Why Stock Returns Aren’t Just About Market Risk

A staple of business schools all across the country, Capital Asset Pricing Model, or CAPM, is traditionally considered a model sufficient to explain the stock returns. CAPM tends to paint all stock returns with a single brush – a function of market risk. You probably know the term beta. Over a period of time, as the thinking goes, stock returns move with the market returns. Stocks with higher beta will have greater than the market return. Stocks with lower beta will have lower than the market return. A beta of 1 is assigned to the market.

The main outcome of CAPM was the insidious proliferation of index funds. You can’t beat the market without taking more than market risk, they say. Just buy the index, they also said.

Eugene Fama and Kenneth French found that there are many stock returns that do not cleanly fit this model. Market Risk, or beta, is not sufficient to explain the stock returns. They introduced the 3-Factor Model to better explain stock price movements. They found that small company stocks and value stocks actually generate excess risk adjusted returns compared to the market. Initially written off as anomalies, these became factors (of outperformance).

At Astute Investor’s Calculus, we target both of these 2 additional factors by limiting our focus to small-cap value stocks. These 2 factors, coupled with our intelligent portfolio allocations allow us to generate market beating returns year after year in a very systematic fashion.

The Basics of the Fama and French 3 Factor Model

Market Risk is still one of the key factors that drive stock returns. The Fama-French 3-Factor model adds Size Premium and Value Premium to the key contributors of stock returns.

- Market Risk (Beta) – Stocks tend to move with the overall market, but this alone doesn’t explain all returns. If this is all you want, buying a broad based index fund such as S&P 500 index will get it for you.

- Size Premium (Small Minus Big, SMB) – Historically, small-cap stocks outperform large caps due to higher risk and inefficiencies. However, recently it appears that the Size Premium has disappeared. Cliff Asness et. al. found in their 2015 paper that the Size Premium still exists if you qualify the stocks for quality. Newer research suggests that you may have to go further down the size elevator and consider private equity to get your fill of the Size Premium. I suspect this will continue to erode as more and more financial products such as ETFs target the Size Premium.

- Value Premium (High Minus Low, HML) – Stocks with high book-to-market ratios (value stocks) tend to outperform growth stocks over the long term. The Value Premium has persisted over time and I do not see much of a risk of it disappearing. This is the field Benjamin Graham started and Warren Buffett carried the torch, and now as readers of Astute Investor’s Calculus, you are taking it forward.

Why Size and Value Factors Matter More Than Market Risk

CAPM’s single-beta model misses these return premiums. It is quite unnecessary for investors to intentionally ignore the factors that reliably deliver excess market returns, in favor of just meeting the market performance.

In earlier times, it was expensive to access these factors. Today this is not the case. There are many ETFs and mutual funds available today with inexpensive expense ratios that you can purchase commission-free. The barriers to entry in this world are almost non-existent. If you want to self-manage your portfolio, there are many options for you to find well-researched stock reports to help you construct your portfolio.

Here is what you need to know to effectively capture the Size and Value Premiums:

- Focus on small-cap and micro-cap stocks. These stocks are not well followed by the wall street and can offer you wider discrepancy between the intrinsic value and the stock price

- Test for quality by insisting on low debt and high profitability. You should also see evidence of growing sales and earnings, and a clear runway to continue doing so in the near future

- Any competitive advantages that build a moat around their business is a plus

- Expect low liquidity in the stock. Use it to your advantage instead of letting it scare you

- Know that the Value Premium exists due to basic human behavior. As long as there are humans concerned about their portfolios, this opportunity will continue to exist.

- Small-cap and value stocks have historically provided excess returns, which aligns with fundamental value investing principles.

- Market inefficiencies, behavioral biases, and risk exposure explain these persistent premiums.

How the Fama-French Model Changed Portfolio Construction

The 3-Factor model has revolutionized investing by bringing additional factors of outperformance to light. Prior to this, generating excess returns was considered a matter of skill and luck. With this model, it became clear that there are factors of outperformance that anyone can harness.

This has helped introduce a systematic way to explain why some portfolios outperform others. It has changed the portfolio construction from an amorphous enterprise based on hunches and guesses to a more structured process. The multi-factor view has led to the possibility of structuring your portfolio to target specific factors, in various levels of exposure, to match your needs and expectations.

Factor investing, or smart-beta, has now become widely used by hedge funds and quant funds. Small retail investors like us can also use the same tools and techniques in our own portfolios.

Fama-French Model in Action: How It Helps Value Investors

I think the very first thing to realize that this model is a validation of sorts for the practice of value investing.

We knew about Benjamin Graham and how he was able to generate exceptional returns. Academics wrote him off as an anomaly. We knew about Warren Buffett and John Templeton. They are also considered anomalies, while the universities and fund industry kept screaming at retail investors to buy index funds. Apparently, 70% of the fund managers fail to beat the market, so we should all ignore the remaining 30% of the fund managers who do beat the market and resist the temptation to learn the factors that allow them to beat the market. This was sarcasm!

Afterall, if you found out that there is a systematic and well researched way of doing that, most of the index products will be worth nothing.

As a value investor, you are very familiar with conducting fundamental research. You likely focus on tangible assets more than future expectations of growth. And you tend to naturally gravitate toward high book-to-market stocks. Additionally, you may not want to buy the “popular” stocks as you understand that there is not much profit left in these stocks. This leads you to look for underappreciated stocks, which tend to be smaller companies more often-than-not.

Understanding this model will help you structure your portfolio and manage risks such as volatility and liquidity. Having historical benchmarks will also help you separate your skill from luck in active management of your portfolio.

Beyond the 3-Factor Model: Expanding the Framework

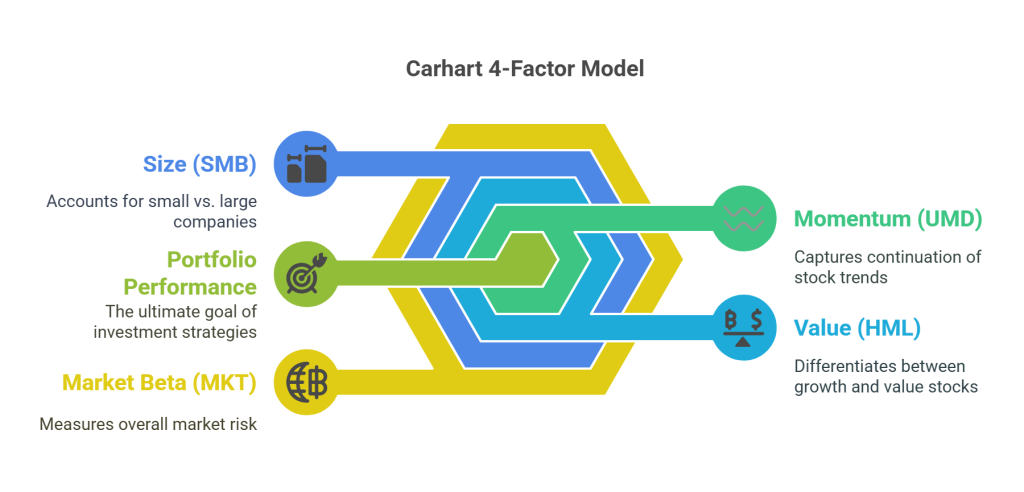

In the years after the 3 Factor model was proposed, we have found that there are additional factors that contribute to excess returns. Fama and French themselves expanded the 3-Factor model to 5-Factor model by adding profitability and investment factors. Other models such as the Carhart 4-Factor model introduce momentum as a factor.

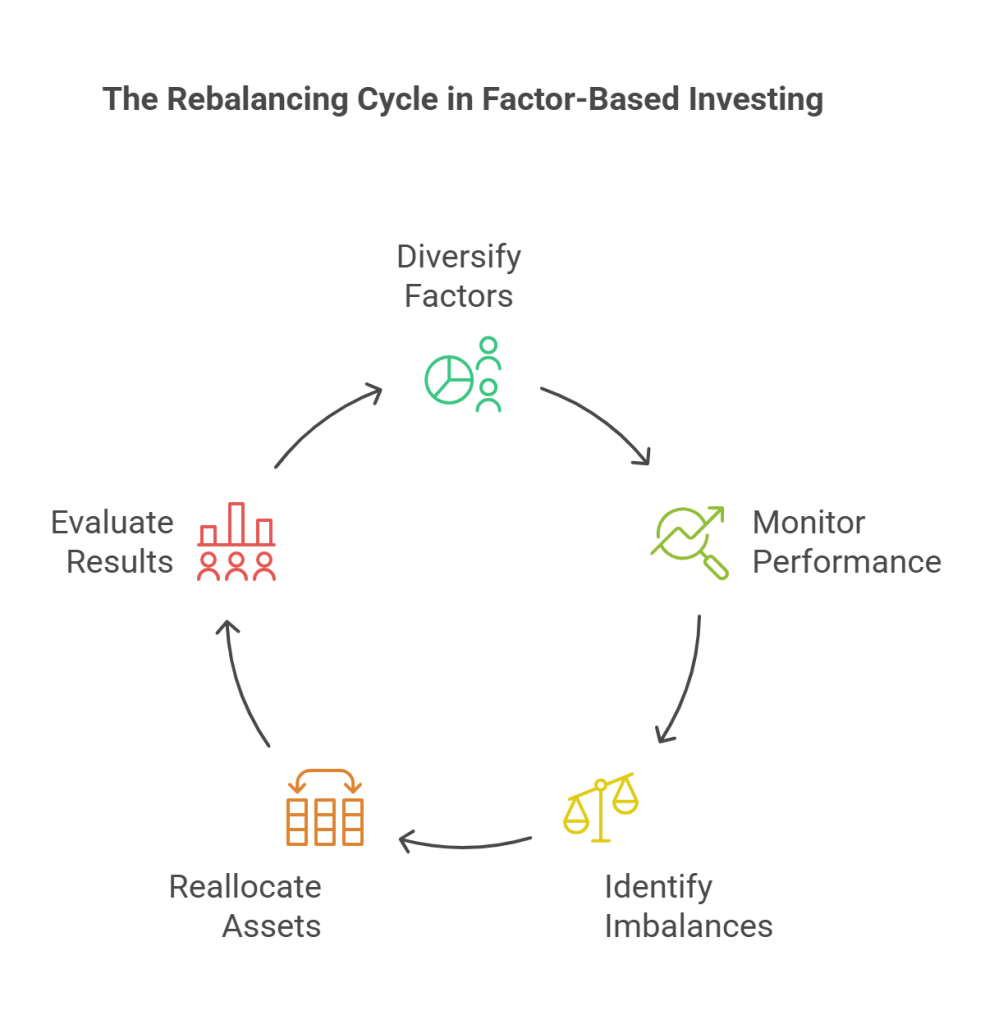

While my primary focus is on the small-cap value, I also manage a portfolio that targets the Value, Size and the Momentum factors. This is borne out of the observation that the Value and Momentum factors tend to be counter-correlated, and therefore there is a significant rebalancing bonus that can be had with this factor based portfolio.

I expect with the advent of machine learning and AI, there will be many additional factors that will be discovered in the future. Keep in mind that the opportunity to target factors tend to be short, as most of these factors do not persist over time.

The Model’s Lasting Impact on Value Investing

The Fama-French 3-Factor Model remains a foundation for understanding market returns. Value investing principles align well with its insights, reinforcing the idea that stock selection isn’t only about market risk. It shows us that active investing and stock selection has a role to play, and that there are widely available opportunities for small investors to outperform the institutions and funds. As markets evolve, understanding factor-based investing will be critical for staying ahead.

Featured products

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: