Ignore the Noise, Focus on the Real Drivers of Value

Every investor starts with good intentions: read the 10-K, skim the ratios, check the P/E. But most never move past the surface. They get stuck in the weeds, distracted by shiny metrics that don’t predict long-term performance. That’s not your game.

If you’re managing your own portfolio and aiming for real returns, you need to cut through the clutter. Focus on the three pillars of serious fundamental analysis: earnings, moats, and margins. These are the numbers that Wall Street watches quietly—and the foundation long-term compounders are built on.

Most other numbers are derivative. They’re often downstream from these three fundamentals. Your edge as an individual investor doesn’t come from speed or access to information. It comes from patience and knowing what truly matters.

Let’s break down how to evaluate each, what to watch for, and how to tie them together into a cohesive investing strategy.

Earnings: Not All Profits Are Created Equal

Start here. Earnings are the heartbeat of a business, but the headline number often misleads.

There’s a big difference between reported earnings and true owner’s earnings. GAAP net income includes all kinds of accounting noise—non-cash charges, one-time items, or even creative revenue timing. What matters is whether the business generates cash you can pull out without hurting operations.

Earnings manipulation is common, especially when management is compensated on earnings targets. It’s important to look at the consistency of earnings across time, and whether earnings growth is accompanied by corresponding growth in free cash flow.

Look beyond the surface:

- Free Cash Flow (FCF): Cash from operations minus capital expenditures. This is closer to Buffett’s “owner earnings.”

- Earnings Quality: Are earnings backed by cash flow? If net income is high but cash flow lags, something’s off.

- Recurring vs. One-Off: Strip out nonrecurring events. You’re investing in a business, not a lottery ticket.

- Trends and Durability: Has the business grown earnings across multiple economic cycles? Or is it highly cyclical?

Even strong earnings mean little if the business can’t protect them. That brings us to moats.

Moats: The Hidden Armor Behind Consistent Earnings

The market eventually notices profitability. The question is—can it be defended?

Economic moats are structural advantages that shield profits from erosion. A company with a wide moat can grow earnings without inviting competitors to eat their lunch. Without a moat, even high profits are temporary.

Think of a moat as the difference between a temporary opportunity and a compounding machine. Without a moat, you may find yourself chasing one-off turnarounds or fleeting trends.

Ask the right questions:

- Pricing Power: Can they raise prices without losing customers?

- Customer Stickiness: Do clients return year after year? Contracts, switching costs, and network effects are strong signs.

- Market Share Stability: Are competitors gaining ground, or does the company dominate?

- Return on Invested Capital (ROIC): High and consistent ROIC is often the clearest sign of a real moat.

- Capital Efficiency: Are reinvested earnings generating incremental returns above the cost of capital?

Moats come in many forms—brand strength, scale advantages, distribution networks, regulatory licenses, and technological lead, among others. Your job is to figure out whether the advantage is durable or eroding.

Moats allow a company to sustain or expand profit margins. And that brings us to the final number.

Margins: The Telltale Sign of Business Health

Margins show how efficiently a business turns revenue into profit. They offer a clear window into the company’s operating leverage and pricing dynamics.

While earnings growth tells you whether the business is getting bigger, margins tell you if it’s getting better. That’s a critical distinction. A company that’s growing revenues by 15% but watching its margins shrink is likely creating very little actual shareholder value.

Know the three types:

- Gross Margin: Reflects pricing power relative to cost of goods sold. It can indicate brand strength or product differentiation.

- Operating Margin: Includes overhead and shows managerial efficiency. Rising operating margins often reflect economies of scale.

- Net Margin: Final profitability after all expenses—best for comparing across companies and industries.

Margins should be evaluated in the context of industry norms. A 10% margin in retail might be phenomenal, while a 10% margin in software might suggest operational problems.

Rising margins in a competitive market often signal pricing power or cost discipline. Declining margins, even with growing revenue, can indicate value destruction. And importantly, shrinking margins are often the first red flag before an earnings collapse.

Also ask yourself: how are margins trending during recessions? Do they hold up in downturns, or collapse under pressure? This can tell you a lot about the underlying resilience of the business.

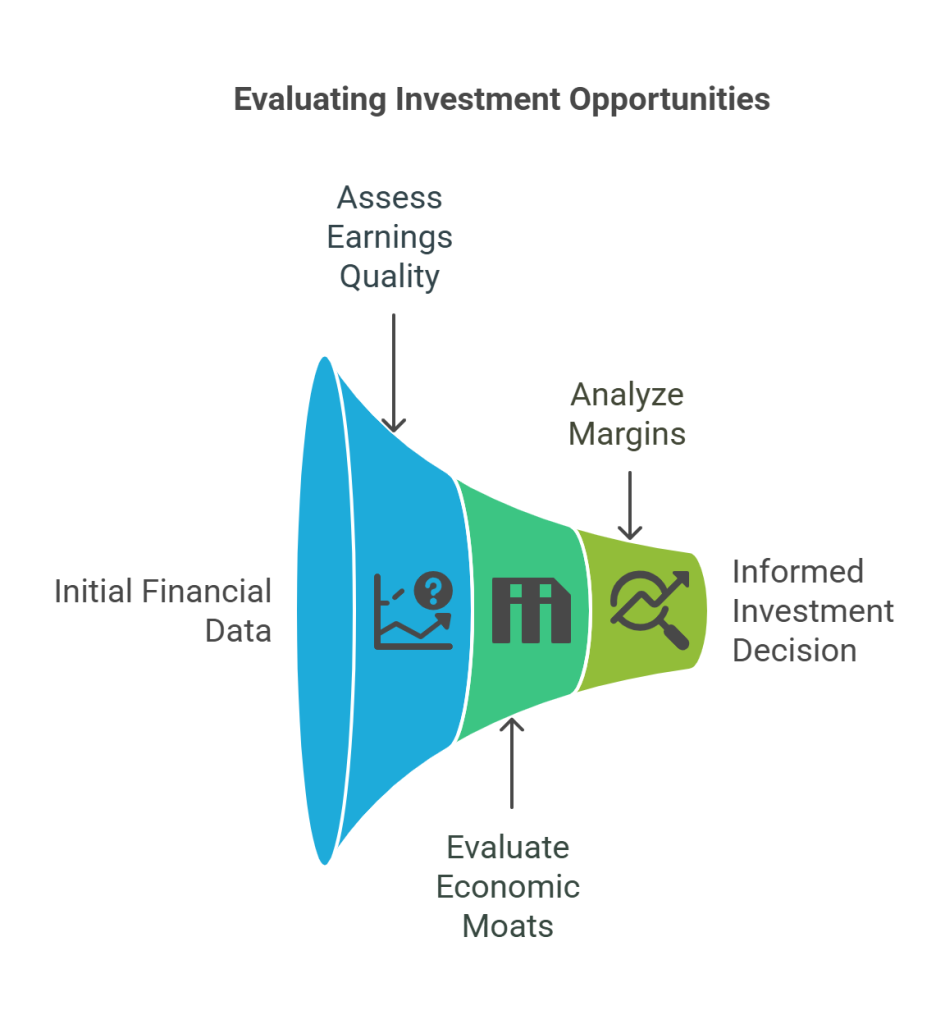

Use All Three Together for a Full Picture

You don’t evaluate these numbers in isolation. You look for alignment.

If a company shows strong and growing free cash flow, high ROIC, and expanding net margins—it’s not just surviving. It’s compounding.

But if only one or two look good, proceed carefully. Earnings without a moat invite competition. High margins without growth may signal stagnation. And a moat without profitability? That’s just a story.

These three metrics form a triangle. When all three points are sharp, you’ve likely found a long-term winner.

The synergy between these numbers is where real insight lives. High free cash flow with expanding margins and a demonstrable moat is how you identify companies that grow both in size and quality over time.

Smart Fundamental Analysis Checklist

Use this before you buy:

- Are earnings backed by strong free cash flow?

- Is the moat visible, quantifiable, and defensible?

- Are margins stable or expanding?

- Is ROIC consistently above the company’s cost of capital?

- Has management demonstrated sound capital allocation?

- How does the company perform in economic downturns?

- Are competitive advantages reflected in financial outcomes, not just narrative?

- Is management reinvesting intelligently, returning excess capital when appropriate?

If a company checks all the boxes, go deeper. If not, walk away.

Closing Thoughts: Stick to the Core, Outperform the Crowd

Fundamental analysis isn’t about memorizing every ratio. It’s about knowing which ones actually matter—and why.

You’re not trying to guess next quarter. You’re finding businesses that reward your patience for the next decade. That’s what separates a speculator from an owner.

Focus on earnings quality. Confirm the moat. Monitor the margins.

This simple framework helps you avoid distractions and stay grounded in real business economics. It protects you from hype, from fads, and from chasing yesterday’s winners.

Do this consistently, and the odds tilt in your favor. In the long run, the market may be a weighing machine—but with the right inputs, you can stack the weights in your favor from the start.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: