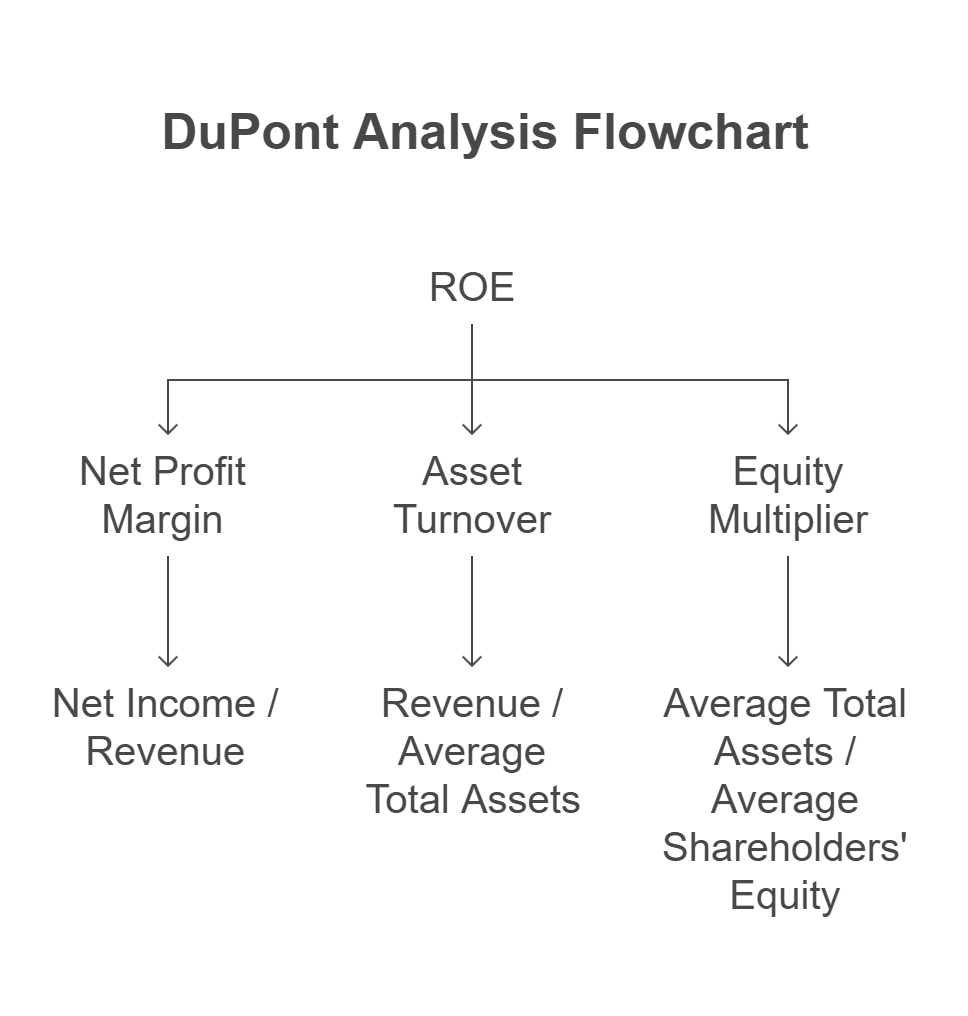

The Hidden Power of the DuPont Analysis: Unpacking ROE for Serious Investors

ROE Alone Can Mislead You. Return on Equity (ROE) gets a lot of attention—and rightly so. It’s a quick indicator of how effectively a company generates profits from shareholders’ capital. But used in isolation, ROE can give you a false sense of security. What you really need is a way to unpack ROE into its […]

The Hidden Power of the DuPont Analysis: Unpacking ROE for Serious Investors Read More »