The Growth Trap No One Warns You About

Scaling a small business sounds like the dream, until it starts to feel like a trap. Revenue is up, orders are flying in, and suddenly, every fire ends up at your desk. What should be a victory lap feels more like an endless treadmill. For investors who also run businesses or are contemplating investing in one, this moment is critical. The challenge isn’t just about growth. It’s about control.

To make the leap from operator to owner, you need to shed the habits that got you here and adopt a mindset that positions your business to thrive without you at the center. This is the key to preserving strategic clarity, scaling sustainably, and ultimately building real equity value.

Why Scaling Feels Riskier Than Starting

Growth exposes everything you used to be able to ignore. When you’re small, you can get away with plugging gaps yourself. But as complexity increases, your patchwork starts to tear. Founders often become the bottleneck in their own business. And the more they hustle, the worse it gets.

The irony? Most small business owners dream of freedom. But without a plan to scale intelligently, growth actually chains you tighter to the day-to-day. Investors recognize this pattern. Many businesses plateau because the founder refuses to evolve. What got you to $1 million will not get you to $10 million, at least not without changing who makes the decisions and how.

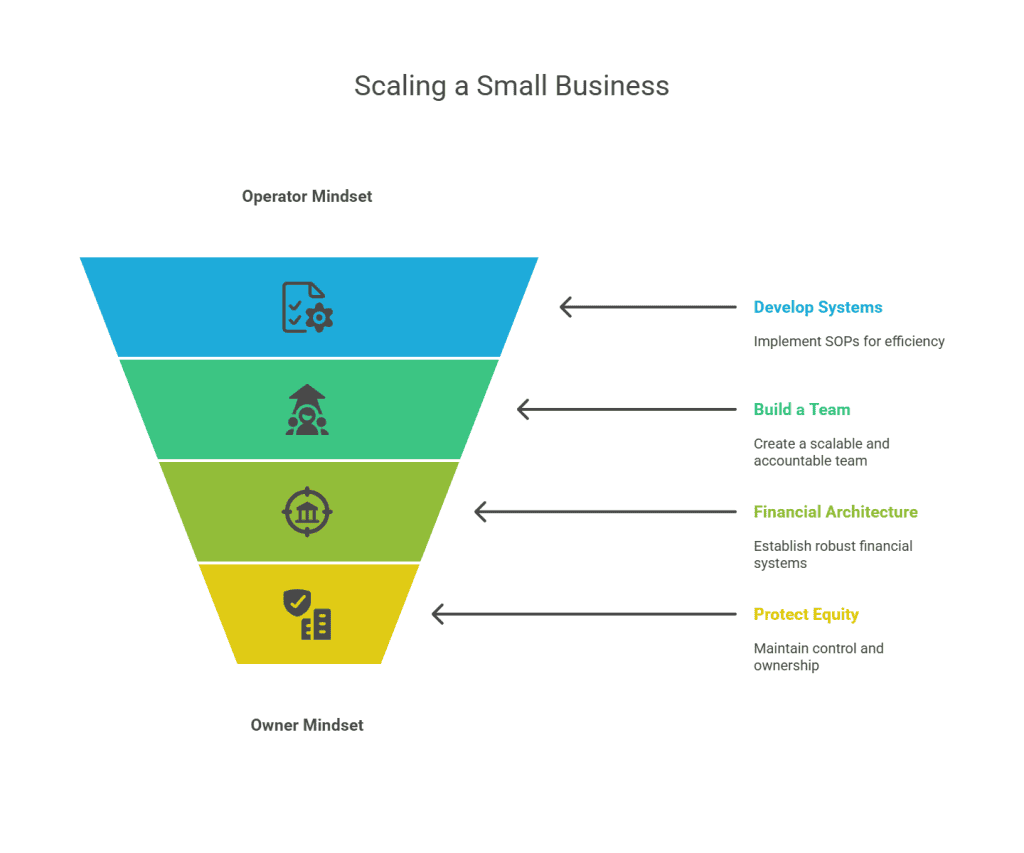

The Operator-to-Owner Mindset Shift

Operators solve problems. Owners build machines that solve problems. If you want to scale a small business, you must start thinking like an owner and allocate your time like capital. Every hour you spend working in the business is a distraction from working on the business.

Buffett doesn’t run his companies. He owns them. That’s the standard. When you adopt this mindset, your role becomes one of strategy, capital allocation, and leadership. You set the targets. You measure the outcomes. And you build the team and systems to deliver results without micromanagement.

If you build to sell (even if you never do) you will naturally create a more durable and investable business.

Systems Are the New Skill

Hustle doesn’t scale. Systems do. The reason most founders hit a wall is because their processes live in their heads or on scraps of paper. That doesn’t cut it when the team grows.

You need standard operating procedures (SOPs) that are simple, scalable, and measurable. Think of systems as your second brain. They should handle recurring tasks with minimal friction so you can focus on high-leverage work. This doesn’t mean becoming a bureaucracy. It means building clarity and consistency into your business, so decisions and execution don’t always funnel through you.

Just today we were discussing the launch of our advertising campaigns on Amazon for one of the businesses we run. As we sat down to create new ads, set strategy, budgets, and targets, we naturally began using spreadsheets to track performance. But we know this won’t be enough as complexity increases. As more data points emerge and interdependencies form, we’re already thinking about scalable systems to manage it all.

Some of the most essential systems a small business needs include:

- Customer Relationship Management (CRM) to track interactions, sales pipelines, and follow-ups

- Inventory management to avoid stockouts or overstocking, especially for ecommerce or product-based businesses

- Order processing and fulfillment workflows to automate and streamline transactions

- Marketing automation systems to handle email campaigns, retargeting, and lead nurturing

- Financial systems including invoicing, bookkeeping, payroll, and forecasting

- Project and task management tools to coordinate work across teams and track progress

- Customer support systems such as ticketing, live chat, or self-service help centers

Better systems reduce error, improve margins, and increase valuation. They also make your business more attractive to both investors and strategic buyers.

People Over Product: Building a Scalable Team

As your business scales, your team becomes your greatest asset, or your biggest liability.

To build a team that truly scales, you need to take intentional steps at every level:

Start with clarity in roles and responsibilities. Every team member should know what they own, how their success is measured, and how it fits into the broader business strategy. Vague titles or undefined roles create confusion and inefficiency.

Invest in structured onboarding and training. Don’t just hand over tasks, equip people with the playbooks, SOPs, and context they need to perform well and make decisions without you. The systems you built earlier will be critical here. This builds confidence and reduces errors.

Design a management layer that reports on KPIs, owns outcomes, and can coach others. You need leaders who multiply your impact, not employees who depend on you to unblock them.

Create feedback and performance loops. Regular reviews, 1:1s, and project debriefs build a culture of accountability and learning. Without this, teams drift and performance stagnates.

Embed incentive alignment early. Profit-sharing, performance bonuses, or phantom equity can motivate your team to think like owners and care deeply about outcomes.

Use collaboration and visibility tools. Project management platforms, shared dashboards, and knowledge bases. These reduce dependency and create operational transparency.

Finally, build a culture that scales. Encourage initiative, reward results, and communicate consistently. A team that understands your values can make smart decisions without your direct involvement.

Financial Architecture That Supports Scale

If your financial systems are weak, scale will crush you. Many founders operate on gut feel or bank balances. That doesn’t work when you’re managing multiple departments, growth initiatives, or lines of credit.

Here’s what good financial architecture looks like in a small business:

Start with a dedicated financial tech stack: QuickBooks or Xero for accounting, Gusto or Rippling for payroll, Expensify or Ramp for expense tracking. These should integrate with your bank and give you visibility into cash flow and trends.

Layer on a forecasting and budgeting process: Start with spreadsheets, then graduate to tools like LivePlan or Fathom for rolling forecasts, what-if analysis, and variance tracking. Monthly reports should compare actuals to budget and inform next actions.

Break down your P&L by department or product line: You need to know which parts of the business are profitable and which are dragging you down.

Build a dashboard of critical metrics: cash runway, gross margin by SKU, CAC, LTV, contribution margin, ROIC. Tools like Databox or Tableau help visualize this.

Establish a monthly close process and financial review cadenc: Closing the books by the 10th and reviewing numbers with leadership builds financial discipline.

Bring in a fractional CFO or strategic advisor as you grow: They’ll help you plan capital allocation, raise funding, and maintain investor-grade reporting.

This isn’t overhead, it’s control.

Protecting Your Equity: Staying in Control as You Scale

One of the biggest risks in scaling is dilution, of your time, your brand, or your ownership. Many founders hand over equity too easily in exchange for short-term cash or help. But there are smarter ways to grow.

Reinvest retained earnings. Negotiate vendor terms. Explore customer prepayments. Use debt wisely when the returns are predictable. If you must bring in investors, structure terms that protect your control.

Here are several funding strategies that preserve your equity:

- Revenue-based financing: Lenders take a percentage of your monthly revenue until a cap is repaid. Flexible and non-dilutive.

- BDCs (Business Development Companies): Provide debt or non-voting equity to support small business growth.

- Kickstarter or crowdfunding: Great for product-based businesses. Raise capital via preorders without giving up ownership.

- Government grants or SBA loans: Often overlooked, but offer favorable, non-dilutive terms.

- Vendor and customer financing: Ask for longer payment terms or upfront deposits to ease cash flow.

- Royalty financing: Offer a percentage of future revenue until a return target is met. No equity given up.

But beware of bank loans or working capital lines with personal guarantees. These can tie your personal assets, home, savings, future income, to the business. Only agree to personal guarantees if the cash flow margin of safety is strong and repayment is highly predictable.

The key is to match your funding strategy to your growth stage, risk tolerance, and long-term objectives.

For Investors: What to Look For in a Scalable Business

If you’re evaluating a private company as an investor, this framework becomes your due diligence checklist:

- Can the founder step back without the business falling apart?

- Are systems repeatable, not founder-dependent?

- Is there a competent management team?

- Does scale improve margins or add complexity?

- Are financials clean, timely, and investor-ready?

Strong answers to these questions signal a business that can scale profitably and sustain long-term value.

Conclusion: Scale with Intention

You can’t hustle your way to freedom. You can only systematize your way there. Whether you’re a founder scaling your own business or an investor allocating capital into one, the principles are the same: focus on leverage, build for durability, and structure the business to succeed without you.

Scaling a small business isn’t about growing for growth’s sake. It’s about growing wisely so your business becomes more valuable, more stable, and more independent over time.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: