You’ve probably asked yourself: how do I research stocks without wasting hours chasing the wrong leads? That’s the right question—but most people get the wrong answers. They either read every piece of data under the sun or blindly follow stock tips without context. That’s a recipe for regret, not returns.

In this article, I’ll walk you through exactly how I research stocks—before I put even one dollar at risk. It’s a process shaped by two decades of wins, losses, and lessons in value investing. You’ll walk away knowing what to focus on, what to ignore, and how to gain the conviction to act.

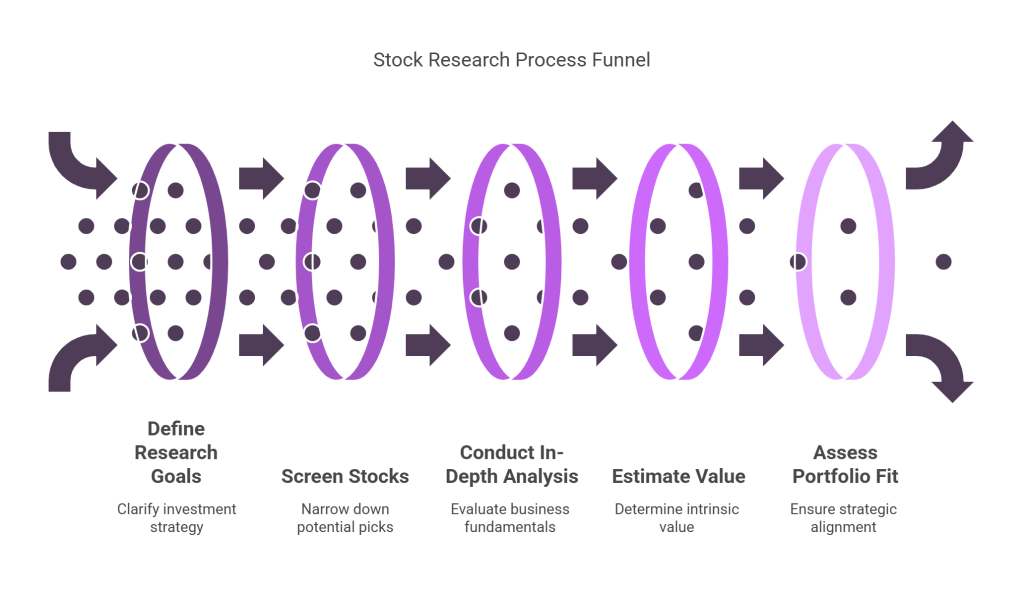

Know What You’re Looking For Before You Start

Before you fire up the screener or dive into a 10-K, stop. If you don’t have a clear goal, you’ll drown in information. My research always starts with intention—what type of stock am I looking for?

This step grounds your research in strategy. It helps you filter the noise and zoom in on companies that deserve your time.

Define whether you’re researching for income, growth, deep value, or special situations. Clarify your market cap range, industries, and red lines. For example, I don’t waste time on unprofitable companies or those with excessive leverage. Having a mental checklist helps you zero in fast. Knowing these things before you start screening helps you build your criteria in the screeners you use. That way, you will not waste a lot of time sorting through screener results, most of the undesirable stocks would have already been filtered out.

Start With the Screener, But Don’t Let It Be the Final Word

Screeners are a fantastic way to narrow the universe of stocks, but that’s all they do—narrow. They don’t answer the question: is this business actually good, and is the price right?

Once a screener gives you names, the real research begins.

I use filters like EV/EBIT under 10, debt/equity under 1, free cash flow yield over 5%, and insider ownership over 10%. Stock Rover is my preferred tool because of its depth, but Finviz and even raw Excel-based screens have their place. The goal is simple: identify 10–20 companies that are worth researching, not necessarily buying.

I have a set of 8 pre-built screeners that I consistently use. I split each of these screens in small-cap, mid-cap and large-cap based on market caps. Every day I run 1 screen and quickly scan through the list of stocks it generates. The stocks that I find interesting enough to research further, I add them to my watchlist.

Read Like a Detective, Not a Historian

This is where most people get stuck. They read everything but retain nothing. I approach filings like a detective—looking for motives, patterns, and inconsistencies.

By treating filings and presentations like clues, you learn what really drives the business—not just what they want you to see.

Focus on the business model, cash flow drivers, and risk disclosures. Highlight red flags like customer concentration, off-balance sheet liabilities, and recurring impairments. Pay attention to management’s tone and insider alignment. Are they eating their own cooking, or just talking up the stock?

It is at this point that you should go as deep as necessary to find the answers to the questions that may arise. I have been known to search for newspaper clippings from 1952 for reports of an acquisition so I understand the terms of the acquisition. Of course, this is not always necessary. If you get stuck, you may also need to make a call or send an email to the investor relations for the company.

This is the most time consuming part of the research process. Of course, the reward for the job well done is nice profits (instead of losses) so it is very well worth it to spend the time that is needed. If you ever feel that the opportunity will slip by before you conclude your research, you should be prepared to let the opportunity go. There are many opportunities in the market, but taking a loss because you skimped on research is not a good bargain to make.

Estimate Intrinsic Value (And Be Conservative)

Now it’s time to put a number on it. Not a wishful guess, but a thoughtful valuation grounded in reality. I build a conservative range—not a single target—because the future isn’t knowable.

If the current price falls well below the low end of your value range, you may have something.

I focus on owner earnings, not just reported net income. I use a mix of DCF (with conservative assumptions), comparables like P/E or EV/EBIT, and asset-based valuation when relevant. But the most important step is to layer in a real margin of safety. I expect to be wrong on details, so the cushion protects against that.

Check the Bigger Picture: Industry, Catalysts, and Correlations

You don’t invest in a vacuum. A great stock in a dying industry can still destroy capital. And a good stock with no catalyst may stay undervalued for years.

This step helps you avoid the “value trap” and invest in mispriced opportunity—not just cheap garbage.

Research the broader industry. What headwinds and tailwinds exist? Look for catalysts that can unlock value—like spinoffs, activist involvement, buybacks, or improving margins. And think about your portfolio: does this stock diversify you or add unwanted exposure?

Position Sizing and Portfolio Fit: Where It All Comes Together

Even the best stock is a disaster if it throws off your portfolio balance. My last step is always to determine how much to buy—and if it belongs in the portfolio at all.

Risk doesn’t come just from bad ideas. It comes from good ideas sized wrong. This final check protects your downside.

I use a modified Kelly criterion to size positions. If a stock has high expected return and low correlation with the rest of the portfolio, it gets a bigger weight. If it’s more uncertain, I size it smaller. It’s never all or nothing—it’s about stacking the deck in your favor, while minimizing drawdowns.

I always have a backlog of great value stocks that check all the boxes, but do not fit in the portfolio. Sometimes it is because of the correlations, and if we exit an existing position, a stock from this backlog will be able to take its place. Do not feel compelled to place money on every good stock your find. The stock has to make your portfolio stronger to be included.

Final Thought: Action Without Conviction is Gambling

You don’t need to be 100% right—you just need to avoid obvious mistakes and play the odds when they’re in your favor. My research process is designed to build that conviction. When I buy a stock, I want to know that I’ve done the work to justify it—not just to myself, but to every investor who’s trusted me with their capital.

So the next time you wonder how do I research stocks?—use this framework. It won’t just save you money. It’ll give you the clarity and confidence to act.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: