Why You Should Be Wary of Factor ETFs?

You already know that factors like value, momentum, quality, and low volatility have a long track record of outperformance. That’s why the explosion of “factor ETFs” looks so tempting on the surface. But here’s the dirty little secret Wall Street doesn’t advertise: most factor ETFs dilute your edge to the point where you might as well buy the market itself. In this article, you’ll uncover why these products often fail, and how building your own DIY factor portfolio can give you the pure exposure and real outperformance you’re actually looking for.

The Promise vs. Reality of Factor ETFs

Factor ETFs launched with the promise of smarter returns through scientific investing. Fast forward to today, and most of them have strayed far from the original research.

Instead of offering clean, concentrated exposure to true factors, most ETFs have become bloated, watered-down versions filled with hundreds of stocks, many of which barely meet the factor definitions. Marketing pressures, asset gathering incentives, and committee compromises have left serious investors holding an inferior product.

How Factor Dilution Happens (And Why It Hurts Your Returns)

This dilution is no accident. Fund managers know that narrower, purer factor portfolios are more volatile; and volatility is harder to sell to the average investor. So they expand the portfolios to smooth the ride. But in doing so, they blunt the very edge that made the factor work.

For example, a value ETF that owns 400 stocks, many of which only barely qualify as value stocks, won’t behave anything like a pure value strategy. The signal-to-noise ratio collapses. You think you are getting factor exposure, but you are getting a faint shadow instead.

The Hidden Costs Inside Factor ETFs

Beyond performance dilution, most factor ETFs carry hidden costs.

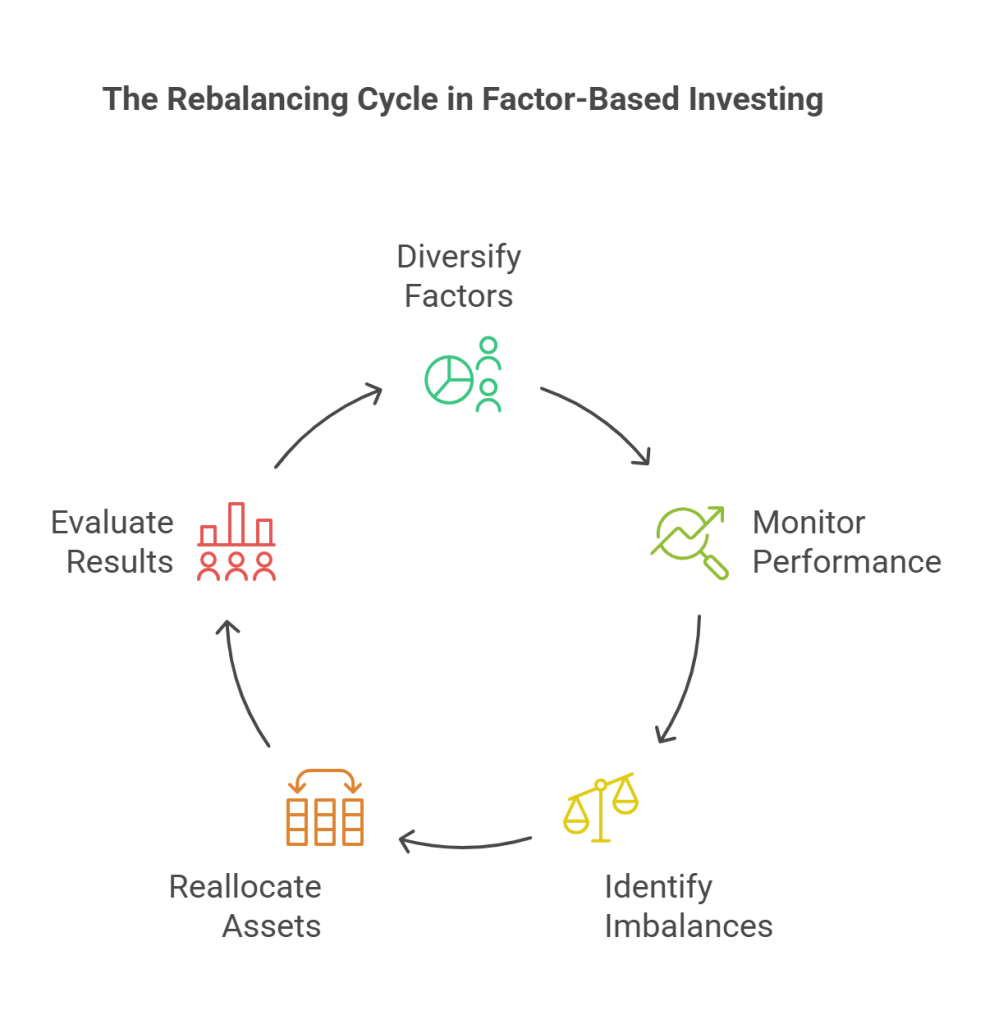

Management fees are typically higher than traditional index ETFs, and turnover inside the fund quietly eats into your returns. Worse, many factor ETFs fail to rebalance properly during periods of market stress, meaning you lose the very protection you were counting on when it matters most.

The idea that you can “set it and forget it” with factor ETFs is comforting. But it’s a comfort that comes at a steep cost over time.

Why DIY Factor Portfolios Beat Packaged ETFs

Fortunately, there’s a better way.

By constructing your own factor portfolio, you control which stocks make it in, how concentrated your exposure is, and when you rebalance based on true opportunity, not some arbitrary calendar date.

You can go where the true signals are strongest. You can keep your portfolio clean, efficient, and aligned with the real academic research that originally uncovered these factors in the first place.

How to Build Your Own High-Performance Factor Portfolio

It’s simpler than Wall Street would have you believe.

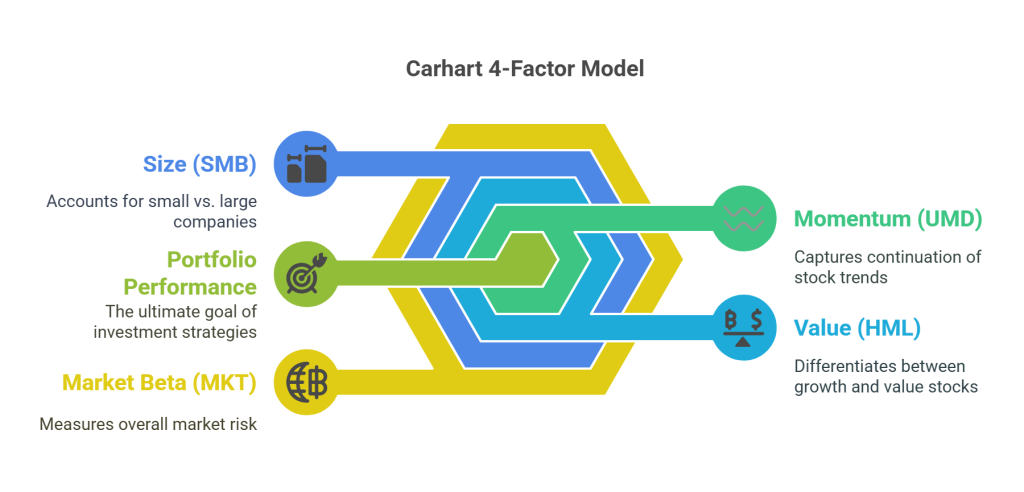

Focus on the few core factors that have enduring evidence: value, momentum, quality, and size. Use strict screening criteria to select the highest-ranking stocks. Limit your portfolio to 20 to 50 stocks and rebalance intelligently based on how far holdings drift from your target weights, not based on a calendar.

Use Fidelity Baskets of M1 Finance Pies to create a basket or slice that functions just like an ETF but is custom built for your needs.

You don’t have to be perfect. Even an imperfect DIY portfolio will likely outperform most mass-market factor ETFs because you’re preserving the purity of the signal.

When Using Factor ETFs Still Makes Sense (Rarely, But Sometimes)

There are exceptions.

If you truly need a “one-click” solution because of extreme time constraints, or you are seeking very niche factor exposure (like international small-cap value) that’s difficult to replicate, a handful of well-constructed factor ETFs can still serve a purpose.

Two fund managers stand out in this regard: Avantis Investors and Dimensional Fund Advisors (DFA). Both firms have a long history of sticking closely to rigorous, evidence-based factor definitions. They avoid the typical marketing games and instead focus on delivering pure, academically rooted factor exposure with intelligent portfolio construction techniques. If you must use an ETF solution, seeking out Avantis or DFA funds gives you a much better chance of getting what you are paying for.

In fact, we use carefully selected factor ETFs, including funds from Avantis, in our Dynamic Core Hedge Portfolio available exclusively to Founder’s Club members. By combining the best-designed factor ETFs with intelligent portfolio construction, we aim to preserve the benefits of factor investing without falling into the common traps most ETF investors face.

But even then, you must be selective and understand that you are trading away some performance potential for the sake of convenience.

Final Thoughts: Take Back Control of Your Factor Investing

Factor investing works. It always has.

But letting Wall Street package it into a mass-market product with diluted criteria and hidden costs is a losing strategy for serious investors.

You don’t have to settle for mediocrity. You can build your own concentrated, pure factor portfolio, grounded in real research and tailored to your goals.

The rewards go to those who keep it pure, and keep it smart.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: