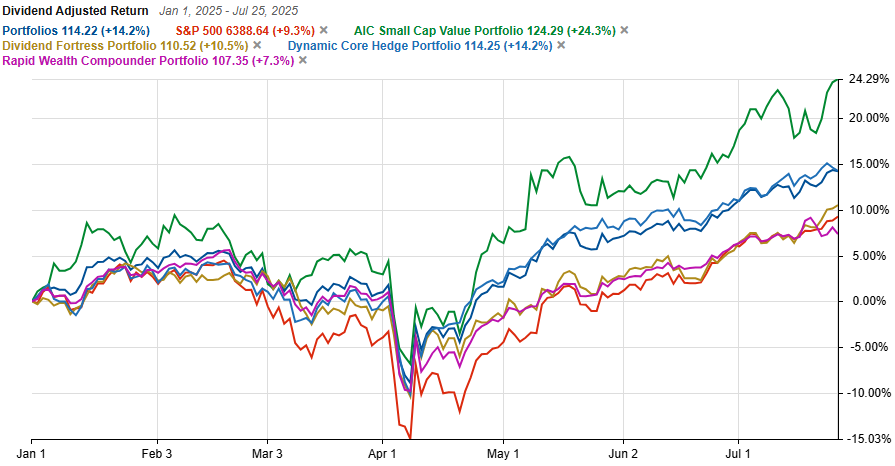

I am a small cap value investor, first and foremost. I know this space and I am very very good. When I buy a stock, I typically make money. This is a result of the deep research that goes behind the stock, and of course hours and hours of contemplation, going through scenarios and possibilities.

So it is not surprising that my primary focus on this website is small cap value. However, as a responsible investor for my family and my clients, I offer 3 additional portfolios to help create a complete investment system.

(Please note that the Premium and Founder’s Club portfolios are combined into Inner Circle on this website)

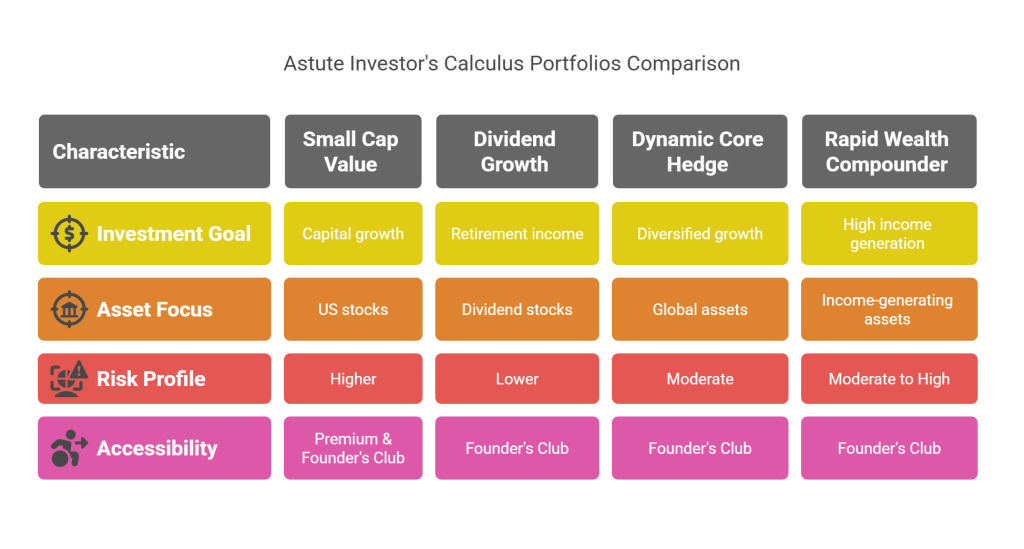

I run 4 portfolios that are accessible to Inner Circle subscribers:

- Small Cap Value Portfolio – This is focused on US stocks. I use growth optimal allocation strategy (Kelly Criterion) to maximize risk-adjusted returns in this portfolio.

- Dividend Growth Portfolio – Think of this as a “never sell” portfolio that I am building up for eventual retirement. Most investors should have this, regardless of your investment philosophy. These companies will pay your bills and will allow you to travel and do everything you plan to do in your bucket list.

- Dynamic Core Hedge Portfolio – This along with my flagship Small Cap Value portfolio is my vehicle for capital growth. As you have noticed, my Small Cap Value portfolio is focused on the US company stocks. This is the space I know best. Dynamic Core Hedge Portfolio gives me diversification across the continents and asset classes, creating an “all weather” portfolio that is designed to perform in all economic conditions.

- Rapid Wealth Compounder Portfolio – This is an “income factory” style portfolio whose sole purpose is to generate high income and compound it so every year I get a pay raise. If you every want to quit your job and build your own income factory, this would be the way to do it passively.

This 4 portfolio setup makes this a complete investment system for me. I can make a strong argument that this setup also makes a complete investment system for you. You can vary the relative sizes of these portfolios to account for your own particular situation and the stage of life.

All these portfolios can be accessed today through the Inner Circle membership.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: