Most investors see a high current ratio and breathe a sigh of relief. The company’s liquid. It’s safe. There’s nothing to worry about, right?

Not so fast.

As a value investor, your job isn’t just to avoid bankruptcy. It’s to generate returns. And sometimes, excess liquidity hides something more dangerous: a management team that doesn’t know how to allocate capital. When you see a high current ratio, you should ask: is this prudence, or is this a failure to deploy capital where it can earn real returns?

Here’s when a high current ratio stops being reassuring and starts signaling trouble, and how you can identify the difference with a sharper investor’s lens.

The Textbook Definition vs. Investor Reality

The current ratio is a simple formula: current assets divided by current liabilities. It tells you if a company has enough short-term assets to cover its short-term obligations. A ratio above 1 is considered safe. A ratio above 2 is seen as conservative, and I look for this. But a ratio of 4 or more?

That should raise eyebrows.

Why? Because it means the company is sitting on a pile of working capital. That capital could be earning returns. Instead, it’s parked in cash, accounts receivable, or slow-moving inventory. These are assets that offer little to no return. That drag on return on equity (ROE) and return on invested capital (ROIC) compounds over time.

The Hidden Cost of Excess Liquidity

Liquidity is supposed to protect you from risk. But too much of it can become a form of risk itself, a kind of opportunity risk.

Cash that isn’t reinvested is cash that isn’t growing. Receivables that aren’t collected quickly represent capital locked up in other people’s businesses. Inventory that’s not turning over is an expense waiting to be written off.

These inefficiencies hurt your total returns. They reflect either a business with no growth opportunities, a management team unwilling to take calculated risks, or worst of all, a lack of discipline in capital allocation.

When you’re investing in small-cap value, dead money on the balance sheet is the last thing you want.

Case in Point: The Illusion of Safety

Imagine you’re analyzing a micro-cap stock that trades below book value and has a current ratio of 5. On the surface, this looks like a net-net goldmine. But then you look closer.

Receivables have grown faster than revenue for three years straight. Inventory turns have slowed to once per year. Cash balances have climbed, but capex and R&D have flatlined.

In this case, the high current ratio isn’t a sign of strength. It’s a symptom of managerial paralysis. The company is hoarding cash, dragging its feet, and diluting shareholder value with every quarter that passes. That’s not a bargain. That’s a value trap in disguise.

Zooming out, this pattern is more common than you might expect. There are currently 257 companies on American exchanges with market capitalizations above $50 million and current ratios over 4. Some of these may be justifiably conservative, while others could be inefficiently parking cash and inventory. As always, context and scrutiny matter.

When a High Current Ratio Makes Sense

There are exceptions. Sometimes, a high current ratio is warranted. Seasonal businesses like retailers may build up inventory before holidays. Cyclical companies may hoard cash to survive downturns. Firms anticipating a major acquisition or dividend may need excess liquidity.

The key difference is intent. If there’s a plan in place, and if management communicates that plan clearly, then excess liquidity can be a strategic asset. But if there’s no capital plan, you should be skeptical.

Some industries are also structurally more likely to have low current ratios. For example, Real Estate Investment Trusts (REITs) typically operate with current ratios close to or even below 1. This might seem alarming at first glance, but it’s entirely intentional. REITs focus on long-term assets and liabilities, and are required to distribute at least 90% of their taxable income as dividends. As a result, they hold minimal current assets and rely on refinancing or access to capital markets rather than short-term liquidity buffers. A low current ratio in this case is a function of their tax-advantaged business model, not financial weakness.

Other capital-intensive sectors, like utilities and telecommunications, may also run lean on current assets while holding stable cash flows and regulated pricing. On the flip side, industries like tech hardware or industrial distribution might maintain relatively higher current ratios to manage supply chain complexity or cyclical demand. A notable example is Fastenal (FAST), a company in the industrial distribution sector, which currently sports a current ratio of 4.7. This may reflect strong inventory management and a conservative financial posture in a sector prone to cyclical demand spikes, but it also raises the question: could this capital be working harder elsewhere?

Understanding the industry context is crucial. A high or low current ratio doesn’t mean much without knowing what “normal” looks like for that sector.

What to Watch Instead: Capital Efficiency

Instead of getting comfort from a high current ratio, focus on how efficiently a business converts assets into returns.

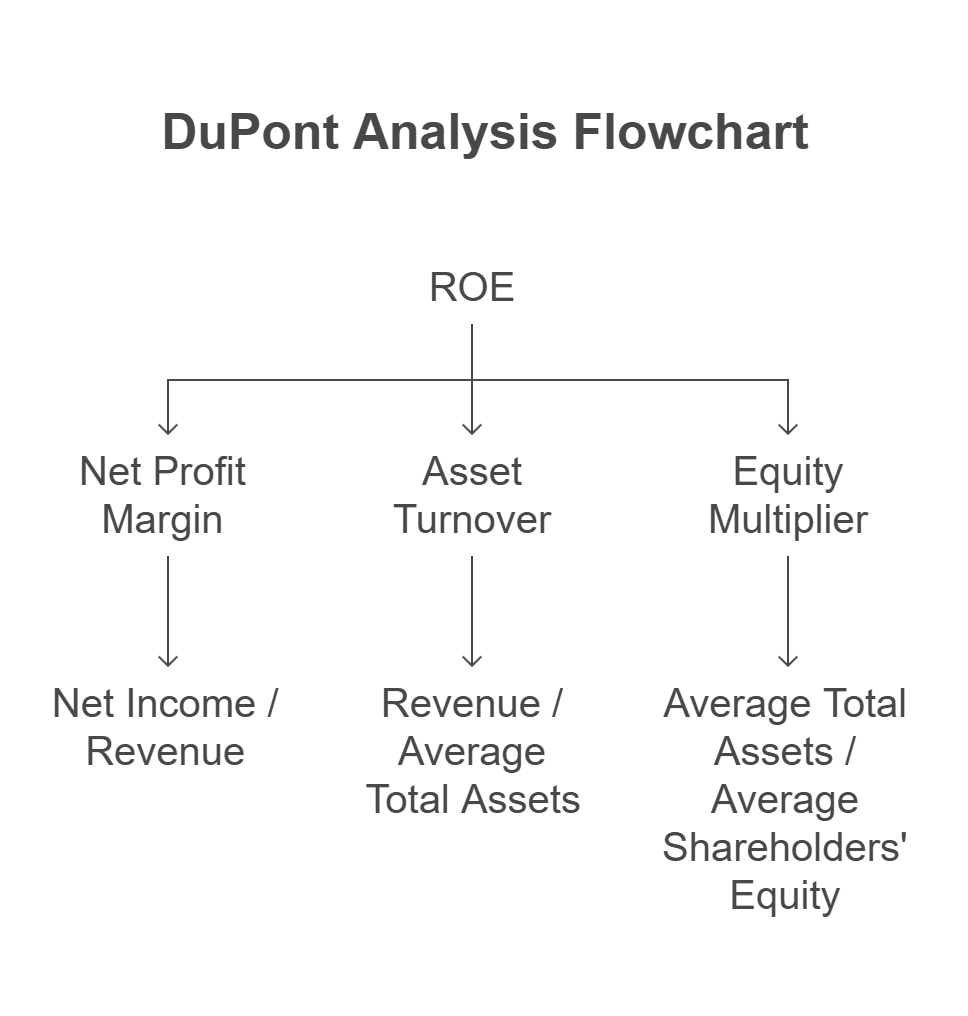

Return on Invested Capital (ROIC) tells you whether they are earning enough on the capital they retain. Free Cash Flow Yield shows whether cash is actually being generated. DuPont Analysis reveals whether the company is boosting ROE through margin, turnover, or leverage. Asset Turnover measures whether assets are being deployed productively.

These metrics tell you whether capital is being put to work or left to rot.

Conclusion: You Don’t Want Safe. You Want Smart.

As a serious investor, your job is not to seek safety at all costs. Your job is to earn exceptional risk-adjusted returns. A high current ratio may protect you from insolvency, but it can also hide stagnation, waste, and mismanagement.

The best value stocks are underappreciated, underpriced, and often misunderstood. But they are never lazy with their capital.

References

Need Cash? Look Inside Your Company – Harvard Business Review