If you’re serious about compounding wealth, bootstrapping a business isn’t just an entrepreneurial path, it’s an asymmetric bet with outsized upside. You invest time, discipline, and a little capital. In return, you create a high-margin income stream, long-term asset appreciation, and, perhaps most importantly, complete control. For investors frustrated with limited alpha in public markets or anyone looking to transition out of a full-time job, learning how to bootstrap a business may be your next great investment thesis.

What Bootstrapping Actually Means, and Why It Attracts Real Investors

Most people misunderstand the term. Bootstrapping doesn’t mean starting a business with no money. It means starting without outside money. You still invest, just with your own capital, sweat equity, and strategic resourcefulness. That distinction matters. When you bootstrap, you retain full equity, control your pace, and avoid the dilution and misaligned incentives that often ruin startups.

The upside of bootstrapping is massive, but it requires a specific mindset. Before we get into the how, let’s talk about what kind of investor succeeds with this approach.

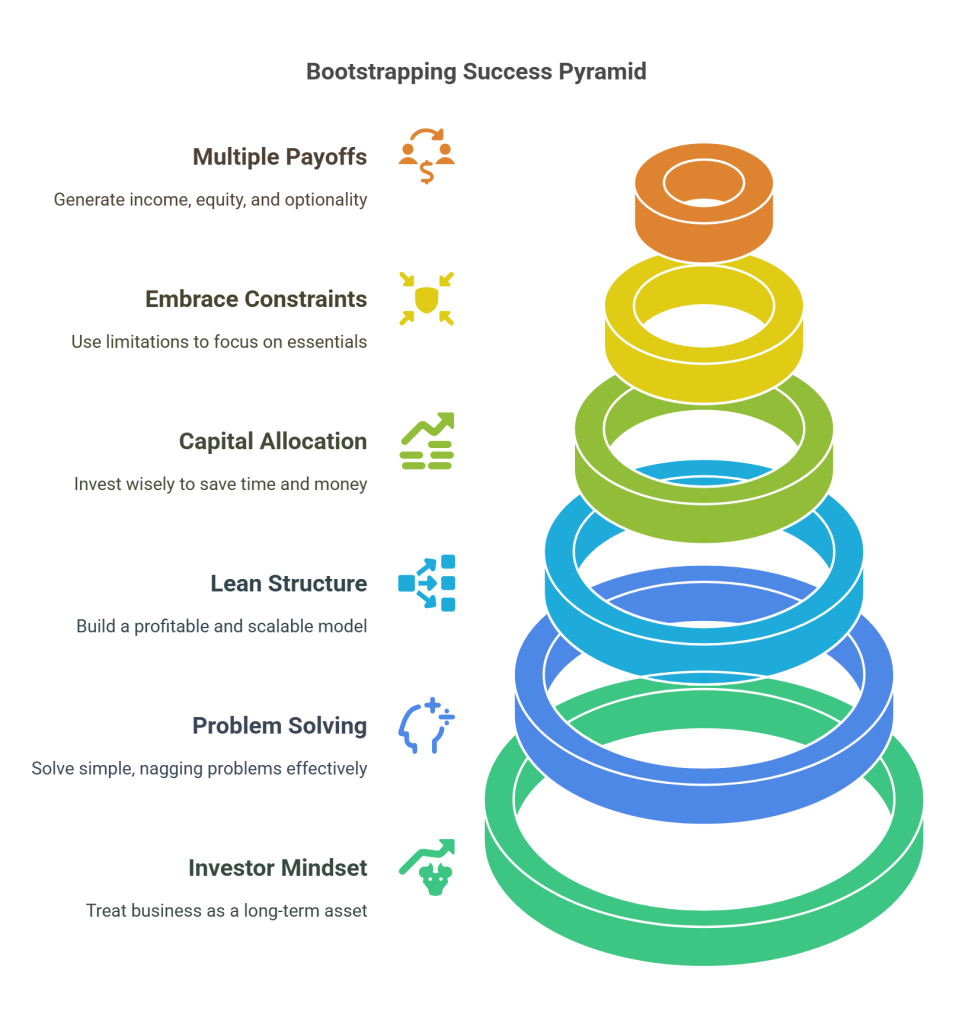

The Investor’s Mindset: Treat Bootstrapping Like Building an Asset

As a long-term investor, you already understand the value of assets that cash flow. A business you control can generate returns far in excess of stocks, and unlike market-based assets, you influence the outcome.

Think of it this way: a good small cap stock might return 15–25% a year. A bootstrapped business can return 100%+ annually on invested capital if reinvested wisely.

But the discipline is the same: focus on capital allocation, reinvest earnings, and protect your downside.

So how do you actually get started, especially if you have more investing experience than operational experience?

Start Small, But Start With a Real Problem

The best bootstrapped businesses solve simple, nagging problems. Think ugly interfaces, poor service, confusing pricing, or overlooked niches. You don’t need to reinvent the wheel, just offer a better version of something that already exists.

Whether it’s high-quality physical goods, niche software tools, or a useful service, you start by solving one painful problem well. That’s where traction begins.

With the idea in place, let’s talk about structure, because a solid foundation can save you years of headaches.

Structure It Right From Day One: Keep It Lean, Profitable, and Scalable

Most founders overcomplicate the early stage. You don’t need a C-corp, a flashy office, or a brand consultant. You need one thing: customers who pay.

Build a model that makes money from the beginning. Focus on cash flow. Eliminate vanity metrics. And reinvest back into what works.

Next comes execution,and how you allocate time and capital will define your results.

Allocate Capital Like an Investor, Not a Founder

Avoid the traps that turn businesses into expensive hobbies. Don’t sign up for long-term contracts before your revenue can support them. Stick with free tools or pay monthly for what you truly need. Don’t waste valuable hours perfecting your branding when you haven’t even had your first customer. Focus your attention on tools that actually save time or make money—not the ones that create busywork and false progress.

Bootstrapping is capital compounding. Your retained earnings today are your optionality tomorrow.

But this journey isn’t linear. You’ll hit walls. What separates those who quit from those who build real wealth is the next concept.

Embrace Constraints: The Secret Weapon of Bootstrap Founders

Constraints force clarity. When you have no outside capital, you make every dollar count. You focus on what your customers care about. You build only what’s essential.

Some of the most successful companies, Mailchimp, Basecamp, Craigslist, scaled because they stayed lean and focused on user value, not investor perception.

Of course, all this is only worth it if your payoff is big enough. Let’s look at the exit scenarios.

Multiple Payoffs: Income, Asset Appreciation, and Strategic Exit Optionality

A business you control pays off in three fundamental ways. It generates monthly income that you can either reinvest or use to replace your current job. It builds equity that grows as you expand your customer base and improve your margins. And it gives you tremendous optionality—you can choose to sell, hold, automate, or leverage the business to fund your next idea.

Even a $100K/year business, if run profitably and sold at a modest 3x earnings multiple, delivers a $400K return. Scale it to $500K/year with strong margins, and you’ve built your own personal Berkshire.

For true investors, once you have the business up and running and have scaled it to a level that it generates a steady and healthy cash flow, you unlock a new set of choices. You can consider selling the business to take profits and redeploy capital elsewhere. Or, you can structure and delegate operations so the business runs with minimal time commitment from you. That frees you up to pursue other projects—perhaps even your next business.

So how do you actually stack the odds in your favor?

Best Practices to Maximize Success

Start in a domain where you have knowledge or access. That’s your edge. Once you’ve identified your niche, make sure to validate demand early. The smartest way to do this is to sell before you build—so you’re solving a problem that real people are already willing to pay to fix.

From there, build slowly and focus on sustainability. This isn’t about chasing the fastest growth at any cost; it’s about letting compounding work in your favor over time. Every process you improve and every customer you retain stacks the odds further in your favor.

Finally, optimize capital allocation at every stage. Think like an investor. Every dollar you put into the business should either bring more money in or save you time that you can redeploy more profitably. This isn’t just a side project. It’s an asset you’re building from the ground up.

Why I Do This: The Real Answer to a Common Question

People often ask me, “If you’re such a good investor, why do you need to build a website, write a newsletter, and sell products?

The answer is twofold:

First, generating external cash flow accelerates portfolio growth. Every dollar I earn through these businesses is another dollar I can allocate into high-return investments.

Second, investing in a private business is no different from investing in a public one, except the market is even more inefficient. That means the rewards can be even more asymmetric.

I am applying the same value investing principles to building businesses. I look for margin of safety, capital efficiency, and underpriced upside.

Final Thoughts: A Business Is the Only Investment You Fully Control

Bootstrapping isn’t for everyone. But if you’re an investor looking to turn time into capital and capital into freedom, this is one of the highest-return plays available.

You don’t need to pitch VCs. You don’t need a bull market. You just need to start.

If you’re building or planning to bootstrap a business, subscribe to Astute Investor’s Calculus. We cover capital allocation not just in markets, but in your life. Because wealth isn’t built with luck, it’s built with leverage, ownership, and insight.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: