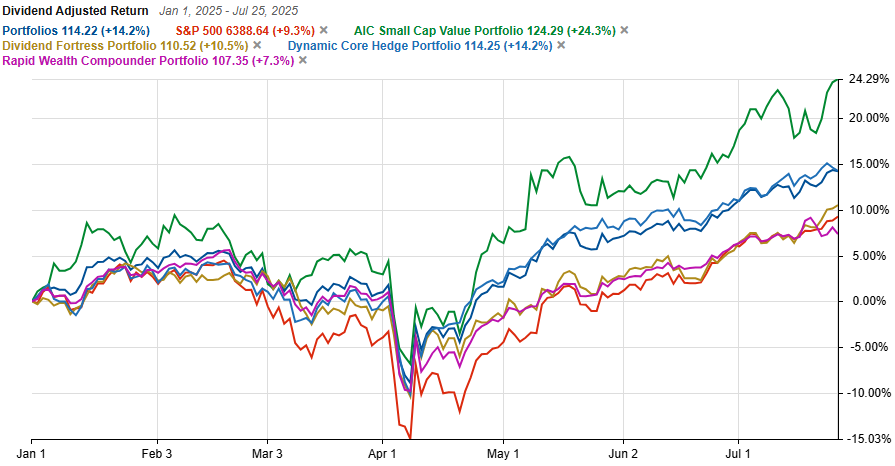

My Investment Thesis Briefs are Now on Yahoo Finance Pages + Portfolio Performance Update

A number of my investment thesis briefs now appear on the ticker pages of Yahoo Finance. You can see 2 examples below: Scroll down to the Featured Community Analysis section. These will be available as long as my thesis remains relevant. Over time you will see these show up on more stock tickers where I […]

![[Inner Circle] 🏰 PEP — PepsiCo, Inc. A 53-Year Dividend Growth Streak, Attractively Priced 4 pepsi stock analysis](https://astuteinvestorscalculus.com/wp-content/uploads/2025/07/pepsi-1024x574.png)

![[Inner Circle] The Next Berkshire Hathaway, Part 3, Final 18 Next Berkshire Hathaway](https://astuteinvestorscalculus.com/wp-content/uploads/2025/06/next-berkshire-hathaway-1-1024x574.png)