The Edge You’re Ignoring Could Be Costing You Millions.

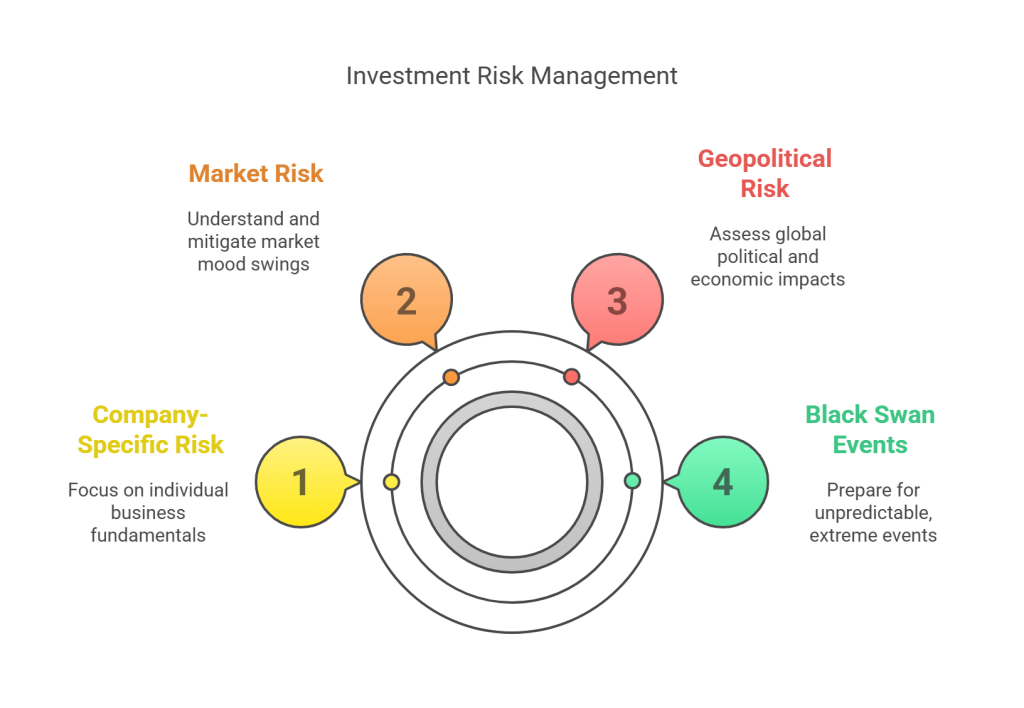

For value investors, risk is not the volatility in the market or in the stock price, but in fact it is how you react to it.

Most investors obsess over metrics like price-to-earnings ratios, discounted cash flow models, or EBITDA margins. And yet, the biggest edge in long-term investing rarely shows up on a spreadsheet: your risk tolerance. It’s not something you can plug into a model, but it determines whether you stay the course through market chaos or capitulate at the worst possible moment.

In value investing, where holding undervalued assets through market pessimism is the name of the game, risk tolerance separates the long-term compounders from the chronic churners. This isn’t about being fearless. It’s about knowing how much short-term pain you can endure without sabotaging your own portfolio. And more often than not, investors find out the hard way that they overestimated their resilience.

Value Investing Demands a Different Kind of Stomach

Unlike trend-followers or traders who can pivot quickly with market sentiment, value investors operate on a different frequency. You buy stocks precisely because they are hated, ignored, or misunderstood. Your opening position is a big middle finger to the market. The market rarely agrees with your assessment in the short term, and that’s where the psychological toll begins.

Holding a stock that keeps drifting lower despite solid fundamentals tests your conviction. When the market screams “Sell,” and your research says “Buy,” you need the emotional bandwidth to stay the course. That bandwidth? It’s risk tolerance. In value investing, where mean reversion and fundamental repricing can take months or years, it’s your willingness to endure discomfort that ultimately drives results.

Believe me, you need thick skin to look at your portfolio every day. 360 days out of 365 in a year, you will trail the market and your stocks will test your conviction. But those 5 glorious days when your stocks get repriced will push you far ahead of the market.

How Risk Tolerance Shows Up in Real-World Behavior

Risk tolerance is easy to overstate when the market is calm and your portfolio is green. But real risk tolerance reveals itself in down markets, during drawdowns, and when headlines shift from hopeful to apocalyptic.

I’ve seen two investors hold the exact same stock and behave completely differently. One calmly adds to the position when it drops 20%. The other sells in a panic at the bottom, then regrets it weeks later. Same information, same thesis—but different outcomes driven entirely by the investor’s ability to handle stress. What made the difference wasn’t knowledge. It was temperament.

True risk tolerance comes from experience, from knowing your own emotional triggers, and from designing a process that reduces the chance of emotionally charged decisions. The more you align your portfolio with your actual psychological comfort zone, the more likely you are to stick with your strategy through thick and thin.

Misjudged Risk Tolerance Destroys Compounding

Compounding requires time. And time only works in your favor if you stay invested. The moment you let discomfort push you out of your holdings, you interrupt the process that builds wealth.

When you misjudge your risk tolerance, the outcome isn’t just emotional fatigue. It’s real, permanent loss. You sell at the bottom, miss the recovery, and often redeploy into safer assets that barely keep up with inflation. Over the course of a decade, these decisions add up to significant underperformance, even if your stock picks were sound.

Value investing already asks you to buy what others are avoiding. If you also make the mistake of selling early out of discomfort, you’re compounding in reverse. The market eventually rewards patience. But only if you’re still holding when the turn comes.

The Kelly Criterion and Structuring Risk Intelligently

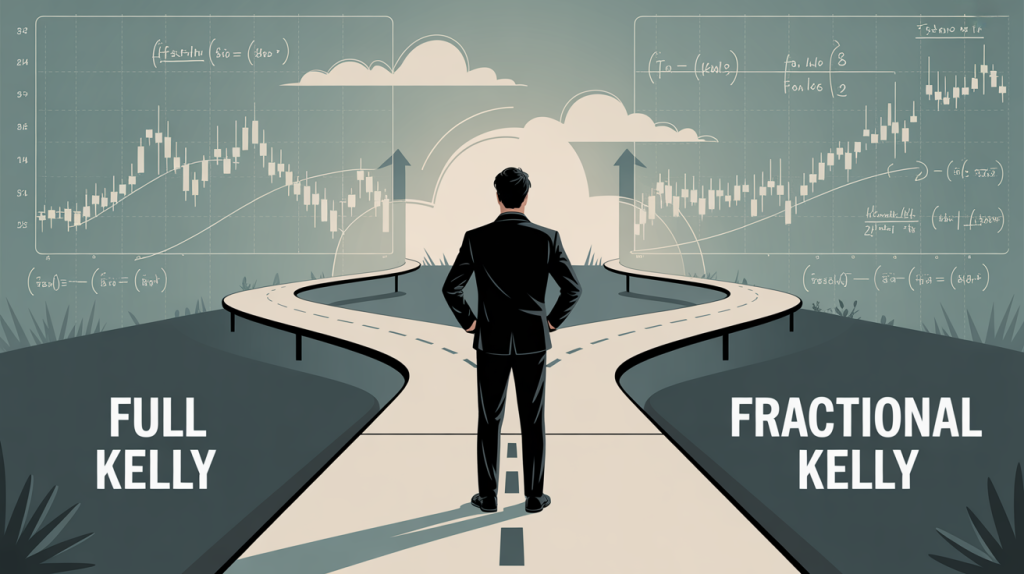

I use the Kelly Criterion to guide position sizing in my small cap value portfolio. It’s a mathematical formula that balances expected return with volatility to find the optimal allocation. But even the most elegant formulas fail if they don’t match your emotional bandwidth.

A position might be statistically optimal but feel like a hand grenade in your portfolio. If you can’t sleep at night, it’s not a good investment—no matter what the numbers say. That’s why I adjust position sizes not just for the math but also for behavioral fit. It’s better to under-allocate and stay in the game than over-allocate and bail out when pressure mounts.

Smart portfolio construction means aligning your capital with both opportunity and tolerance. That’s not weakness. That’s durability. And over decades, durability outperforms bravado.

How to Discover—and Respect—Your Real Risk Tolerance

You won’t find your true risk tolerance in a risk questionnaire. You’ll find it in your past behavior. When did you sell? Why? What did you feel during drawdowns? These are the data points that reveal your actual tolerance level.

Use that data to create a portfolio structure that respects your boundaries. Include rules that prevent heat-of-the-moment decisions. Build cash cushions if you need them. Diversify among strategies so one bad quarter doesn’t feel like the end of the world.

Above all, be honest with yourself. You can’t game risk tolerance. But once you understand it, you can build an investing process that works with it—not against it.

Your Greatest Advantage in Value Investing Isn’t IQ. It’s EQ.

Markets reward discipline, not brilliance. And discipline is driven by emotional control. The best value investors aren’t always the smartest in the room. They’re the ones who stay calm when others panic, who hold when it’s hardest, and who know their limits well enough to avoid costly mistakes.

Your risk tolerance is your foundation. Get it wrong, and everything else collapses. Get it right, and you’ll find yourself on the right side of compounding more often than not. The edge is real—you just have to stop overlooking it.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: