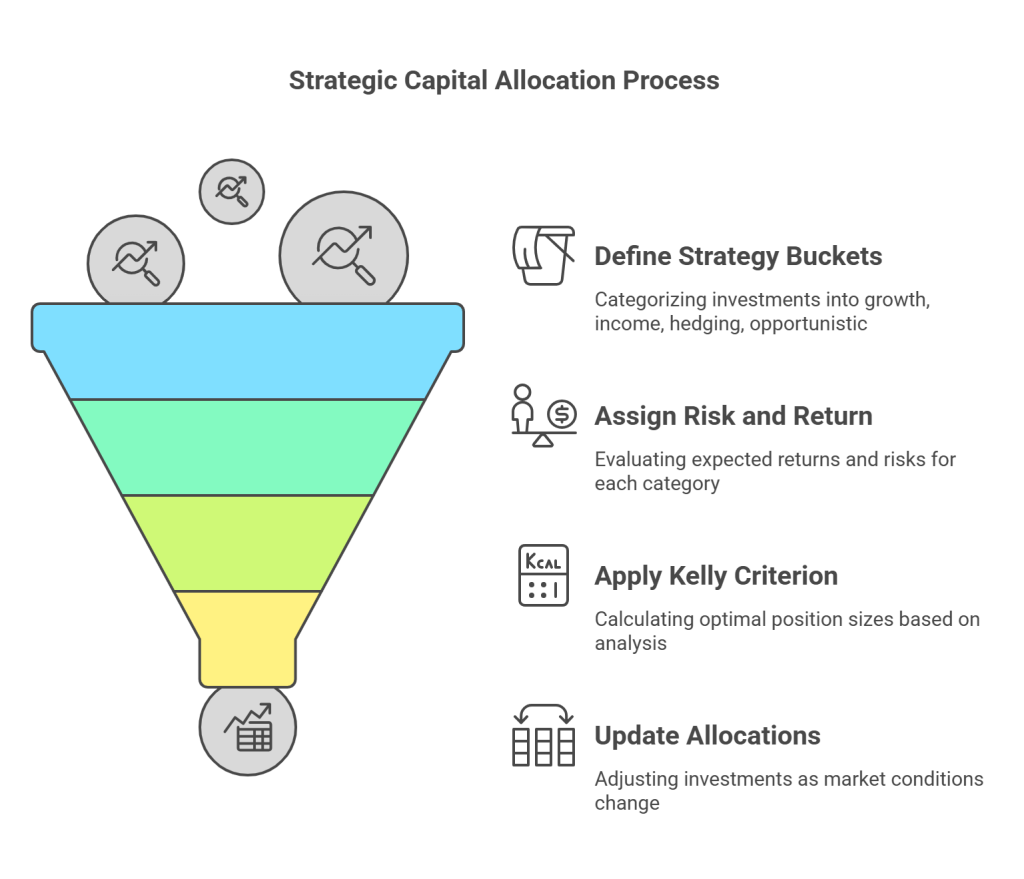

Here’s how to build your own rational allocation framework:

- Define your strategy buckets (growth, income, hedging, opportunistic).

- Assign realistic return expectations and risk measures to each.

- Use a sizing model like Kelly to allocate based on expected value.

- Update allocations quarterly or when fundamental assumptions change.

Even if you never calculate the math explicitly, this mindset shift alone will sharpen your portfolio decisions.

Conclusion: Allocate With Intention—And Let the Compounding Do the Rest

The best value investors don’t guess the market. They focus on what they can control: buying undervalued assets and allocating their capital wisely. If you want to turn smart stock picks into lasting wealth, your asset allocation strategy needs to evolve beyond templates. Build it like a professional—strategy first, size with math, update as you go. That’s how you get off the rollercoaster and onto the compounding train.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: