You already know that your edge comes from buying undervalued stocks and letting them work over time. But even with a sound process and solid research, you keep second-guessing your trades. You hesitate when it’s time to enter. You trim winners too early. You panic when a position dips. The problem isn’t your strategy, it’s your sizing. Most investors dramatically underperform not because of bad stock picks, but because they can’t psychologically handle optimal position sizes. Let’s talk about why you self-sabotage and how to fix it with a smarter, more sustainable approach to fractional Kelly sizing.

You Say You Want High Returns, But Your Sizing Tells a Different Story

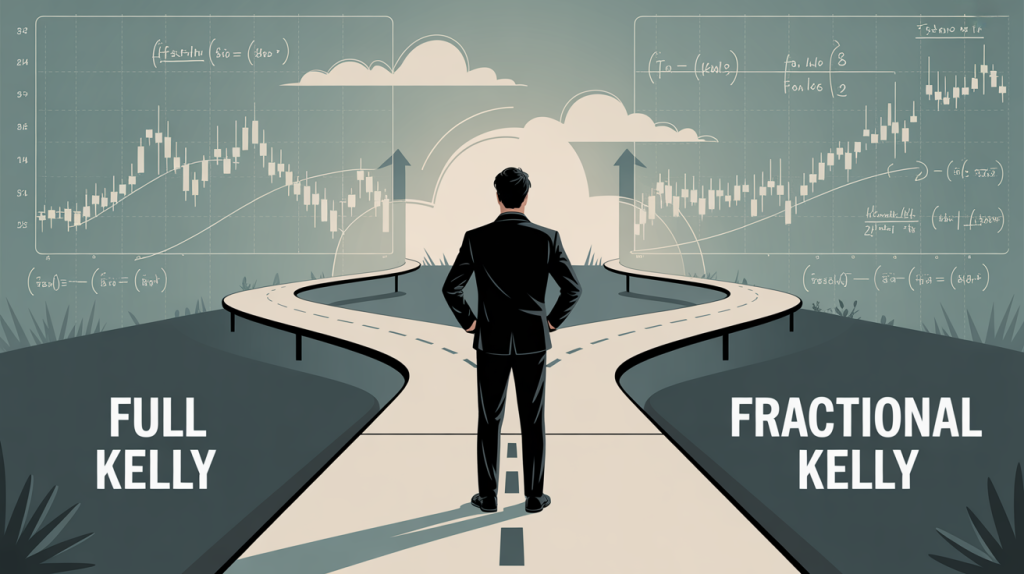

Investors say they want to compound wealth like Buffett. But when it comes time to place a big bet, they freeze. Full-Kelly sizing, the mathematical optimum for long-term growth, is too psychologically painful for most people.

The theory is sound. The drawdowns are real. And your brain hates them.

A full-Kelly position that drops 30% on paper will make you want to abandon your entire investing process. Even when you know that over time, these bets should pay off. Even when the edge is in your favor. You watch it fall and convince yourself the edge has vanished.

That’s not rational. That’s just biology.

Understanding Kelly Sizing: Where Math Meets Your Pain Threshold

Kelly Criterion is simple:

Position Size % = (Expected Return) / (Variance of Return)

It’s a tool that maximizes long-term growth rate. But like many things that maximize growth, it also maximizes pain.

In the real world, you don’t want the maximum growth curve. You want the one you can actually stick with. That’s where fractional Kelly sizing comes in: half-Kelly, one-third-Kelly, whatever helps you hold your ground during volatility.

You give up a sliver of return in exchange for dramatically improved emotional stability. That’s a trade worth making.

Another often-overlooked reason to use fractional Kelly is that the formula depends on inputs that are difficult to pin down. Your estimate of expected return might be optimistic. Your assessment of variance might not account for new risks. Even slight miscalculations can have outsized effects when applied to full-Kelly. The position size is only as reliable as the numbers behind it.

Full Kelly magnifies errors. Fractional Kelly cushions them.

When Full Kelly is Not Advisable

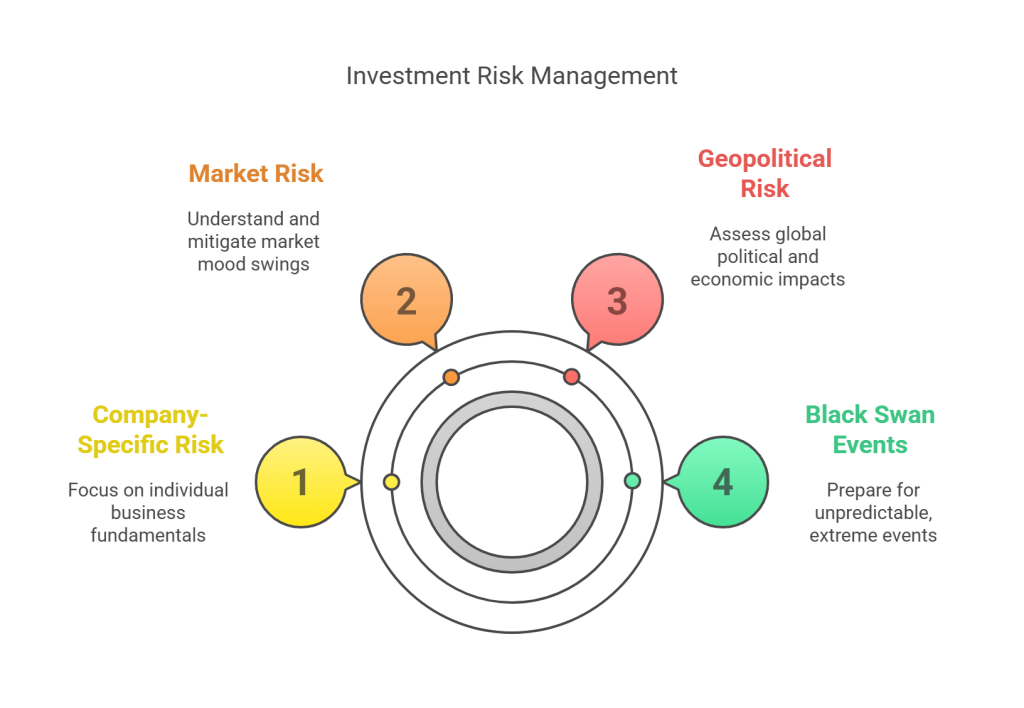

There are times when full Kelly is flat-out dangerous. Here are a few situations where backing off is not just wise, it’s essential:

- When inputs are based on qualitative judgment: If your expected return relies on assumptions about management, market share expansion, or future catalysts, it’s better to dial back the size.

- When volatility is underestimated: In small-cap value stocks, volatility often clusters. The variance can double in a short span and render your original sizing obsolete.

- When your confidence in the thesis is not absolute: Even if you love a stock, if there’s lingering doubt or unresolved red flags, you need a margin of error in your sizing too.

- When portfolio correlations are unstable: If you hold multiple stocks in related sectors, a shock to one might impact others more than historical correlations suggest.

Full Kelly assumes perfect clarity and stable conditions. Neither exist in real markets.

The Trap of Too-Small Sizing: You’re Playing Not to Lose

Of course, the opposite extreme is just as dangerous. Many investors take position sizes so small they barely move the needle. This makes it easy to lose conviction. There’s no emotional ownership. It’s just a ticker symbol bouncing around your portfolio.

And when that stock dips, even slightly, you’re out. You weren’t invested. You were merely watching.

Fractional Kelly avoids both extremes. It’s enough to matter. Not enough to wreck your portfolio if you’re wrong. It respects both the math and your humanity.

How to Actually Implement Fractional Kelly Without Losing Your Nerve

You can’t do this on gut instinct. That’s the whole problem. You need a system.

Start with a base calculation of expected returns for each stock, based on your fair value estimate. Track historical volatility. Use those to calculate your base Kelly fraction.

Then cut it in half, if you are using half-Kelly.

And here’s the part most investors forget: Recalculate periodically, quarterly or monthly. New earnings, price moves, updated thesis: these all impact your expected return. If the company hits your target, the expected return becomes zero. Time to trim. If earnings improve, your fair value rises, you may need to increase position size.

Fractional Kelly isn’t static. It breathes with your analysis.

Why You Hesitate, and What to Do About It

Hesitation comes from uncertainty. You didn’t define your size ahead of time. You let each trade become an emotional referendum.

That’s a recipe for paralysis.

Instead, write it down. Size it before the price moves. If you think the fair value is 70% above the current price, and volatility is manageable, use your fractional Kelly system to set the allocation now. Then execute it.

Do not resize based on vibes. Size based on process.

Letting Winners Run: How to Avoid Trimming Too Early

The flip side of hesitation is premature selling. The stock finally works and you cut it. Because you’re afraid to lose the gain.

You weren’t following a system. You were chasing comfort.

Kelly assumes you let the position grow. You only cut when the expected return vanishes. That’s not when you’re up 40%. That’s when the price reaches your updated intrinsic value.

In our Premium Portfolio, we trim based on this math. If the fair value increases, we hold or even add. If the thesis breaks, we cut. We never sell just because it “went up.” Most of our incremental increases of decreases happen at the time of monthly recalculations.

Match the Math to Your Mindset

You are not a spreadsheet. You are a person with instincts, fears, and memory of past scars. Kelly sizing doesn’t fail you. You fail when you try to follow a model you weren’t emotionally ready for.

But don’t throw out the model. Adapt it.

Start with half-Kelly. Or even one-third. Build your conviction through experience. Let the process teach your emotions that volatility is not failure. That dips are not danger. That sizing is not just math, it’s the foundation of behavior.

Because your portfolio doesn’t just need better stocks. It needs a more disciplined you.

Ready to Upgrade Your Investing Discipline?

Join the Premium Membership of Astute Investor’s Calculus and access our growth-optimal portfolio allocations—pre-sized using Kelly math, adjusted for your psychology. Stop sabotaging your gains and start investing with precision.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: