You don’t need to eliminate risk. You need to understand it, isolate it, and price it correctly.

The biggest mistake investors make is treating all risk the same—panicking when markets fall, diversifying blindly, or refusing to act because the future looks uncertain. But the truth is: you don’t get paid for avoiding risk—you get paid for bearing the right kind of risk.

Risk is not your enemy. It’s the cost of admission for meaningful long-term returns. And your job as a serious investor isn’t to run from risk—it’s to structure your portfolio so that you only take on the kinds of risks that offer a positive expected payoff.

Let’s break down what that looks like in practice, so you can start building a portfolio that compounds confidently through uncertainty.

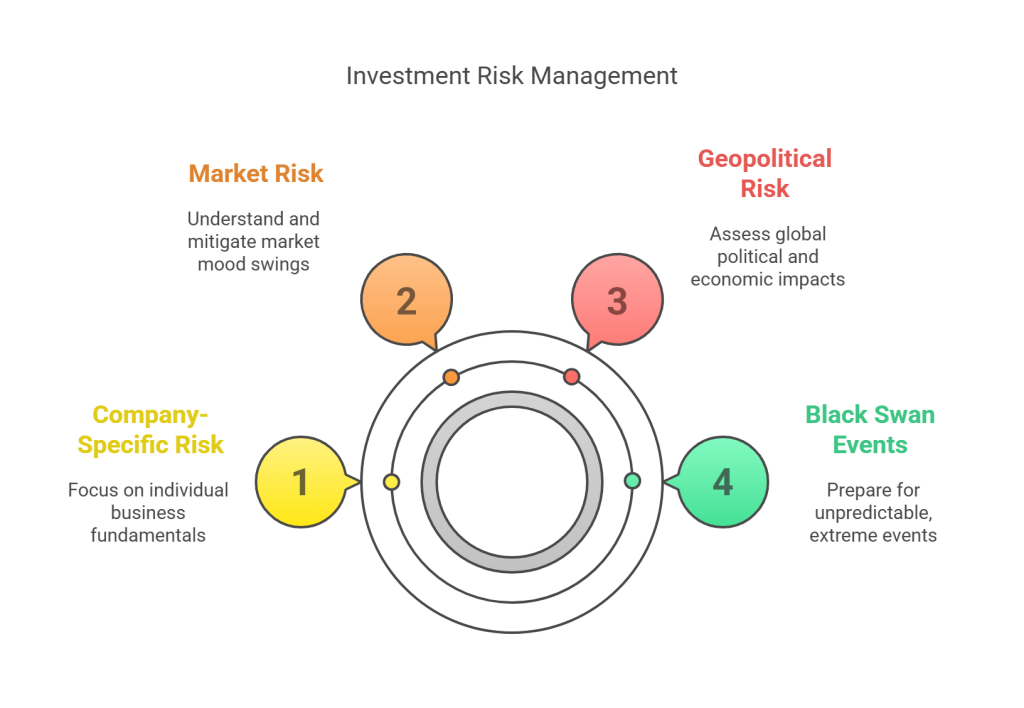

Company-Specific Risk: The Real Reason Stocks Blow Up on You

Before you worry about recessions, inflation, or geopolitical tensions, look closer at what’s inside your portfolio. Because more often than not, it’s company-specific risk—not macro shocks—that delivers the hardest hits to your capital.

This is the risk that stems from the underlying business: poor management decisions, margin compression, balance sheet fragility, fraud, or simply bad products. When these blow up, they take your money with them.

This is why I never rely on broad diversification to manage company risk. I go deeper. I insist on a margin of safety on every single investment I make.

That means buying companies only when their stock price is meaningfully below my estimate of intrinsic value. If I’m right, great—I compound at a high rate. If I’m wrong, I’ve built in a cushion.

If a stock starts to fall and the fundamentals haven’t changed, I might add. But if the story breaks—if debt becomes unmanageable, or if customer demand evaporates—I exit. No heroics. No averaging down into a death spiral. Just disciplined risk control.

Your edge in company-specific risk is selectivity. Most permanent losses come from ignoring red flags or stretching valuation assumptions too far. In my Premium and Founder’s Club portfolios, nothing gets added unless I can see the downside—and sleep at night.

Market Risk: The Invisible Force That Wrecks the Undiversified

Even if every business you own is rock solid, you’re still exposed to the market’s mood swings. That’s market risk—the risk that asset prices move together, not because something changed in the business, but because investors panic or get greedy in sync.

And most investors misunderstand it.

They think diversification means owning a lot of stocks. But if all your stocks move together during a correction, you’re not diversified—you’re just holding more of the same risk.

That’s why I construct portfolios based on correlation, not count. I run correlation matrices between every pair of stocks I own. This helps me assemble a portfolio where different positions respond to different triggers—some cyclical, some defensive, some event-driven. The result is lower volatility without sacrificing return potential.

Then I use the Kelly Criterion to size each position optimally. Kelly tells me how much to bet, based on expected return and volatility. It’s not just a formula—it’s a compass for rational position sizing.

The outcome is a portfolio designed for maximum long-term compounding, with minimal drawdowns.

Market risk isn’t going away. But you can neutralize a lot of its sting with smarter portfolio construction.

Geopolitical Risk: When the World Shifts Beneath Your Feet

Most risk models ignore geopolitics until it’s too late. But real investors don’t have that luxury.

War. Trade embargoes. Sanctions. Currency crises. Regime changes. These are not black swans—they’re part of the investing landscape. And they can devastate portfolios with heavy exposure to the wrong region at the wrong time.

You have to be aware of where your companies operate, where their revenue comes from, and how global events might impact their business models.

In my process, I weigh geopolitical exposure alongside financial metrics. A Chinese manufacturing firm with a pristine balance sheet still faces higher systemic risk than a U.S.-based supplier with moderate leverage—especially if tensions escalate.

The antidote here is strategic flexibility:

- Favor companies with diversified international revenue streams.

- Be wary of jurisdictions with capital controls, poor shareholder protections, or inconsistent regulatory enforcement.

- Always ask: what happens to this stock if relations between two major economies turn hostile?

Geopolitical risk won’t announce itself in advance. But you can design your portfolio so that it doesn’t implode if the ground suddenly shifts.

Black Swan Events: Planning for the Unplannable

Some events are beyond modeling. They don’t fit into a Monte Carlo simulation or a discounted cash flow spreadsheet. These are the true black swans—pandemics, flash crashes, terrorist attacks, financial system failures, economic resets, etc.

And while you can’t predict them, you can prepare for them.

I do this by embedding optionality and redundancy into every portfolio I manage. That means:

- Keeping cash (or short term investments that can be easily converted to cash) on the sidelines so you can act when others can’t.

- Holding positions that aren’t correlated with the broader market—such as special situations or event-driven trades.

- Rebalancing when things get out of line, trimming winners before they get too frothy, and adding to laggards if their fundamentals remain intact.

These are structural decisions—not forecasts. I don’t know when the next black swan will hit. But I do know that when it does, I’ll be one of the few ready to buy.

Your Risk Protocol: A System for Staying in Control

Risk management isn’t a set of rules you apply once. It’s a process you follow every day.

Here’s the protocol I live by—and you should too:

- Company Risk: Only buy with a margin of safety. Exit quickly when business fundamentals break.

- Market Risk: Diversify across uncorrelated positions. Use Kelly sizing to guide allocation.

- Geopolitical Risk: Understand your exposure. Diversify geography and revenue streams where appropriate.

- Black Swan Risk: Stay liquid. Stay nimble. Design with redundancy.

Notice that you can do all this without compromising on the process you use to select your investments. Adding a layer of risk control does not mean your investment returns suffer. They might in fact be enhanced by it.

Most investors fail because they manage risk emotionally. You need to manage it structurally. That’s what allows you to stay rational when others are scrambling—and compound over the long term.

When You Remove the Downside, the Upside Takes Care of Itself

The secret to long-term investment success isn’t in finding magic stocks. It’s in building a portfolio that can survive reality.

Markets will wobble. Companies will stumble. And every few years, something will come out of left field and shock everyone.

But if you’ve done the work—if you’ve structured your portfolio to absorb the hit, adapt, and reposition—you won’t just survive. You’ll thrive.

That’s what I help my members do every day. If you’re serious about managing real capital in the real world, consider joining the Premium Membership or Founder’s Club. You’ll get access to my complete portfolios, stock analyses, capital allocation tools, and strategies that are designed for one thing only: intelligent compounding in an uncertain world.

Join us today and start building a portfolio that respects risk—and gets rewarded for it.

Shailesh Kumar, MBA is the founder of Astute Investor’s Calculus, where he shares high-conviction small-cap value ideas, stock reports, and investing strategies. He is also a strategy and operations consultant focused on measurable business outcomes

His work has been featured in the New York Times and profiled on Wikipedia. He previously ran Value Stock Guide, one of the earliest value investing platforms online.

Subscribe to the Inner Circle to access premium stock reports and strategy insights.

Featured in: