I was asked recently if we should move to cash to protect from the volatility. Perhaps you have wondered this too.

My answer is no.

Volatility is a feature of the market. And when you invest in small caps, you do not only learn to live with volatility, but you need to embrace it. Volatility creates wealth. The trick is to know how to harvest it well.

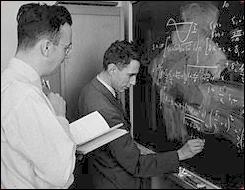

Enter Shannon’s Demon

Claude Shannon, known as the “father of information theory,” was the brilliant mind who gave us the mathematical foundation for everything from digital communication to data compression. But few know he also played with a financial thought experiment now called Shannon’s Demon.

This is a strategy that turns volatility into profit.

In essence, Shannon showed that even if two assets move sideways on average, you can grow wealth by regularly rebalancing between them. By buying low and selling high through disciplined rebalancing, it transforms market noise into steady compound growth.

Sometimes this is also called rebalancing premium or rebalancing bonus. William Bernstein has laid out the math behind how this works. Anson Glacy discusses various research behind this phenomena, and also whether it really exists.

I am convinced that Shannon’s Demon exists, but it takes time to make its presence felt. However, the best results occur when the stocks in the portfolio are uncorrelated – as there are more opportunities to rebalance, and greater rebalancing required.

In short, when both the frequency and amplitude of rebalancing is more pronounced.

But Taxes!

This constant buying and selling could end up creating many taxable short term capital gains transactions. Worse, some of these could be wash sales (in the US), and therefore profits may not be completely offset with losses.

Besides, have some sympathy for your accountant that has to go through reams of statements at tax time.

With experience spanning years trying to find the perfect balance, I have settled on a flexible rebalancing schedule of 1-3 months. Typically every quarter, but may do it more frequently if the allocations drift considerably from the target.

Works When Stocks Go Sideways, But What do You do When a Stock Breaks Out?

As value investors, we buy stocks at a discount. Often, the stock stays underpriced for some time, before it catches wind and rises. There could be a catalyst or could just be better recognition in the market.

So do we start selling as the stock rises? Wouldn’t this reduce our potential profit?

Yes, and possible yes for individual stocks. But our goal is not to maximize profit on each stock. Our goal is to maximize the portfolio growth and minimize the risk of drawdowns.

The math is simple – when the stock price rises and gets closer to our target price, the expected returns now are lower. Therefore, Kelly Criterion will tell us to lighten up on this stock and increase allocations on stocks where the expected returns are higher.

Buffett is known for increasing his stake in a company when his conviction is high, often during periods of market turmoil or when a company’s prospects are overlooked. High conviction is the same as high expected returns, or greater margin of safety which implies lower risk of capital loss.

Often we will completely exit a position before it reaches our target. Sometimes, there is a material improvement in the business prospects and the target price is moved up, in which case it is possible we increase the position size of the stock.

Rather than making guesses as how to adjust as prices fluctuate, we use a well defined process to make correct and optimal decisions.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: