Why Market Cycles Matter in Value Investing

The market moves in cycles, swinging between optimism and pessimism, creating opportunities for patient investors. While value investing focuses on identifying fundamentally strong businesses trading below intrinsic value, recognizing where we are in the cycle can help enhance returns and avoid value traps.

Understanding cycles is particularly important because the best opportunities arise not just during broad market downturns, but more often in industry- or sector-specific declines. The investor who recognizes these patterns can buy when fear is high and valuations are low, positioning for substantial long-term gains. However, failing to account for these cycles can lead to costly mistakes, as misjudging whether a company is cyclically undervalued or in structural decline can result in capital being allocated inefficiently. This is why market cycles, particularly industry and sector cycles, are crucial considerations in value investing.

Understanding Market Cycles: The Basics

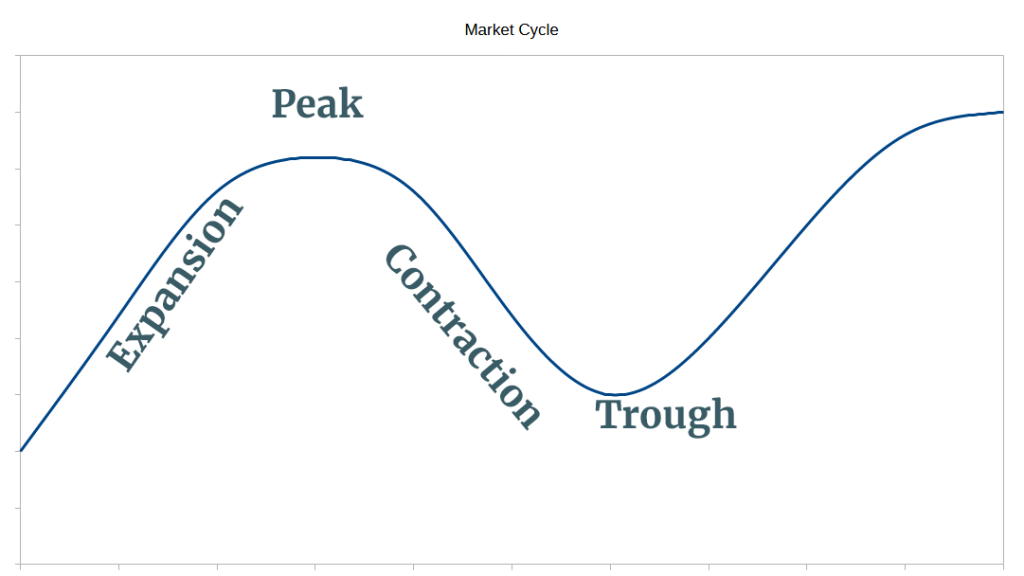

Market cycles follow predictable phases: Expansion, Peak, Contraction, and Trough. While the stock market as a whole follows these phases, different industries and sectors go through their own independent cycles, often at different times.

- Expansion: Optimism fuels growth, earnings rise, and valuations expand. Companies ramp up production, capital investment increases, and employment grows.

- Peak: Investors become euphoric, pushing prices beyond fundamentals. Overleveraging and excessive risk-taking become common.

- Contraction: Overvaluation, economic slowdowns, or industry-specific headwinds trigger declines. Layoffs increase, and asset prices fall as sentiment turns negative.

- Trough: Pessimism dominates, causing stock prices to fall below intrinsic value, often excessively. This phase provides the best buying opportunities for disciplined investors.

These cycles repeat, often exaggerated by investor psychology. Broad market cycles are important, but they are not always the most actionable for value investors. Instead, the real mispricings happen within industries, where excessive fear or greed can create substantial opportunities. Recognizing these patterns allows value investors to act decisively when markets overreact to cyclical downturns.

Industry and Sector Cycles: The Real Source of Opportunity

Each industry has its own rhythm, often driven by economic factors, technological change, or shifting consumer demand. Some industries are highly cyclical by nature, while others experience booms and busts due to external shocks.

Examples of Industry-Specific Cycles:

- Energy: Oil and gas stocks tend to follow the price of crude oil. During oil price crashes, capital expenditure cuts lead to production declines, setting up the next supply shortage and eventual price recovery.

- Financials: Banks and insurance companies are heavily affected by interest rate cycles. When rates are rising, margins expand; when rates fall, profits contract.

- Technology: The industry experiences innovation cycles, where periods of rapid growth lead to overcapacity and subsequent downturns. New technological breakthroughs create temporary investment frenzies, which later normalize.

- Consumer Discretionary: Retail and travel industries rise and fall with consumer spending, often linked to broader economic conditions. A slowing economy can cause discretionary spending to decline, while economic expansion fuels growth in these sectors.

Recognizing these cycles helps a value investor separate temporary industry downturns (which create buying opportunities) from structural declines (which can destroy value permanently). Successful investors develop an awareness of how different industries interact with macroeconomic trends, enabling them to allocate capital effectively and avoid mispricing traps.

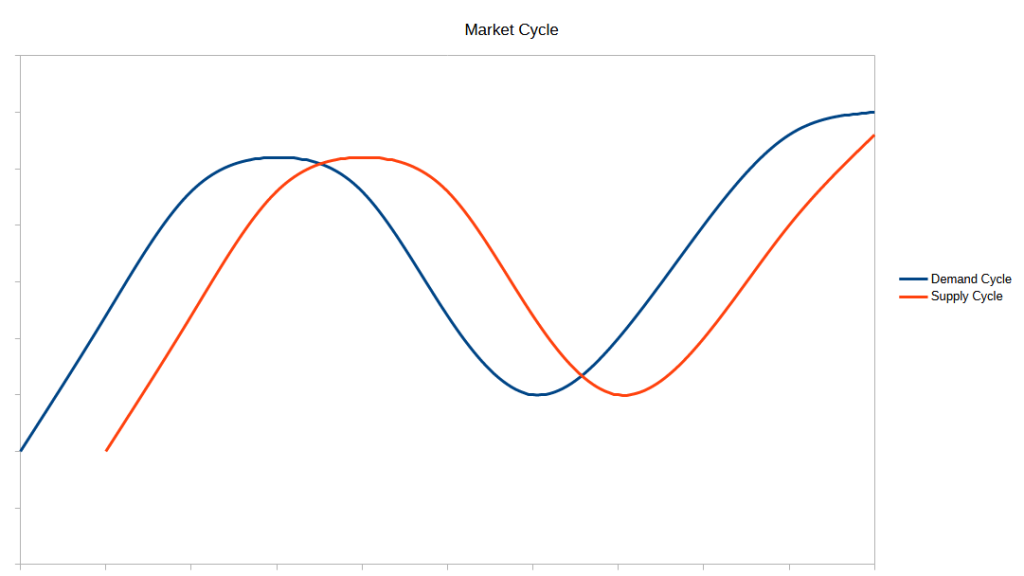

Additionally, the demand cycle often drives the supply cycle, though there is usually a lag between the two. When demand surges, companies struggle to meet it, leading to capital investments in new capacity. However, these investments take time to materialize. During this period, supply remains constrained, causing prices and profitability to rise dramatically. Conversely, by the time new supply comes online, demand may have already started to decline. This creates an overcapacity issue, putting downward pressure on prices and forcing weaker companies out of the market. Recognizing these dynamics allows value investors to anticipate industry turning points and position their portfolios accordingly.

The Value Investor’s Playbook: Timing Entries Within Cycles

Once an investor identifies an industry or sector in a downturn, the next step is determining whether it presents a real value opportunity or is a value trap.

Buying in the Trough: The Ideal Setup

- Strong businesses are sold off alongside weaker peers, providing bargains.

- Negative sentiment drives valuations to irrational lows.

- Look for strong balance sheets, durable competitive advantages, and an eventual catalyst for recovery.

Case Study: Auto Stocks Post-2008

During the 2008 financial crisis, auto stocks were decimated. Ford (F) was lumped in with bankrupt General Motors (GM) and Chrysler. However, Ford had a solid balance sheet and avoided government bailouts. Investors who recognized this distinction were rewarded as the industry rebounded. This demonstrates the importance of separating strong cyclical companies from those facing existential threats.

Avoiding Value Traps: The Difference Between Cyclical Downturns and Structural Decline

Not every falling stock is a bargain. Some industries or companies face permanent declines due to disruptive changes.

- Cyclical downturn: Companies with strong fundamentals recover as the cycle turns (e.g., airlines during travel slumps, energy stocks after oil crashes).

- Structural decline: Companies facing obsolescence or long-term headwinds (e.g., Kodak and Blockbuster) may never recover.

The key is to distinguish between temporary price declines driven by cycles and genuine destruction of business value. This requires deep fundamental research, an understanding of industry trends, and insight into management’s ability to navigate downturns.

Selling in the Boom: Recognizing When the Cycle Has Turned

The best time to sell is when optimism peaks and valuations stretch beyond fundamentals. Investors who fail to recognize the end of a cycle risk giving back gains.

Signs of Excessive Optimism:

- Price-to-earnings ratios exceed historical averages.

- Industry insiders and corporate executives start selling shares.

- New entrants flood the market (e.g., SPAC and IPO booms in tech).

- Increased speculative behavior, such as high leverage and unrealistic earnings expectations.

Case Study: Energy Stocks in 2007 and 2022

In 2007, oil prices surged above $140 per barrel, driving energy stocks to extreme valuations. Many investors stayed in too long and were crushed when oil crashed below $40 in 2008. A similar situation played out in 2022, when energy stocks soared as oil rebounded post-COVID, only to face headwinds again when recession fears took hold.

Knowing when to exit can be just as important as knowing when to buy. This requires maintaining a disciplined approach, assessing valuation metrics, and staying ahead of cyclical inflection points.

Applying Market Cycle Insights to Portfolio Strategy

Understanding market cycles is essential for value investors looking to optimize their portfolio allocations. By recognizing how different industries move through their unique cycles, investors can strategically adjust their holdings to maximize returns and minimize risk. This involves diversifying across industries at different points in their cycles, adjusting position sizes based on cycle awareness, and incorporating key economic indicators into decision-making.

Diversification Across Cycles

A well-balanced portfolio should include exposure to industries that are in different phases of their respective cycles. When one sector is peaking and showing signs of overvaluation, another may be in the trough phase, presenting attractive buying opportunities. This natural counterbalancing helps smooth out overall portfolio returns and reduces the risk of being overly exposed to a single sector’s downturn.

Position Sizing Based on Cycle Awareness

Investors can optimize their returns by adjusting allocations based on where a sector is in its cycle. During downturns, when valuations are depressed, increasing exposure to high-quality companies in those industries can yield strong returns as the cycle eventually turns. Conversely, when valuations in a sector become stretched and investor sentiment reaches euphoric levels, it may be wise to reduce exposure and lock in gains before the inevitable correction.

Using Economic and Industry-Specific Indicators

Several economic indicators can help investors anticipate turning points in market cycles. Interest rates and credit conditions, for example, have a significant impact on financial stocks, influencing their profitability and lending capacity. Commodity prices dictate cycles in materials and energy, often leading to periods of extreme profitability followed by sharp contractions. Additionally, earnings revisions and forward guidance from companies provide valuable insights into whether an industry is experiencing an upswing or nearing the end of its growth phase.

The Cycle-Aware Value Investor

Great value investors don’t just buy cheap stocks; they buy cheap stocks at the right time. Market cycles provide the backdrop for extreme mispricings, and industry-specific cycles are where the best opportunities emerge.

Featured products

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: