Most investors think the Kelly Criterion belongs on the blackjack table or in some Ivy League quant’s toolkit. They assume it’s a mathematical toy, not something a grounded, long-term value investor should take seriously. That’s a mistake. Because when used correctly, Kelly sizing can sharpen your capital allocation like a scalpel. In my own small-cap value portfolio, I don’t just throw darts, I back my conviction with precise sizing, guided by an evolved version of the Kelly formula that balances opportunity with risk. Let’s break down why the Kelly Criterion belongs in your investing process and how it helps separate signal from noise in a world full of hype.

What Is the Kelly Criterion (and What It’s Not)

Before we bust the myths, let’s make sure we’re talking about the same thing.

The Kelly Criterion was developed by John Kelly in 1956 at Bell Labs. Its goal was to determine the optimal bet size to maximize the geometric growth of capital over time. It takes two inputs: your estimated edge (expected return) and the odds (variance or risk), and tells you what fraction of your bankroll to allocate.

The formula for a single bet is:

f∗ = (bp – q) / b

Where:

- f∗ = fraction of capital to bet

- b = odds received on the bet (net odds, not including your stake)

- p = probability of winning

- q = probability of losing = 1 – p

For investing, where we deal in continuous returns rather than discrete odds, the formula adapts. In its simplified investment form:

f∗ = (μ – rₑ) / σ²

Where:

- μ = expected return of the investment

- rₑ = risk-free rate

- σ² = variance of returns (square of standard deviation)

There is also a portfolio-based extension, often referred to as the multi-asset Kelly formula. In matrix notation:

f = Σ⁻¹(μ – rₑ)

Where:

- f = vector of optimal capital allocations across assets

- Σ = covariance matrix of asset returns

- μ = vector of expected returns

- rₑ = risk-free rate vector (often uniform)

This version helps determine the ideal capital allocation across multiple assets considering both expected returns and correlations. In practice, I normalize the resulting Kelly weights so they sum to 100% of the portfolio, allowing full deployment of capital.

Most people associate it with gambling or high-frequency trading. But the core principle is universal: compound your capital at the highest possible rate without blowing up. Kelly sizing doesn’t chase returns. It protects against ruin while maximizing growth over the long haul.

Why Most Investors Misuse or Ignore It

The problem isn’t the formula, it’s how investors react to it.

Kelly can feel uncomfortable. It often suggests taking larger positions than most investors are used to. On the flip side, if your conviction is weak or your edge is thin, it might recommend only a small allocation. This conflicts with gut-driven investing, where emotions often override logic.

Even worse, many investors use bad inputs. Kelly is only as good as your estimate of fair value and risk. Garbage in, garbage out. That’s why fractional Kelly is often more appropriate in practice. It smooths out the volatility and protects against overconfidence. Another way to input good data is to get really good at estimating fair value, which comes with experience and a lot of fine tuning, which is what I provide to my members.

But ignoring position sizing altogether is worse. It leads to scattered portfolios with no edge. Kelly at least gives you a rational framework for deploying capital based on asymmetric opportunities.

How I Use Kelly in Real Portfolios

This isn’t just theory, I use Kelly fractions to manage real money, every single day. I use the portfolio-based extension of the Kelly formula, implemented through a model I’ve built in a spreadsheet to calculate optimal position sizing based on expected returns, risk, and correlations.

When I research a stock, I estimate its intrinsic value. From that, I calculate the expected return. I also measure the volatility of the stock and its correlation with the rest of the portfolio. These inputs go into a modified, multi-asset Kelly formula that outputs suggested position weights.

We then scale these weights so the total allocation sums to 100%. This gives me a fully invested, risk-adjusted, growth-optimized portfolio. I don’t disclose the exact equations because that’s proprietary, but understand that this process lets me control risk, increase diversification, and maintain conviction across ideas.

Crucially, this approach forces me to pass on ideas that look good in isolation but don’t improve the portfolio when measured against others already in it. That’s one of Kelly’s most overlooked strengths: portfolio-level discipline.

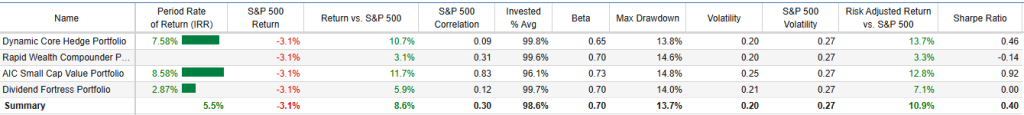

And the results speak for themselves. I use the Kelly Criterion to allocate positions in the Premium Small-Cap value portfolio. During the 1st 4 months of 2025, when the markets were highly volatile and all over the place, the discipline and use of Kelly Criterion helped the Small Cap Value portfolio generate much superior returns compared to the market with less volatility and drawdowns.

The Advantages of Kelly Sizing in Small-Cap Value Investing

If you’re in small caps, your edge is research. Kelly helps you press that edge with precision.

Small-cap value stocks tend to be underfollowed and misunderstood. That’s your opportunity. But many investors make the mistake of equal-weighting or spreading bets too thinly. If one idea is significantly better than the rest, why wouldn’t you own more of it? The top idea in my small cap value portfolio hovers around 25% weight today after it has returned north of 30% in the last 6 months. When the stock price was lower, its allocation was much higher (as the expected return was higher).

Kelly sizing encourages concentration where your edge is highest—while penalizing you for uncertainty. That keeps your portfolio efficient. In my case, it lets me lean into high-conviction, high-margin-of-safety stocks without overexposing the portfolio to any single failure.

Rebalancing: What Happens When Prices Move or Fundamentals Shift

Markets move. Fundamentals evolve. Kelly keeps up.

When a stock appreciates but the intrinsic value estimate remains the same, the expected return shrinks. That reduces its Kelly weight. On the other hand, if the company reports improved earnings and intrinsic value rises, the weight might actually go up.

I recalculate Kelly weights when fundamentals change or new ideas come in. Then I rebalance to get back to the new optimal portfolio. This is not a static process. It evolves with the market and with the companies we own. On average I rebalance once a month.

When Not to Use Full Kelly, and Why I Don’t Either

Kelly sizing can be powerful but it’s not a hammer for every nail.

In practice, input assumptions are rarely perfect. Expected returns can change. Correlations are unstable. That’s why I scale back to fractional Kelly. This keeps the volatility and drawdowns in check while preserving most of the growth advantage.

Full Kelly can be too aggressive unless you’re 100% confident in your edge. Most investors overestimate their accuracy. Fractional Kelly helps temper that bias without abandoning the math. Full Kelly may require you to lever up, which I do not do.

Bottom Line: Kelly Is the Missing Piece in Intelligent Capital Allocation

As a serious value investor, you already do the hard work: researching, estimating fair value, identifying mispriced opportunities. But without intelligent sizing, even the best stock pick can underdeliver. The Kelly Criterion, properly applied, turns your analysis into compounding. It gives structure to conviction. It helps you grow faster, smoother, and smarter.

No, it’s not just for gamblers. It’s for professionals who want to win, and stay in the game for decades.

Kelly Criterion is anecdotally used by Warren Buffett and Bill Gross. It can be your investing edge too, and I can give you the tools to do it. If you’re ready to bring precision to your portfolio and build a growth-optimized strategy grounded in value, join me. Subscribe to the newsletter, access exclusive models, and learn how to apply Kelly sizing in your own investments.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: