Inflation is the Silent Wealth Killer

For all of us today, inflation is a fact of life. We all know that the prices tend to increase as the years roll by. Many of us have fond memories of the bygone times when the same things we buy today cost so much less. A dollar used to buy so much more in the past than it does now.

They say that cash sitting in your bank account doing nothing loses value over time. This is true – inflation gradually erodes the purchasing power of your money. This is even more of a problem during periods of high inflation. As investors, you must shift your strategy during the inflationary times so you can protect and grow your real wealth.

In this article we will take a look at some of the past inflationary cycles and who the winners and losers were in investing. This should give us some ideas of how we want to position our investments when inflation is knocking at the door.

Understanding Inflation’s Impact on Investments

Inflation diminishes the real value of cash. The real returns of fixed-income investments are also lower than advertised, once you take inflation into account. Traditional savings account and short term bonds offer meager yields, that may not be able to keep up with the rate of inflation when it is running high. This means that if you are saving away your dollars in these conservative investments, you are actually losing wealth over time by not keeping up with the inflation.

Real assets on the other hand are repriced higher as the inflation raises prices generally. These assets are better able to keep pace with inflation, and at times they may also be setting the pace for inflation. Investing in these real assets is an important part of the process of navigating your investments through a period of high inflation successfully.

Historical Lessons: What Worked in Past Inflationary Periods?

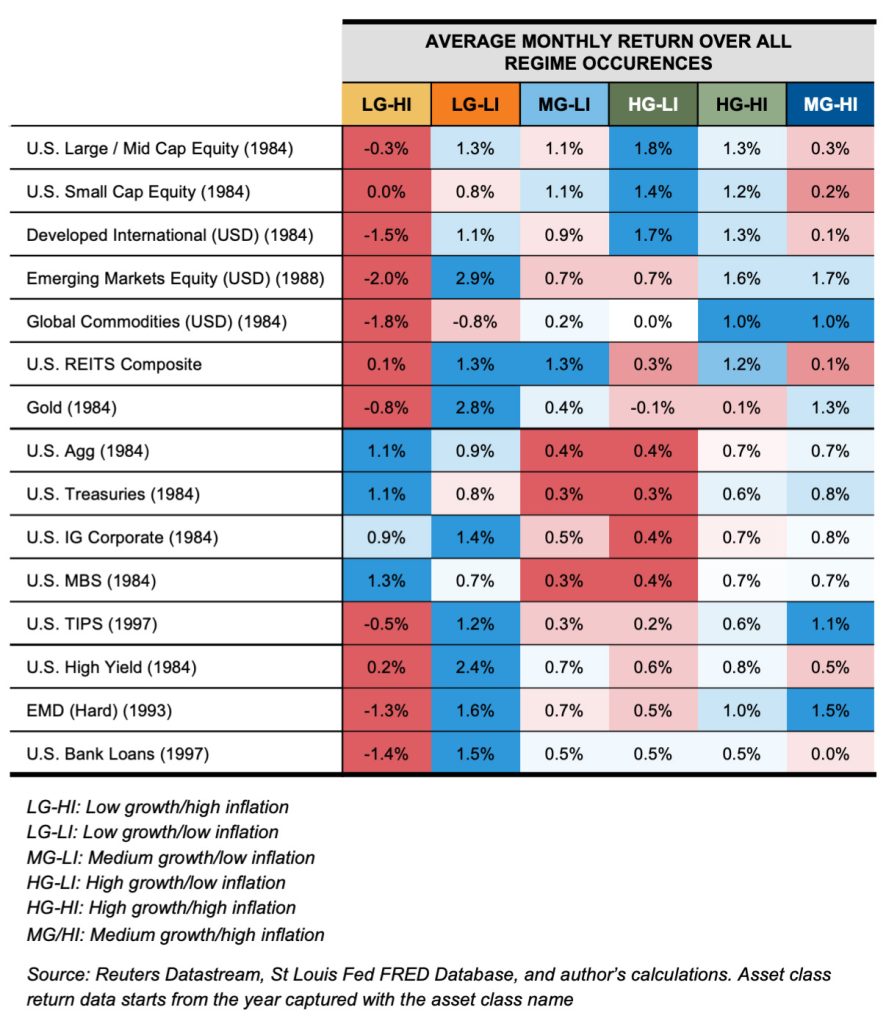

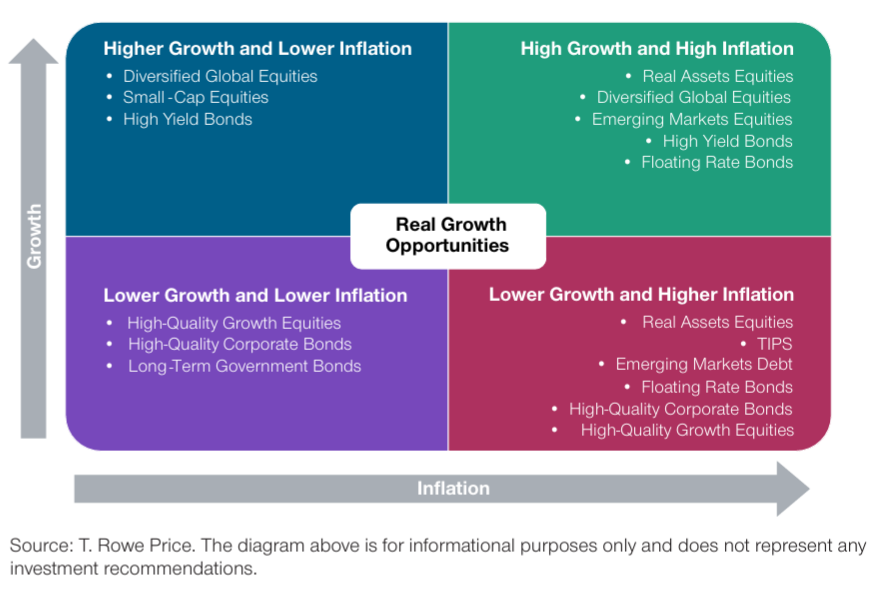

Different asset classes have reacted differently during the past inflationary periods, depending on whether it was a period of high, medium or low growth.

Another way to represent this is below

Some trends emerge. The assets that do well during the periods of high inflation include Real Assets such as Gold, Commodities and Real Estate. TIPs also perform well, as they should, since they are designed to handle inflation. There may be variations in the actual assets that may be driving inflation. For example, the 1970s inflation spike saw the oil prices rise significantly. During the 2008-2011 inflation period, commodities, stocks and TIPS were the winners. And occasionally, it is less about growing your investments, and more about preserving the wealth you have.

The Best Investments During Inflation

Let’s break down the Real Assets that are the best investments during inflation.

A. Hard Assets That Retain Value

Real estate has been the mainstay to combat inflation for decades. Rental income serves as an inflation-adjusted cash flow source. When inflation rises, rents also rise. In fact, if you invest in real estate using mortgage borrowing, inflation can be god send – the rents rise but the loan payments do not change in nominal terms, meaning the loan payments actually decline in real terms.

Gold and precious metals have historically served as inflation hedge by the virtue of being a safe haven. Commodities like oil, agricultural products and industrial metals are also natural inflation beneficiaries as they reprice higher during inflation.

B. Stocks That Beat Inflation

Stocks are natural inflation hedge since the stock prices typical rise during inflation. Dividend stocks generally represent quality companies with pricing power that can pass on the increased costs to the consumers. Energy and natural resource stocks are tied to commodities and as commodities appreciate with inflation, these companies do well, which is often reflected in the stock price or the increased dividend distributions to the shareholders. Finally, infrastructure and utility stocks can be your calm during the storm with their stable cash flows that are inelastic to the inflationary pressures.

C. Alternative Inflation Hedges

If gold works as an inflation hedge, then what about digital gold? While this has yet to be proven as we have not had enough number of years to observe, it is very likely that as crypto matures, many digital assets, including Bitcoin, will take on the role that gold has played so far. This could indeed become great inflation hedges.

TIPS, or Treasury Inflation-Protected Securities are designed to keep pace with inflation with their yield being linked to the inflation rate. The yield itself is not high, but the inflation protection is the allure.

finally, private equity and venture capital investments may not be very correlated with the overall economy and could deliver high growth even when the inflation is running rampant.

Building an Inflation-Resistant Portfolio

So we have some nice asset classes to choose from. The next step is to assemble them in a portfolio that resists inflation and keeps you moving forward.

During inflationary periods, diversification and liquidity become critically important. Therefore, keep your leverage low, spread your investments across different asset classes, and please institute a risk management process in your portfolio, if you do not have one yet. Maintaining liquidity can be a balancing act – you do not want too much idle cash as it will lose value fast. But if you do have quality short term investments that yield better than inflation rate, and are secured with tangible property, then you should go for it.

Proactive Strategies to Stay Ahead of Inflation

Leverage can be a kiss of death, especially during the times of high inflation. Cost of borrowing is also likely to be much higher at these times. You should refrain from borrowing new money, but if you have an existing debt, you should not feel necessary to pay it down early. Let inflation inflate your dollars as the nominal value of debt does not change. If you are employed, your salary should be rising. If you as self-employed, the price of your product or service should be rising as well.

Rebalance your portfolio frequently. Many all weather portfolios are designed to sail through periods of high inflation, as long as you rebalance. These portfolios often have nice allocations to Gold or Real Estate or other real assets.

Finally, investments in yourself in terms of new skills, training, etc. will pay off. If you have considered starting a business before, this also may be a good time to embark on the entrepreneurship journey and build an inflation-resistant asset.

Conclusion: Prepare Today, Profit Tomorrow

Inflation is inevitable—your strategy determines whether you suffer or thrive. While you will adapt by doing what is necessary when the situation arises, it is better to be prepared ahead of time.

It is advisable to always include an allocation to gold, commodities and other real assets in your portfolio as diversifiers. These really come to life when we pass through periods of inflation and other economic strife.

Finally, make it a habit to rebalance your portfolios frequently.

Featured products

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: