You’ve heard the arguments for growth stocks, index funds, crypto, and real estate. But what if the strategy with the strongest long-term performance has been hiding in the shadows, ignored by Wall Street, misunderstood by most investors, and dismissed because it lacks sex appeal?

This isn’t a theory. It’s a fact supported by nearly a century of market data. Small cap value stocks, as a group, have outperformed every other asset class over the long run. But most investors will never benefit from this because they either don’t know the data, can’t stomach the volatility, or aren’t willing to do the work.

This article walks you through the evidence. You’ll see long-term returns, volatility stats, risk-adjusted metrics, and a case for why this strategy continues to work. And you’ll understand how to use it without relying on predictions or Wall Street’s narratives.

The Data Doesn’t Lie: Small Cap Value Crushes the Competition

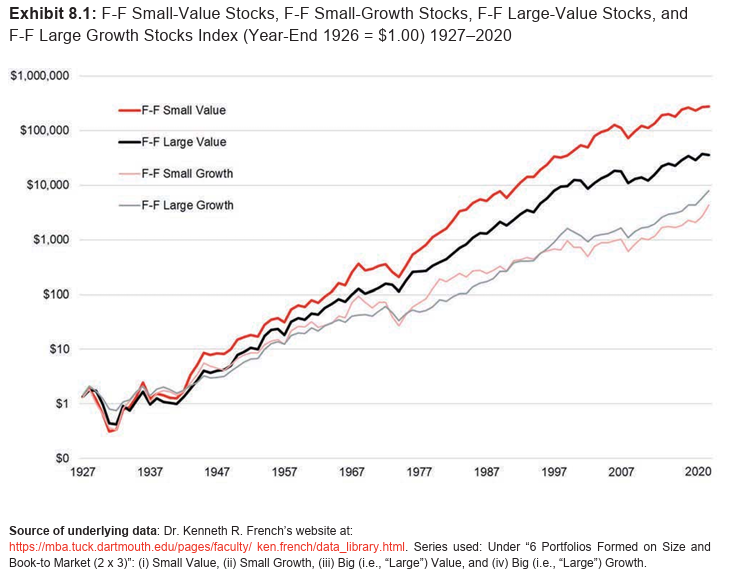

Let’s start with the numbers. Since 1927, small-cap value stocks have delivered higher compound annual growth rates than large-cap growth, the S&P 500, international developed markets, and even private equity in many cases. Over the long arc of time, no other strategy has created more wealth from a base of discipline and rationality.

When you compare cumulative growth of $10,000 across different asset classes, small-cap value ends up miles ahead. The edge persists even after fees and taxes, and it shows up across different economic cycles.

The story is the same whether you look at Fama-French data, Dimensional Fund Advisors research, or Kenneth French’s data library. Time and again, small-cap value comes out on top.

The chart above comes from the Ibbotson’s SBBI Summary Edition 2021. According to this, $1 invested at the end of 1926 grew to over $270,000 in small cap value stocks, and $35,000, $7,000, and, $4,000 respectively in large value, large growth and small growth stocks respectively by the end of 2020.

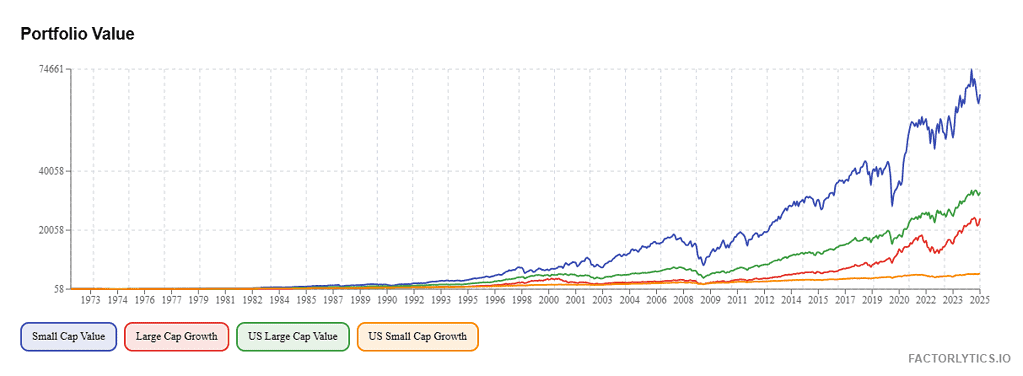

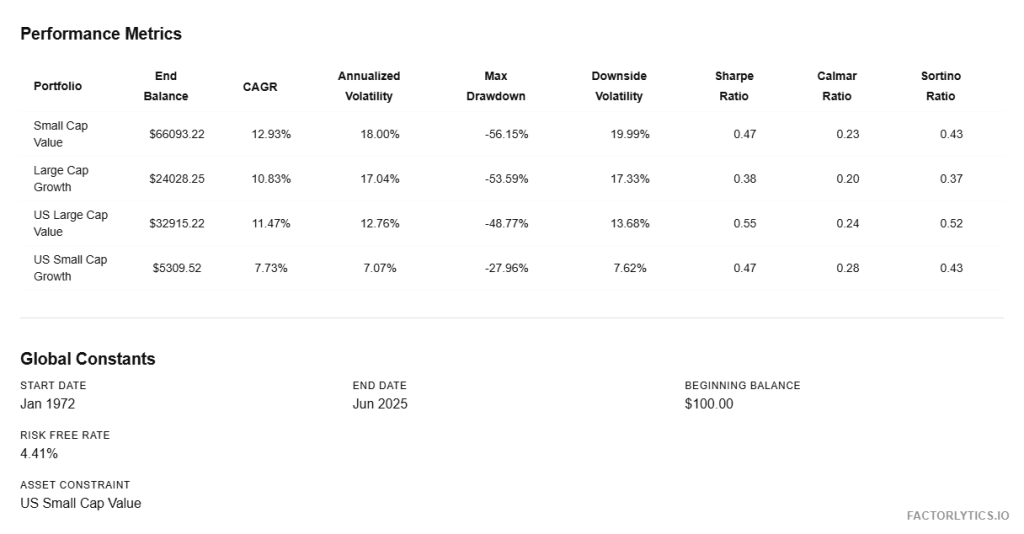

Using backtesting platform Factorlytics.io, you can find a similar performance pattern between these asset classes in the more recent years. This particular backtest is for a period of Jan 1972-Jun 2025. The backtest plots the growth of $100.

It is easy to see that the small cap value stocks do come with higher volatility compared to the other asset classes. if you can bite your lip and invest consistently, you will be rewarded with higher absolute and risk-adjusted returns.

Volatility Isn’t the Enemy; Risk of Ruin Is

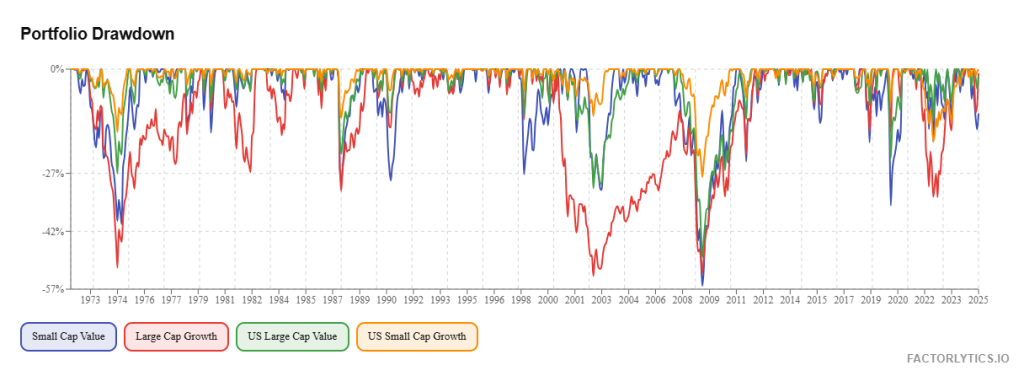

Critics are quick to point out that small-cap value stocks are volatile. And they’re right. The standard deviation is higher than the S&P 500. But volatility isn’t the same thing as risk. Volatility is movement. Risk is permanent loss.

The real risk in investing is allocating your capital in a way that destroys your ability to compound. That happens when you overpay, chase trends, or put your money into assets you don’t understand. Small cap value minimizes this risk by starting from a place of deep undervaluation and embedded margin of safety.

Even drawdowns, while steeper at times, often recover faster in small cap value because mean reversion works in your favor when the starting valuations are low. You can see in the chart above that the recovery has generally been the slowest in the large cap growth asset class, which are pretty much what the FAANG and MAG 7 stocks are. Add in dividends, buybacks, and operational leverage, and the rebound potential is often underestimated.

Wall Street Avoids Small-Cap Value for All the Wrong Reasons

You may be wondering: if this strategy works so well, why isn’t everyone doing it? Simple. The incentives on Wall Street don’t align with it.

Ever heard Warren Buffett remark that if he was just starting out, he would generate an average of 50% returns per year? Bigger asset base now prevents him from buying certain types of stocks that a small retail investor is able to buy.

He was talking about small cap value stocks.

Fund managers can’t scale this strategy without moving the market. Research analysts don’t cover these companies because they generate fewer commissions. Most retail investors avoid it because it feels lonely and obscure. And most financial media doesn’t talk about it because there are no shiny headlines in an obscure $100 million auto parts distributor trading at 6x earnings.

This structural neglect is your edge.

How I Use Small Cap Value to Beat the Market (and Sleep at Night)

This isn’t an academic argument. It’s how I invest my own money, and it’s the basis for the Premium Small Cap Value Portfolio strategy I run in the Inner Circle.

I start by screening for companies with strong earnings power, clean balance sheets, and low valuations relative to normalized cash flows. I look for asymmetric setups where the downside is limited, but the upside is multiples of the current price.

Then I optimize portfolio construction using a variation of the Kelly Criterion. This helps ensure that I’m not just picking the right stocks, but sizing them in a way that maximizes long-term growth without overexposing to any one position.

My portfolios are designed to reduce internal correlation. Even though small cap value is the core, I blend in event-driven ideas, asset-rich companies, and hidden compounders. The result is a portfolio that has historically outperformed the benchmarks while absorbing less psychological stress.

Why This Strategy Works Best Over the Long Haul

Markets are driven by fear and greed. Most investors overreact to short-term noise and underappreciate long-term fundamentals. Small cap value thrives on this behavioral inefficiency.

It works because most investors won’t do it. They want excitement. They want stories. Small cap value demands patience, discipline, and research. It requires comfort with less liquid stocks. But it rewards that discipline with consistent outperformance over decades.

The data shows this. The theory supports this. And the practice, when executed intelligently, confirms it.

You Don’t Need to Be Popular. You Need to Be Right.

Everyone else chases the latest trends. Let them. Being consistently rational is your rare and profitable edge.

Small cap value isn’t for everyone. But if you’re serious about building wealth, protecting capital, and outperforming over the long term, this isn’t just a good strategy. It is, by far, the best.

Want to see the actual portfolio I use? Subscribe to Astute Investor’s Calculus Inner Circle and get immediate access to my research, stock picks, and ongoing performance updates.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: