You already know that alpha doesn’t come from following the herd. But while most investors chase the latest trend, the real edge is hiding in plain sight—inside academic research, portfolio construction, and consistent factor exposures. Factor-based investing isn’t just smart—it’s scientific. And when executed correctly, it becomes your compounding engine: systematic, repeatable, and scalable. In this article, you’ll learn how factor investing can quietly turn your portfolio into a wealth-building machine that doesn’t rely on forecasts or fads.

What Is Factor Based Investing, Really?

At its core, factor investing means tilting your portfolio toward specific characteristics—factors—that have historically delivered superior risk-adjusted returns. Instead of guessing which sector or stock will win, you systematically load up on attributes like value, momentum, size, or quality. The academic foundation for this approach is robust, stemming from decades of research by Eugene Fama, Kenneth French, and Mark Carhart, among others.

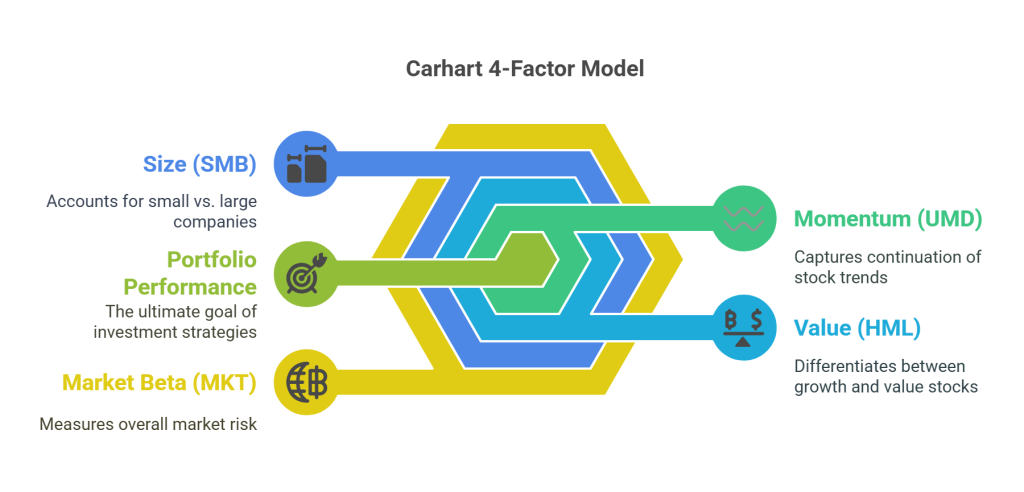

Fama and French introduced the Three-Factor Model, which built on the traditional Capital Asset Pricing Model (CAPM) by adding Size (SMB: small minus big) and Value (HML: high book-to-market minus low). This model demonstrated that small-cap and value stocks have historically outperformed large-cap and growth stocks.

Later, Mark Carhart extended this to the Carhart Four-Factor Model by introducing Momentum (WML: winners minus losers), recognizing that stocks with strong recent performance often continue to outperform in the near term.

Fama and French eventually expanded their model again, developing the Five-Factor Model by including Profitability (RMW: robust minus weak) and Investment (CMA: conservative minus aggressive). These enhancements provided a more comprehensive explanation for asset returns, showing that firms with high profitability and conservative investment strategies tend to deliver superior long-term results.

These models gave investors a structured way to design portfolios that align with empirical evidence rather than emotion or hype. Today, when you invest using factors, you’re implementing the accumulated wisdom of decades of research.

The Core Factors That Actually Work

Not all factors are created equal. Let’s focus on the ones that have stood the test of time:

Value: Buying stocks below their intrinsic worth—measured by ratios like P/E, P/B, and P/FCF. During the dot-com bust, for example, value stocks in traditional sectors like financials and industrials outperformed the inflated tech names.

Size: Small-cap stocks typically outperform large-caps over time, though they carry more volatility. Small-cap value, especially, has delivered standout long-term performance—such as the strong run from 2000 to 2010, when large-cap growth stagnated.

Momentum: Stocks with strong past returns over 6–12 months often continue trending. Momentum complements value by capturing rising companies that value screens may initially overlook.

Quality: Companies with high returns on capital, low leverage, and consistent earnings. Think of long-term compounders like Moody’s or Coca-Cola—exactly the types Buffett favors.

Low Volatility: Contrary to traditional theory, low-volatility stocks often outperform their high-volatility peers, especially in turbulent markets.

The real magic happens when these factors are combined. Take small-cap value—a classic intersection of size and value—that has consistently outperformed large-cap growth across decades. Pairing momentum with quality is another strong duo, especially during market recoveries.

For context, compare this to the Morningstar Style Box, which classifies funds based on size and style. While helpful, it doesn’t quantify exposures like academic factor models do. A “mid-cap value” fund, for instance, might only have moderate value exposure. Factor-based strategies dig deeper to ensure precision.

Each factor has its own cycle, and when blended carefully, they create a durable engine of returns with reduced portfolio-level volatility.

Why Factors Matter More Than Asset Classes

Asset allocation gets all the attention. But factor allocation may be doing the real heavy lifting.

Most investor portfolios are unknowingly tilted toward large-cap growth. The rise of passive index investing has exacerbated this issue. Funds like the S&P 500 or total market ETFs appear diversified, but they are often top-heavy—dominated by the largest 5–10 mega-cap tech stocks.

This hidden concentration introduces significant idiosyncratic risk. A single earnings miss or regulatory threat to one of these behemoths can drag down your entire portfolio.

By intentionally allocating across factors such as value, momentum, and quality, you create a more structurally diverse portfolio. You’re no longer just diversified by geography or sector—you’re diversified by how your investments generate returns.

Real-World Benefits: More Return, Less Regret

So what does this look like in practice?

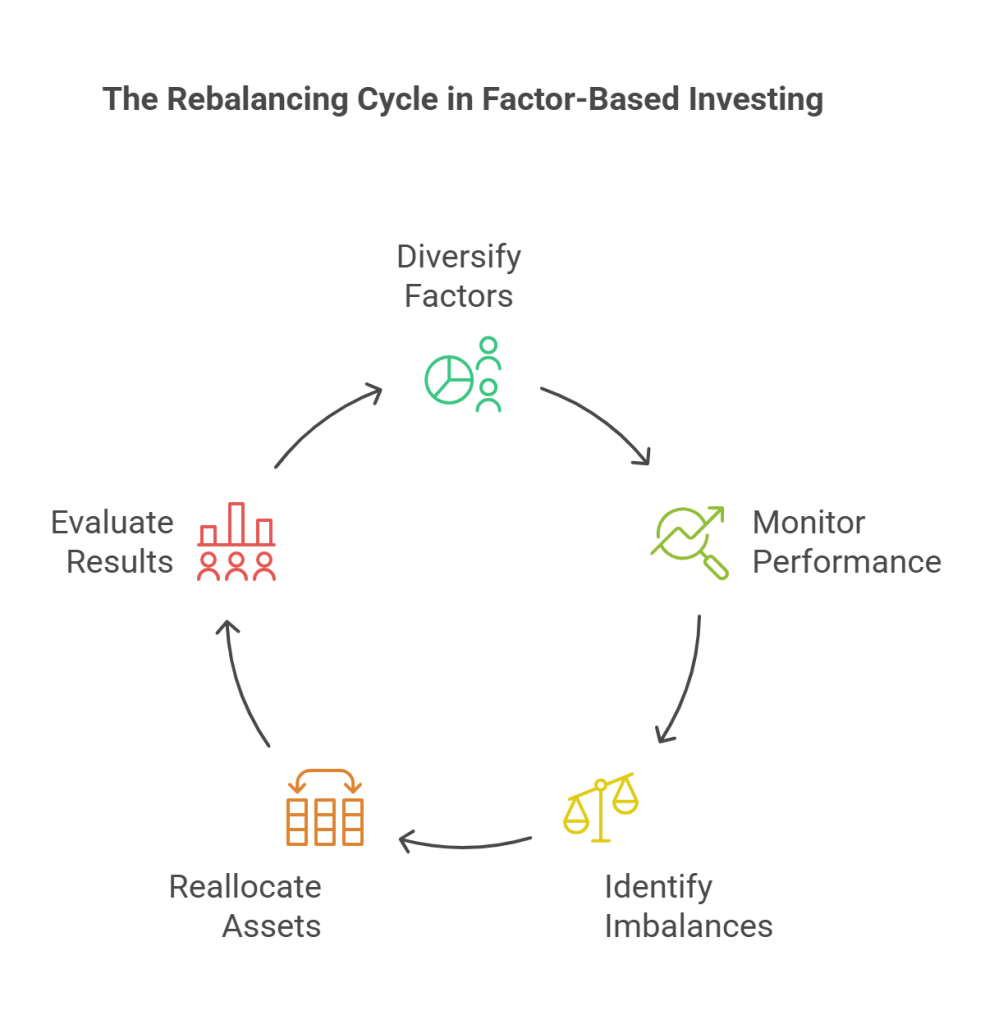

A well-constructed factor-based portfolio tends to deliver smoother returns and better risk-adjusted performance. Since the core factors have low correlations to each other, natural rebalancing opportunities arise. This process not only boosts returns but also lowers volatility, helping you stay invested through market noise. For long-term investors, that behavioral edge is invaluable.

How to Get Started with Factor Based Investing

You don’t need to be a quant or hire an expensive manager to implement factors.

With tools like Stock Rover or Portfolio Visualizer, you can screen for stocks and ETFs based on specific factor criteria. When combining factors—like small-cap and value—you can approach it two ways:

- Independent Exposure: Hold separate small-cap and value stocks.

- Intersection Strategy: Screen for stocks that meet both small-cap and value criteria.

The latter offers more precision and is often the approach behind top-performing small-cap value strategies.

You can also pair momentum with quality, or size with profitability, depending on your goals. Subscribers to the Premium membership get access to curated, ready-to-implement small cap value portfolio, while Founder’s Club members additionally get access to a Value-Momentum Factor Portfolio that balance these factors effectively.

If you prefer ETFs, consider providers like Avantis and DFA, which maintain strict adherence to factor methodologies. WisdomTree and iShares also offer options, though careful due diligence is needed.

Common Pitfalls (And How to Avoid Them)

Factor investing works—but only if executed thoughtfully.

The most common mistake? Chasing recent factor performance. Many investors buy high and sell low, abandoning factors right before their comeback.

Another trap is relying on diluted ETFs. Just because an ETF says “value” on the label doesn’t mean it delivers real exposure. Many hold hundreds of stocks and closely track the overall market.

Watch out for factor drift. This occurs when an ETF gradually loses its tilt due to index rebalancing lag or changing market conditions. You may believe you’re holding a high-value fund, but under the hood, it’s shifted toward blend or growth. Always read the fund methodology, monitor turnover, and evaluate how strictly the strategy is managed.

And finally, remember that failing to rebalance—even with the right factors—leads to portfolio drift. Stay disciplined.

Why Now Is the Right Time to Lean Into Factors

After years of underperformance, value, small-cap, and quality factors are trading at historically wide spreads. That gap? It’s your window of opportunity.

When the market reverts—and it always does—these neglected factors often stage powerful recoveries. If you wait until after the rotation begins, you’ll miss the bulk of the upside. The time to lean into factors is now.

Conclusion: Stop Guessing—Start Compounding

Most investors rely on stories. You rely on structure.

Factor investing eliminates guesswork and replaces it with a time-tested framework grounded in evidence. It isn’t flashy or trendy. But it works. It compounds. And it keeps you from falling victim to the market’s many psychological traps.

If you’re serious about outperforming in the years ahead—and want a system that scales with your discipline—this is your edge.

👉 Ready to build your own factor-powered portfolio? Get started here

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: