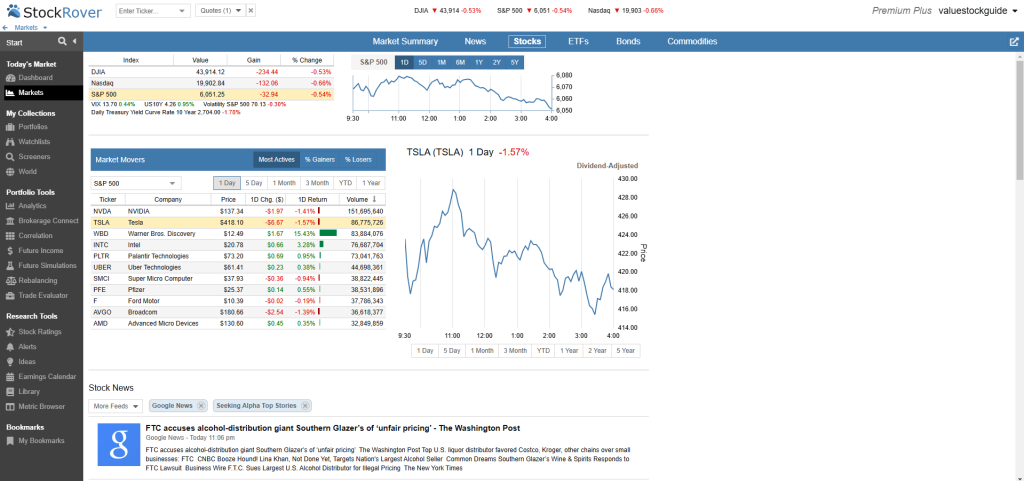

Stock Rover is a full-fledged investment platform that allows you to manage every aspect of your long-term investment strategy, except for the actual transactions. At first, you may think this type of software is unnecessary – almost all brokerages have some screening capabilities and many also provide research reports. But if you are a self-directed investor who values doing your own research and analysis, this is an indispensable tool. It is also one of the most comprehensive tools of its kind in the market. I know, I have been using it in a personal and professional capacity since 2019 – well over 5 years now. I pay for the Premium Plus version of Stock Rover that offers the most number of metrics and data going back 10+ years – which is essential for conducting serious due diligence. I will be using this version as the reference in this Stock Rover review article as I illustrate my workflow and how Stock Rover can help you manage your own investments intelligently so you will never let an opportunity slip by.

There are many investment research and portfolio management tools available to investors today. Charting and Technical Analysis software is everywhere, but there is a dearth of good tools for long-term investors, particularly value investors. Stock Rover is one of the very few, and I argue in this review that it is the best.

(Please note that many links in this review are affiliate link for Stock Rover. This means that if you purchase a subscription, I will be compensated a fee. I take this as a serious responsibility and only recommend a product that I use regularly and find great value in it. This is one of those products)

Why Stock Rover Is Essential for Value Investors

So why do I say that Stock Rover is essential for value investors?

Consider the following:

- Robust stock screening – Stock Rover allows you to screen stocks the way you want. As value investors, we like to look at some basic ratios such as price to earnings and price to book. The fact is that there are millions of investors doing the same thing and finding a truly value stock using these methods is well neigh impossible. Looking for value today involves peeling the layers of the onion – and Stock Rover gives you 100s of layers to peel (Premium Plus version has over 700 metrics you can screen for). For example, do you want to consider the Piotroski High F-Score? Stock Rover already calculates this and other metrics that are not readily available in other screeners.

- Deep financial data access – The Premium Plus level gives you 10 years of historical financial data (income statement, balance sheet, cash flow statement, etc). It gives you line item level data and also calculates the CAGR for each line item so you can quickly scan and see if there is any anomaly. For example, if inventory is rising faster than sales, there is something for you to investigate.

- Portfolio management tools – You can use Stock Rover to track your portfolio in multiple ways. You can connect to your brokerage to download and sync your accounts and positions so you are able to view it on Stock Rover. You can also maintain portfolios without making the brokerage connection if you wish. Manually maintained portfolios are useful as you can create test portfolios without committing any capital to it. For example, if you are testing a new strategy, this would be a nice way to do it. You cannot execute a transaction from Stock Rover – for that you will have to use your broker. You can create alerts of various types to text or email you if a certain position rises or falls by a certain amount.

They say that there are features and there are benefits. Stock Rover obviously has all the features that you would want. The biggest benefit in my eyes is the seamless way in which it integrates into my workflow at all the different steps.

My workflow consists of 5 different steps:

- Screening for Value Stocks

- Building and Managing Watchlists

- Conducting Deep Due Diligence

- Portfolio Management with Stock Rover, and,

- Rebalancing My Portfolio

We will look at each of these below.

Try Stock Rover here and discover why it’s my go-to tool for value investing.

1. Screening for Value Stocks

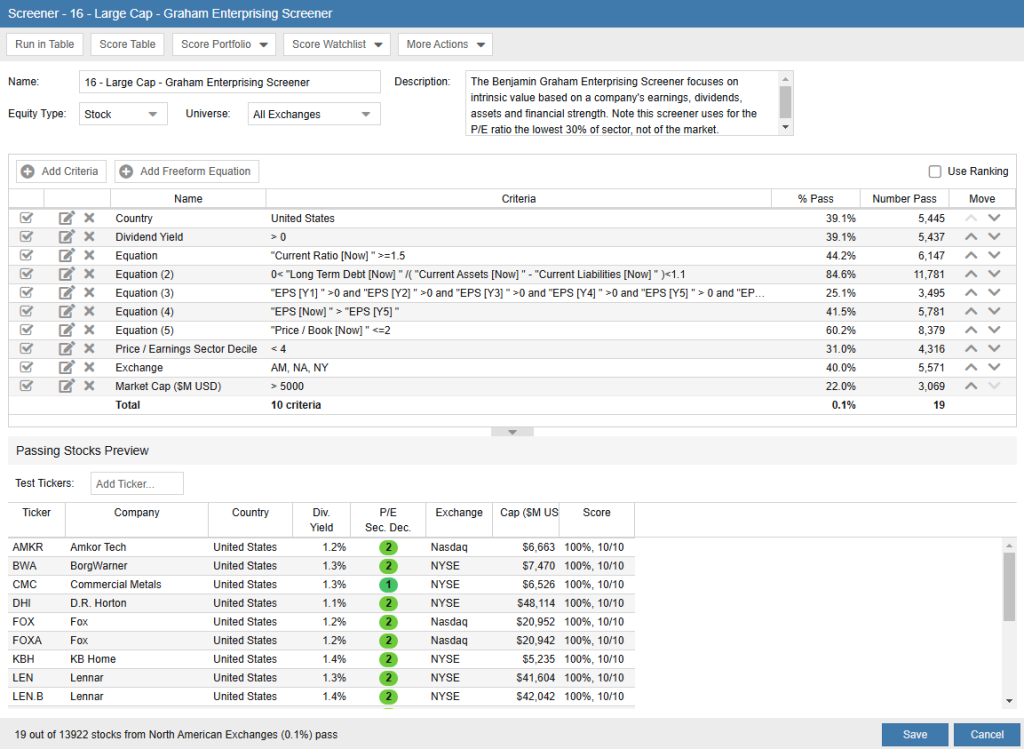

Every new investment starts from a screen. As a value investor, I have gotten into the rhythm of running a different stock screen each day of the month. As you can see from the following screenshot of my Stock Rover account, I 8 different screeners broken up into small cap, mid cap and large cap stocks. Each of the screener name has a number before it – this number is a shorthand for me to remember which screener I should run on today’s date. If today is 16th, then I am running “16 – Large Cap Graham Enterprising Investor” screener.

Of course, you are free to set up your screeners the way you want. Hopefully, my setup gives you some inspiration as to what is possible. For me, this works. I can get up in the morning, brew some coffee, and open up my laptop with my Stock Rover account front and center. I just go through my screen of the day, click through the stocks that it has found and decide what is interesting to pursue and what is not. Every once in a while I will write up the results of a screen for my newsletter. The key is that this creates a disciplined investment process, and it forces me into a rhythm of consistent screening -> watchlisting -> Analyzing, which is essential for every value investor.

Advanced filters

Once of the reasons I love Stock Rover is that it allows me to customize the screening filters to my own requirements. Suppose you want to find stocks that have 5 years of consistent growth in sales. How do you do this? In most other screeners, you may get the metric of 5 year average sales growth, and you may be fine with it. The problem is that you do not know if this was “consistent”. It may have fluctuated wildly, and perhaps even had declines in a year or 2. In Stock Rover, you can set up equations and advanced filters to pin point the exact metric you are looking for.

Consider the following screening criteria from the Graham Enterprising Growth Investor screen:

As you can see, the screener criteria is complex and it involves creating equations. You can do this in Stock Rover Premium Plus. I am not aware of any other screener that lets you do this so efficiently. Other screeners may give you raw data which you will need to export into a spreadsheet and manipulate to get the results you want. This saves me many hours of work every week.

If you want to build a simple screener, it is a cinch. In fact, Stock Rover comes with a large number of pre-built screens for you to import into your account and use, at no additional charge. These may vary from value to growth to dividend investing. Chances are, if you want a screener, it is already there or something very close to it exists that you can modify to suit your needs.

Try Stock Rover here and discover why it’s my go-to tool for value investing.

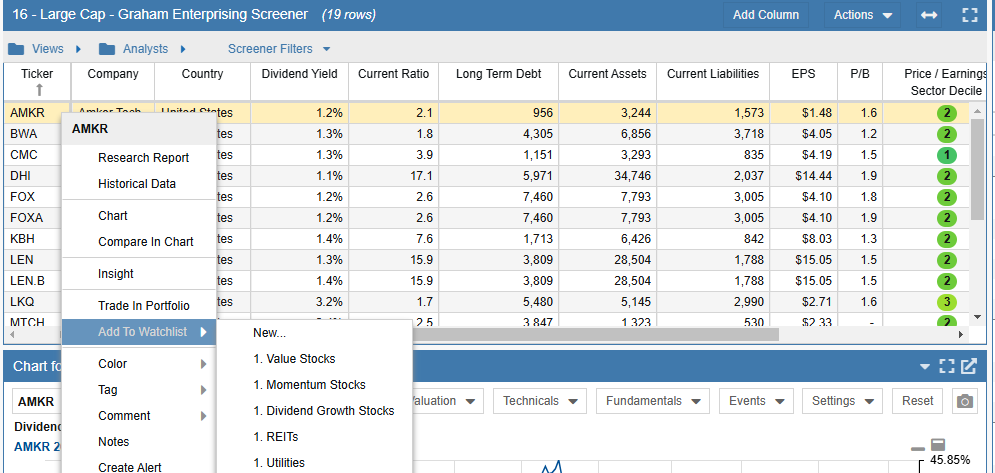

2. Building and Managing Watchlists

After I run my screens, I go through each stock that I found one by one. At this time, the idea is to do a quick scan to see if any of these stocks look interesting enough to dig deeper. When I find an interesting stock, I click on the pulldown next to the stock ticker and add it to a watchlist that I maintain.

Whether I add a stock to the watchlist or not can have varying reasons and I think it comes from experience. Some stocks mentally tick all the boxes – they have ratios that scream undervaluation, income statements that indicate growth, and a balance sheet stronger than an armored car. In this case, this stock will be added to one of the watchlists. Other times, the stock has some obvious disqualifying factor that would make it unlikely I would ever buy this stock. These stocks I ignore.

You can have multiple watchlists created for different purposes. For example, value stocks, dividend growers, green energy utility stocks, etc. The watchlists you create will depend on your use case and how you invest. Remember, at this time, these stocks in the watchlist are candidates for further due-diligence. These are not yet ready to be purchased.

Once a week or whenever it makes sense to you, visit your watchlist(s) and review the stocks in there in detail. Here again, Stock Rover has enough data for you very logically organized to help you dig deep and decide whether any of these stocks merit inclusion in your portfolio.

Try Stock Rover here and discover why it’s my go-to tool for value investing.

3. Conducting Deep Due Diligence

You have a watchlist and now you want to know whether you should buy any of the stocks in this watchlist. They showed promise when you first looked at them and you would expect a large number of them would pan out as viable investments. You would be surprised how many you still end up discarding at this stage.

A word before we proceed further: Most casual investors do not perform this step. A typical investor may run the screens and create a watchlist, and call it their research. For them, the watchlist is their buy list. Do not be that person.

There are 2 steps to this process and both these steps are equally important

- Step 1: Researching the stock and determining if it is buyable. If yes, go to step 2, or else remove the stock from the watchlist and forget about it

- Step 2: The stock is buyable, but, should you buy this stock?

Let’s look at these separately.

Step 1: Research – Is the stock buyable?

I tend to be more of a Graham investor. I have certain things I look for in a stock. I will lay out these things in brief below. You on the other hand are likely to have a different investment philosophy and you will want to review the data and conduct your analysis differently than I do. Luckily, Stock Rover does not prescribe how you can analyze the data, it just provides the data to do with it as you please. Here are the questions I ask when I research any stock.

- Is the stock cheap? For me this primarily involves looking at various markers of the undervaluation. You can start with the balance sheet and consider the assets that exist. What would be the fair value for these assets? Look at the Price/Book ratio, Price/tangible book value and the liquidation value of the company.

- Is there a reason to believe the stock will rise to its correct valuation anytime soon? The income statement is critical here as a profitable company is likely to keep reinvesting profits and increasing the shareholder’s equity. You may want to consider the historical growth in profits, any competitive advantages that the company possesses that will protect its market share and profits in the future, etc. Sometimes a company has a catalyst in the near future that can significantly improve profitability or add new profitable revenue streams. Other times, a lot of value can be created if there are activist investors or competitors circling the company to acquire it.

- Will the management destroy the value in the company before the market realizes the correctio value for the stock? You want to consider the quality of the management, how efficiently is the management operating, whether are they keeping their cash flow positive and running at a reasonable liquidity, do they pay themselves large stock options, do they have a history of diluting the shareholders, etc.

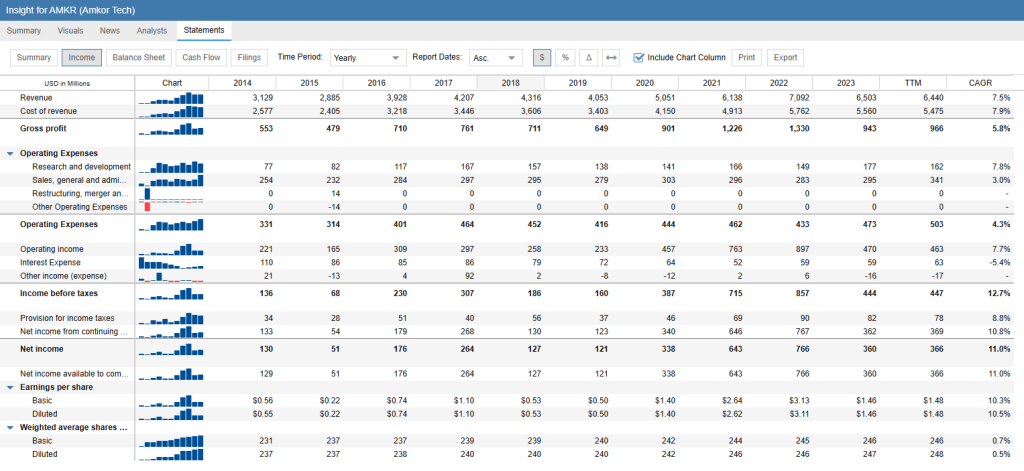

I am not going to go into the actual details of my research process. But I will note that in Stock Rover, you can run full financials for each stock going back 10 years (Premium Plus version). These include Income Statement, Balance Sheet and Cash Flow Statement. Each of these statements have visuals and 10 year CAGR already calculated for you.

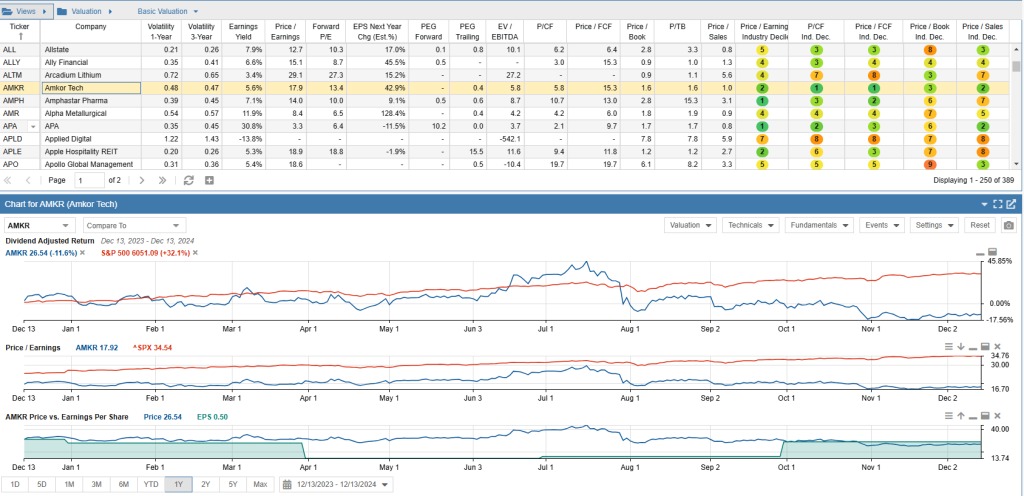

Additionally, you can experiment with different views and they will show you a variety of data and metrics. The Basic Valuation view for example looks liek this

The amount of research data available to you from Stock Rover is phenomenal. The trick is to make the best use of these. You could also look at the Growth screen to see the metrics on the business growth rates.

No value research is complete without consulting the Company’s quarterly filings and its most recent annual report. These can be easily accessed in Stock Rover from their Filings tab.

Step 2: Inclusion – Should you buy this stock?

At this point you have found a stock that is undervalued and it meets all your criteria. There is one last check you need to do before you add it to your portfolio.

Does it fit?

Let me explain this. Suppose you already own Home Depot stock and now you are considering whether to buy Lowe’s stock. If the industry is out of favor, it is very likely that both these stocks are available at a discount. So given that you already own Home Depot, does it make sense to also buy Lowe’s.

If you go ahead and buy it, you may be exposing yourself to the industry risk more than you would want by doubling down on it. If you decide that only one stock needs to remain, which one are you better off holding?

Perhaps this question is easily answered. How about buying Wayfair stock? It kind of is correlated to home improvement, but is not too similar to Home Depot.

Another question: Is a stock with 30% expected return in one year better investment than a stock with 20% expected return in one year? I would say this depends on the risk of loss in these investments.

For most investors, adding a stock to the portfolio or not, given what they already own in the portfolio, is a question that they answer with intuition. As long as you ask this question and attempt to answer this, it can only improve your portfolio.

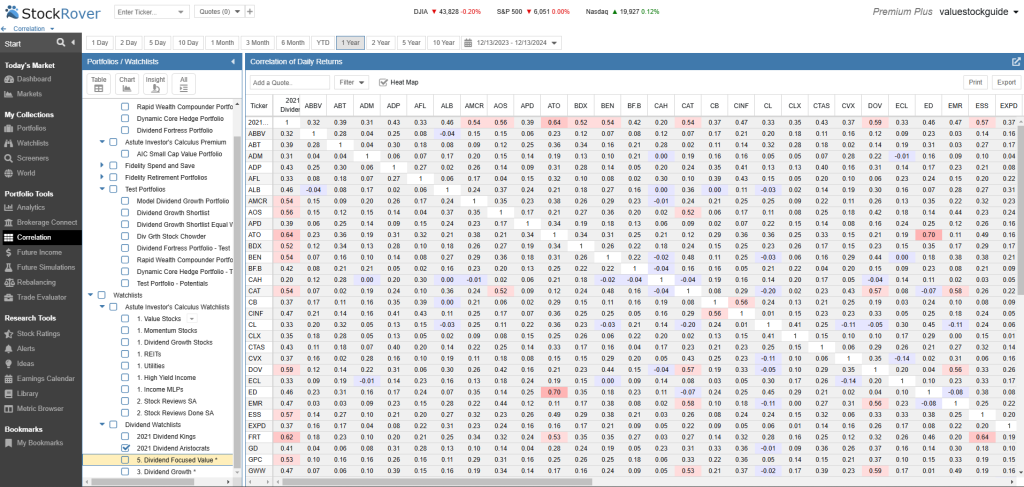

For a long time, my modus operandi was to buy only 1 stock in any given sector and have atleast 5-30 stocks in the portfolio. This ensures that you have a good amount of diversification. Nowadays, I actually review the correlations between the stock to determine which stocks to keep and which to discard.

Stock Rover gives you the correlations between each stock you hold in your portfolio.

This is massive for serious investors.

I use this correlation data, along with expected returns for each stock resulting from my analysis, and I calculated an optimum portfolio allocation that is designed to maximize performance and eliminate the risk of permanent capital loss.

Most investors wing this or use a simple equal-weighted portfolio scheme. Even when you do not use correlations explicitly like I do, you should still evaluate if the new stock is adding or subtracting from your portfolio based on expected gains and risk.

If you would like to use the Kelly criterion like I do to allocate your investments optimally, know that Stock Rover has ALL the data you need to be able to do this kind of intelligent portfolio management.

Try Stock Rover here and discover why it’s my go-to tool for value investing.

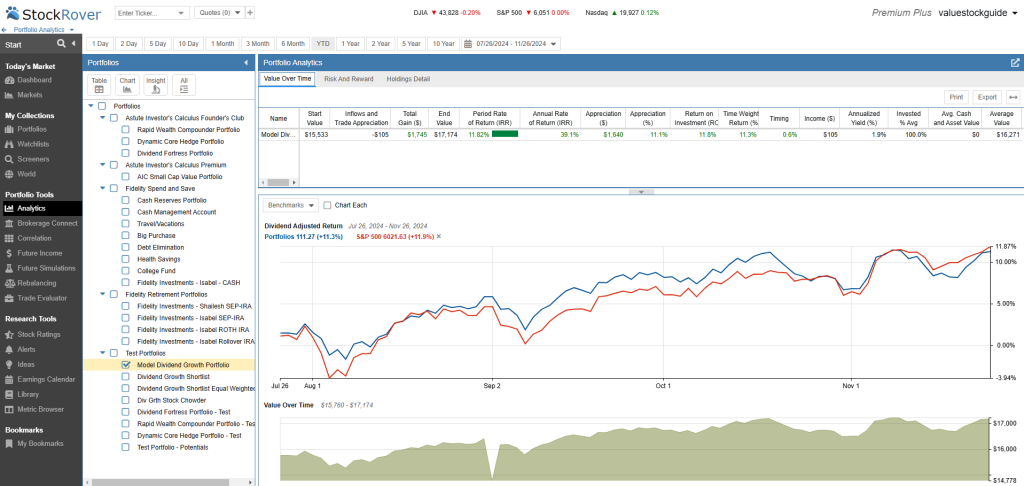

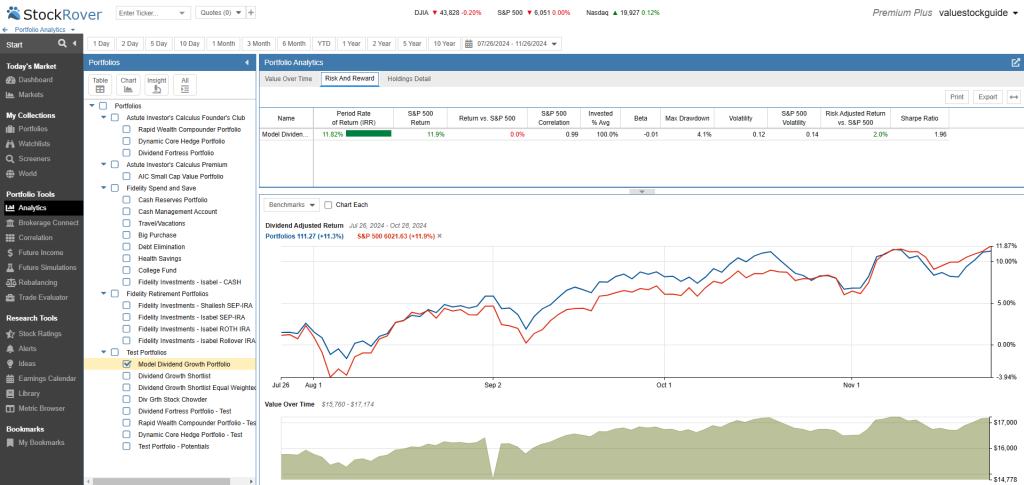

4. Portfolio Management with Stock Rover

We discussed position sizing (portfolio allocation) above. With Stock Rover, you can easily track and manage your portfolio in many other ways. For example, it has a robust analytics section that shows you your performance over time including other metrics such as drawdown and sharpe ratio.

It also gives you the Time Weighted Return, which is a more accurate picture of your portfolio’s actual performance. This is because this eliminates the influence of cash in and cash out of your portfolio. TWR is what, for example, mutual funds report and are judged on. This is critical as they have contributions and redemptions almost every single day. This is also Total Return because it includes the dividends in the return calculations.

Try Stock Rover here and discover why it’s my go-to tool for value investing.

5. Rebalancing Your Portfolio

We have discussed elsewhere on this site why rebalancing is one free lunch you get in the market. Rebalancing not only reduces risk, it also accelerates your compounding by harvesting volatility. And if you invest in small cap value stocks like I do, you have a lot of volatility to harvest.

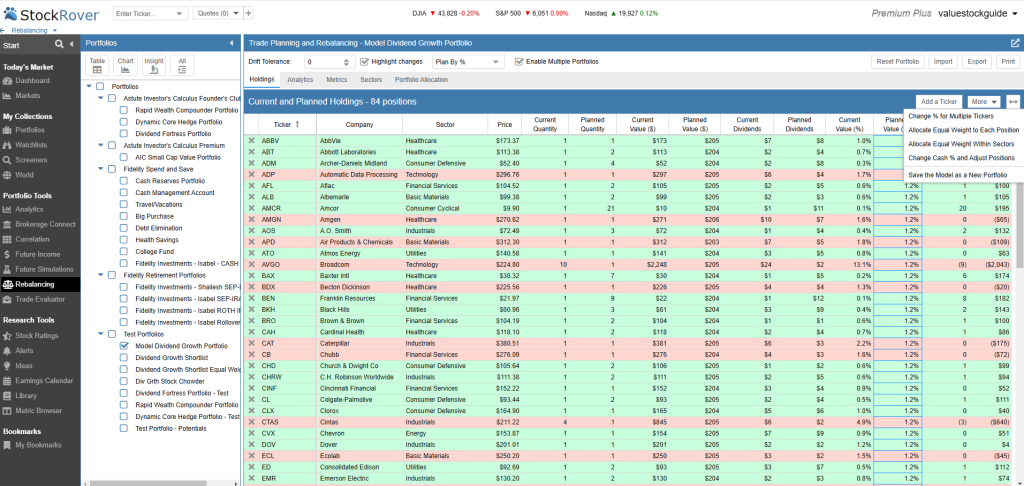

In the following screenshot, I show how the rebalancing tab looks like in Stock Rover. Here I took a portfolio that has drifted from my target allocation and decided to reset it to equal-weight. To rebalance, Stock Rover calculates the buy and sell transactions you need to execute to bring the portfolio close to the target allocation.

If you buy/sell shares in whole units, rebalancing can be a pain. You will need to figure out which position to exceed your target by a little amount and which to stay below, to ensure your portfolio as a whole is optimum and your cash levels at the end are what you desire. Stock Rover takes care of this optimization for you. Now all you have to do is to take its recommendations and execute those buy and sell orders.

You can of course set your portfolio allocation in any way you like. It is very rarely equal weight in an active portfolio.

Try Stock Rover here and discover why it’s my go-to tool for value investing.

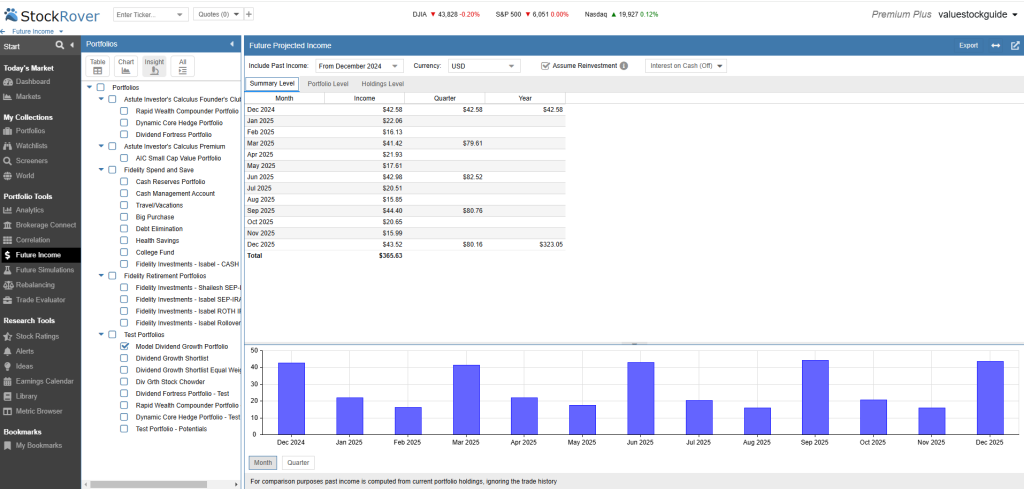

Future Income Estimation for Dividend and Income Investors

Do you also manage an income portfolio? Perhaps high-yield or dividend growth portfolio? Than this section is of a particular interest to you.

You may be particularly interested in projecting your future income as you receive and reinvest your dividends. Stock Rover gives you a Future Income estimation which you can use for any number of purposes. For example, this will help you visualize how your monthly income is distributed. You can use this to fill out the light months by acquiring stocks that pay dividends in those months. You can also use this to model when you will reach a certain threshold of income.

I know Fidelity and other brokers can show your dividend income projections. I like this as an additional tool to visualize because this can show you the estimate in two different ways – whether you reinvest dividends or do not reinvest dividends.

Try Stock Rover here and discover why it’s my go-to tool for value investing.

Final Thoughts: A Value Investor’s Companion

I still remember the days when I used to conduct my research and analysis solely using the screener at Fidelity. Then I got a trial for an Edgar research tool that eventually ran into several thousand dollars per year. Later when SEC opened up their API using XBRL, I started working with a developer to build a custom tool that would allow me to query the financials for companies I wanted to research. I soon realized that these packages are expensive because there is so many layers of work that need to be performed before the data is presentable and understandable. For example, every company reports data in a slightly different way. If you want to be able to compare and make intelligent choices, you need to be confident that the data is scrubbed and normalized to give you a consistently uniform picture across thousands of companies in the US.

Now I do not need to do this because Stock Rover does all this for me, and they do much more than just get you the data. I just described all the functionality and metrics they have built into this tool. They have pretty much given me a platform to conduct my entire investment research and analysis.

And the best of all, this professional-grade software that has helped me systematize my workflow and saved me thousands of hours of work every year, costs me less than $1 per day.

The last time I spoke with Stock Rover’s VP of Sales, I told him that if they were to price this at $100/month, I would still gladly pay. As it is, they only charge $27.99 per month for their highest-level plan. And if you want to try this out, they also give you a 2-week trial for free.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: