My edge lies in the Small Cap Value segment. This is where significant investor wealth is traditionally built, and I am pretty darn good at this.

Over the years I have improved my processes to include a mathematically optimal Kelly Criterion based portfolio allocation system. This implementation has been battle tested through periods of volatility and it has proven its worth in keeping the portfolio volatility down while allowing me to continue to generate market beating returns.

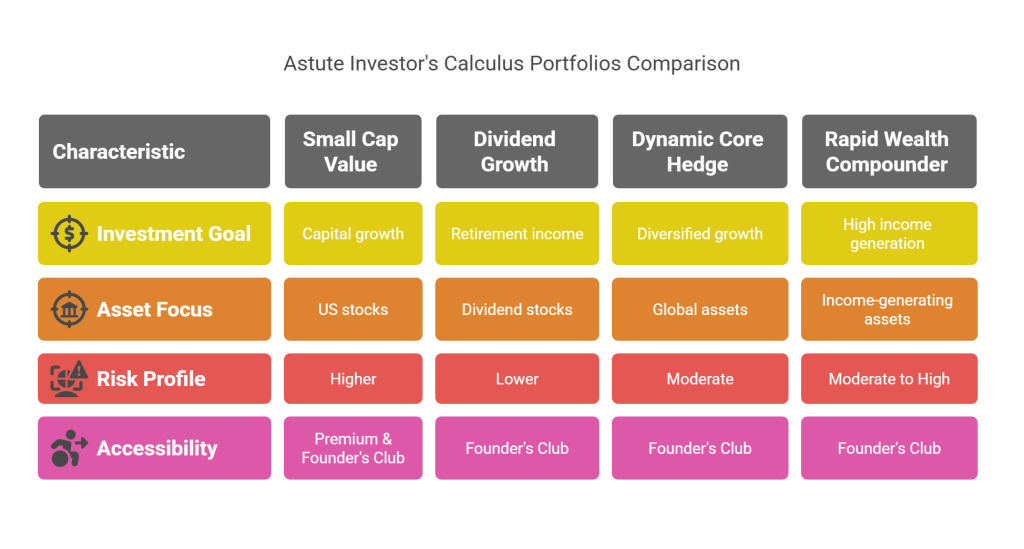

I am changing the Inner Circle to focus solely on the Small Cap Value portfolio.

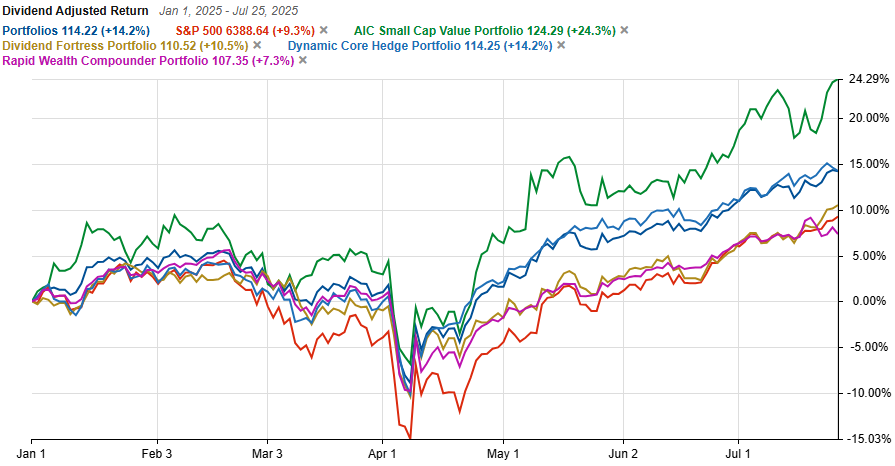

YTD Performance as of Q3, 2025

The Small Cap Value portfolio, or the Inner Circle portfolio, has consistently outperformed the S&P 500 index YTD. We currently hold 8 stocks in the portfolio. 6 of them are profitable, some of them have significant gains. 1 stock is around breakeven and 1 stock is sitting at a loss (or as I call it, at greater discounts). In the next few days I will recalculate the allocations to adjust for price changes and changes in the correlations between the portfolio stocks.

At 29% gain YTD, the portfolio has returned close to twice the market returns..

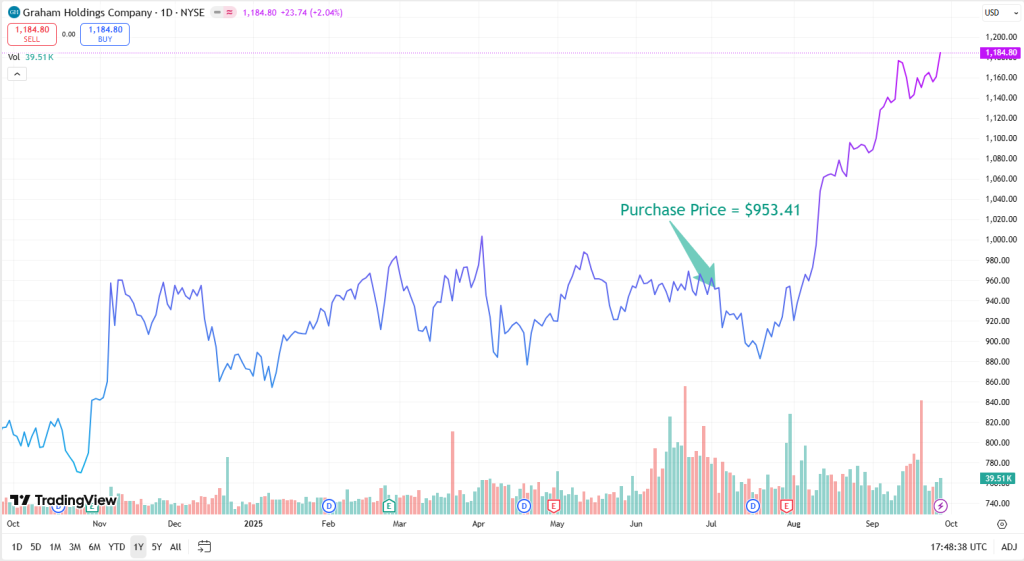

Our latest stock in the portfolio, Graham Holdings Corp (GHC) is now up 20% since its inclusion in the portfolio on July 2nd, 3 months ago.

If you were an Inner Circle member, you received the stock deep dive with my rating as part of your membership. You are also able to see my personal portfolio in the Inner Circle, including allocations to each stock in the portfolio. If you are not a member, feel free to take advantage of the 50% discount coupon at the beginning of this article and sign up right now before this offer expires on Oct 5, 2025, or 100 of your peers get to use the coupon first.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: