ETFs promise instant diversification. Stocks offer control and precision. But the smartest investors know there’s a third option that combines both, and it may just change how you allocate capital.

The Choice That Shapes Your Portfolio’s Destiny

Most investors treat the decision between stocks and ETFs as a matter of convenience. But if you’re serious about performance, risk management, and capital efficiency, this is one of the most consequential choices you’ll make.

You’re not just picking a ticker. You’re picking a strategy. And the path you choose will affect how you build, manage, and profit from your portfolio, whether you’re chasing dividends, compounding returns, or hunting for asymmetric upside in small-cap value.

Stocks: The Ultimate Tool for Precision and Control

Before we get into the trade-offs, let’s acknowledge what individual stocks offer that ETFs never can.

When you own a stock, you control every variable that matters. You decide when to buy, how much to allocate, when to sell, and even how to tax-optimize the gains. You’re not beholden to fund managers who rebalance without your input or charge fees for doing so.

Stocks also allow you to build deeply contrarian positions. This is essential in small-cap value investing where the best opportunities often come from unpopular corners of the market.

ETFs: Diversification on Demand, But at What Cost?

ETFs solve a real problem. They allow investors to gain exposure to an entire sector, factor, or asset class with a single click. That’s useful when you’re early in your capital accumulation phase or want factor-based exposure like momentum or quality without cherry-picking stocks.

But there are trade-offs. You inherit every position in the index, even the overpriced ones. You pay an expense ratio, no matter how well or poorly the fund performs. And tax efficiency, while better than mutual funds, still lags behind direct stock ownership, especially when forced capital gains distributions hit.

Another major flaw is the way most ETFs are constructed. The majority are market-cap weighted, which means the stocks that have gone up the most carry the most weight in the index. This creates a momentum bias where you end up buying more of what’s already expensive and owning less of what’s undervalued. From a value investing standpoint, this is backwards. You want to tilt into opportunity, not chase past performance. With individual stock picking or DIY baskets, you can correct for this skew by designing your own allocations based on value and fundamentals rather than market hype.

For a value investor, ETFs can be a blunt instrument in a game that rewards surgical precision.

The Third Option: Build-Your-Own ETF with Fidelity Baskets or M1 Pies

Here’s where things get interesting. Platforms like Fidelity Baskets and M1 Finance Pies allow you to build your own ETF-like portfolio, but with your rules.

This is especially powerful if you want factor exposure like small-cap value or dividend growth but still prefer to hand-pick your holdings. It also works if you want to auto-rebalance without giving up control over the components. And perhaps most importantly, it gives you the ability to reinvest dividends selectively into undervalued positions, something you can’t do inside a traditional ETF.

All three of our Founder’s Club portfolios, the Dividend Fortress Portfolio, the Rapid Wealth Compounder Portfolio, and the Dynamic Core Hedge Portfolio, are built using Fidelity Baskets. This gives us the ability to combine the control of individual stock ownership with the convenience of automation and rebalancing. In the Dividend Fortress Portfolio, for example, we reinvest pooled dividends only into stocks trading at a discount, rather than blindly reinvesting back into overvalued names. This same philosophy of selective reinvestment and intelligent capital allocation runs through the other two portfolios as well.

Think of it as an ETF with a brain, and it’s yours.

Want the Edge ETFs Can’t Offer?

Discover undervalued small-cap stocks not found in your average ETF. Each report gives you a fair value estimate, financial breakdown, and profit roadmap.

📈 Browse Stock Reports

Cost and Tax Implications: The Devil is in the Details

Owning ETFs can seem cheaper on the surface, but that impression doesn’t always hold up under scrutiny. You pay expense ratios every year, regardless of performance. You may receive capital gains distributions due to forced rebalancing even when you haven’t sold anything. And you lose control over when or how dividends are reinvested.

Contrast this with stocks. There are no ongoing fees. You have complete control over tax events. And you can harvest losses or gains strategically based on your individual tax situation.

Fidelity Baskets and M1 Pies offer a compelling hybrid solution. You get free trading, fractional shares, and some automation, but still retain tax control.

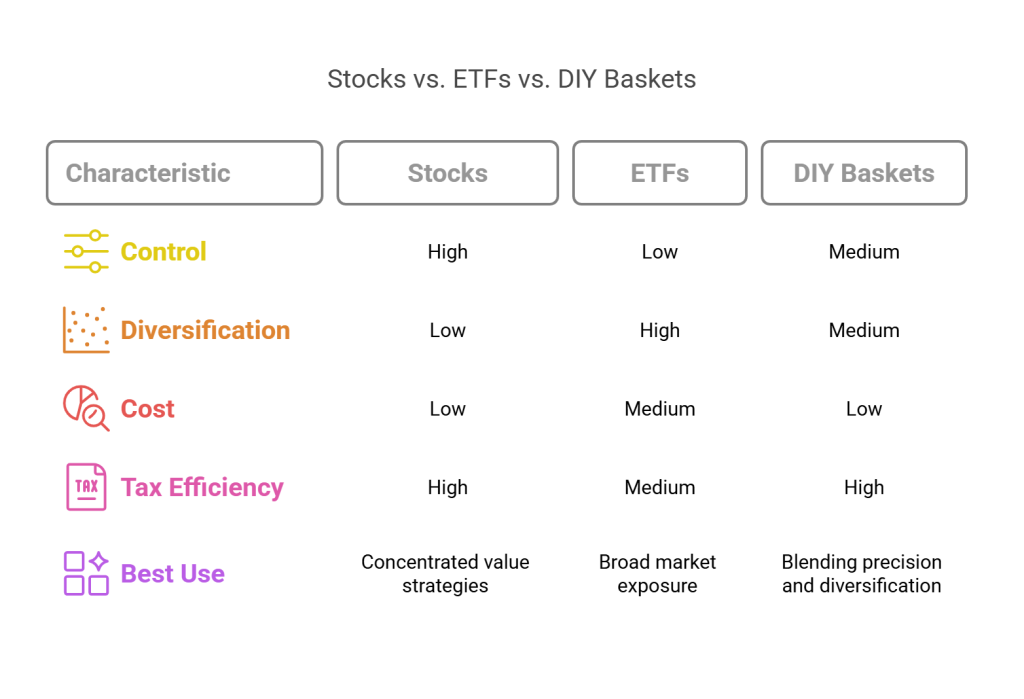

When to Use Each: Strategy Should Drive Structure

So when should you choose stocks, ETFs, or a DIY basket?

ETFs are useful when you’re looking for broad exposure quickly. They make sense when you want to allocate to factors like momentum or low-volatility without hand-picking individual stocks. If tax efficiency isn’t your primary concern, ETFs can provide a functional solution.

Individual stocks make more sense if you have a concentrated value strategy. They give you full control over buying, selling, and rebalancing. If you’re optimizing for risk-adjusted return rather than convenience, stocks are often the superior choice.

DIY Baskets or Pies are ideal when you want to blend precision and diversification. If you value automation but still want control, this model offers the best of both worlds. It’s especially useful when managing a Dividend Growth Portfolio or a factor-based strategy with specific inclusion rules.

Choose the Structure That Matches Your Edge

The real difference between stocks and ETFs isn’t just in the mechanics. It’s in the mindset. ETFs cater to the average investor. Stocks reward the prepared and patient.

But now that build-your-own baskets exist, you don’t have to choose between control and diversification.

If you want to see how we do this in practice with real allocations and stock picks, join us inside the Founder’s Club and explore all three Fidelity Basket-powered portfolios built for different goals but united by one principle: intelligent investing for the long term.

Build Better Portfolios with Better Data

Use Stock Rover to screen for undervalued stocks, compare ETFs, or simulate your own custom baskets.

🔍 Try Stock Rover

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: